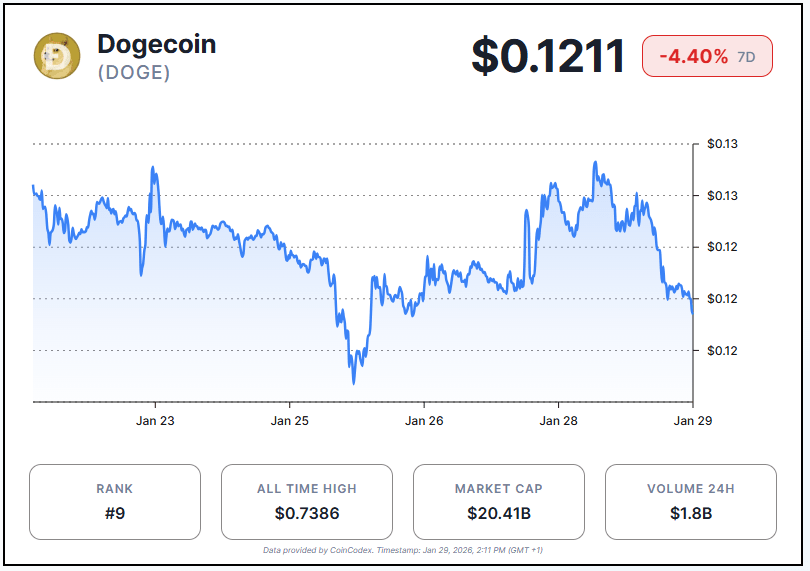

The Dogecoin price has declined 4.19% over the past 24 hours, currently trading at $0.1211. Over the last 24 hours. This decline continues the trend seen over the past week, with Dogecoin losing approximately 4.40% of its value. Over the last 30 days, $DOGE has also shown a modest 2.55% decline.

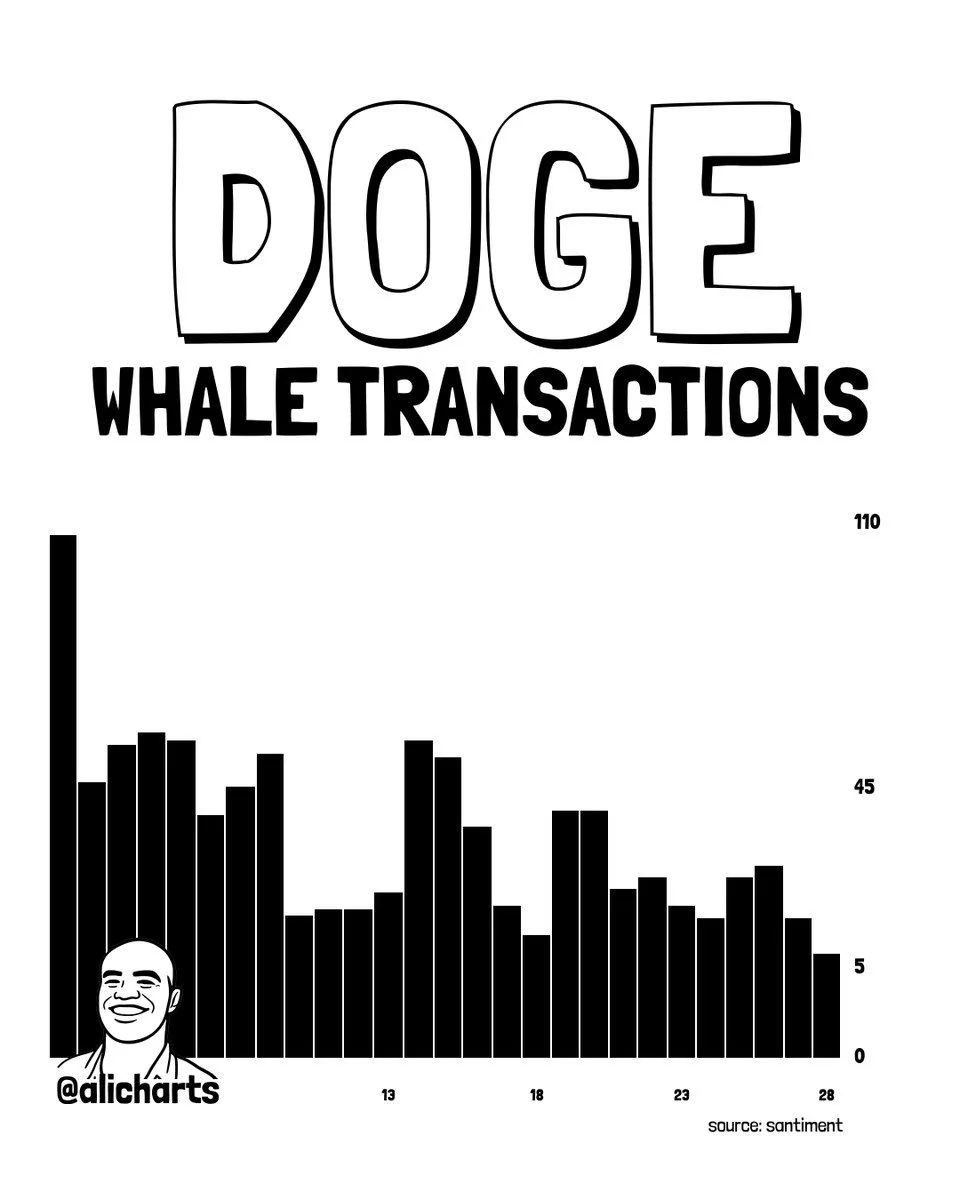

Dogecoin Whale Activity Drops 95% Amid Price Consolidation

Over the past four weeks, large transactions on the Dogecoin ($DOGE) network, defined as transfers exceeding $1 million, have plummeted sharply. According to Ali Charts on X post, whale activity dropped from 109 transactions to just 6, marking a staggering 94.6% decline. This sudden slowdown in high-value transfers indicates that major holders are reducing large-scale movements, which could signal cautious sentiment among whales despite Dogecoin trading near $0.122.

The decline in whale transactions coincides with $DOGE’s recent price stability, where the token has hovered in the $0.121–$0.124 range. Reduced whale activity often leads to lower liquidity for large trades, which can increase price volatility if demand suddenly spikes. For traders and investors, this trend highlights a period of consolidation, suggesting that significant price movements may depend on renewed interest from large holders or a broader market catalyst.

Dogecoin Enters Cycle 3: Analysts Project Potential 4,100% Gain

Meanwhile, according to the chart by analyst Bitcoinsensus, Dogecoin appears to be entering Cycle 3, which mirrors the pattern seen in the previous two cycles. Historically, $DOGE has experienced long periods of consolidation, followed by parabolic gains. Cycle 1 saw an approximate 60x increase, while Cycle 2 surged around 215x. The chart suggests that after the current consolidation phase, $DOGE could enter another significant bullish run if market conditions align.

The projection in Cycle 3 indicates a potential 4,100%+ gain, which could push Dogecoin above $1. The repeating cycle pattern highlights a consistent trend of accumulation followed by explosive growth, supporting the idea that $DOGE’s next major rally might match or even exceed previous parabolic moves. Analysts note that timing and overall market sentiment will be crucial in determining if this cycle reaches its projected highs.