The total crypto market cap (TOTAL) and Bitcoin ($BTC) started Thursday on a bearish note, and the impact of the same has extended to altcoins. River ($RIVER) led the decline among the altcoins, marking a 27% drop.

In the news today:-

- Worldcoin (WLD) jumped over 16% after a Forbes report revealed OpenAI is exploring a social network focused on “proof of personhood” to combat online bots. The early-stage project may use biometric verification, including Apple Face ID and Worldcoin’s iris-scanning technology.

- Fidelity Investments announced plans to launch the Fidelity Digital Dollar (FIDD), a stablecoin on Ethereum for institutional and retail users. The move underscores rising institutional interest in the $316 billion stablecoin market as competition for adoption intensifies.

The Crypto Market Cap Drops

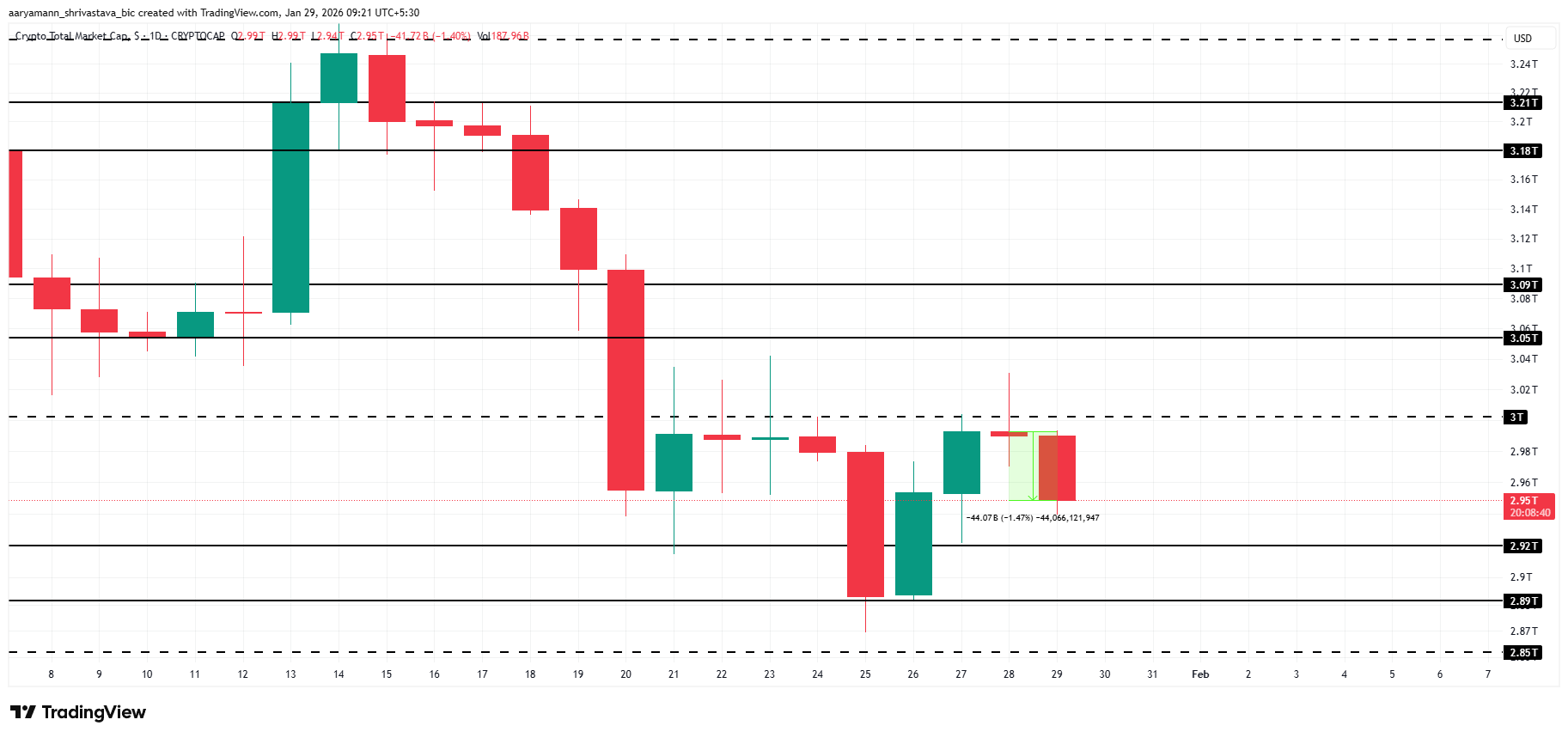

The total crypto market cap declined by $44 billion and now stands at $2.95 trillion at the time of writing. Despite the drop, market structure shows early signs of stabilization. Selling pressure has eased following a bearish weekend, allowing digital assets to attempt a short-term recovery.

The Federal Reserve held its benchmark rate at 3.50–3.75% on January 28, its first 2026 policy meeting. The decision, described as “loosely neutral,” removed near-term fears of a more restrictive pivot. Nevertheless, the crypto market is yet to find a direction. For now, clearing the $3.00 trillion barrier is the target.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Recovery remains possible if sentiment improves alongside macro trends. If bullish conditions align with broader market strength, TOTAL could regain upward momentum. A coordinated move higher may push the total crypto market cap toward the $3.00 trillion level in the coming days.

Bitcoin Continues To Fail Breach

Bitcoin trades at $88,127 after a sharp Wednesday spike sell-off stopped the price from crossing the $90,000 level. The decline reflects heightened volatility and cautious sentiment across the crypto market. Recent weakness has placed Bitcoin near a critical technical zone that may define its next directional move.

If bearish momentum intensifies and Bitcoin breaks lower, the price could slide toward the next support level near $86,987, which marks the 23.6% Fibonacci Retracement. This level is also known as the bear market support level, holding $BTC from falling below the $86,558 support level.

A bullish reversal remains possible if buying pressure returns. Strength above current levels could lift Bitcoin past $90,000. Reclaiming that resistance would open the path back above $90,000 and allow $BTC to target the $90,914 level, invalidating the bearish setup.

River Leads The Decline

River recorded the sharpest decline among major altcoins, dropping 27% over the past 24 hours. The sell-off pushed the $RIVER price down to $47 at the time of writing. This move followed a decisive breakdown below the $61 support level, signaling weakening short-term momentum and elevated downside risk.

If bearish pressure continues and capital outflows accelerate, the $RIVER price could slide toward $36. This level represents the next key support zone. A failure to hold $36 would erase a significant portion of recent gains and expose the asset to a deeper decline toward $19, intensifying the bearish outlook.

$RIVER Price Analysis">

$RIVER Price Analysis">

A bullish reversal remains possible if buying pressure returns. Should $RIVER reclaim $61 as support, momentum could shift decisively higher. Under stronger market conditions, the altcoin may attempt a move toward its $88 all-time high. A confirmed breakout would establish a new price discovery phase.

beincrypto.com

beincrypto.com