The US Federal Reserve voted to leave interest rates unchanged on Wednesday, a decision that was widely anticipated by investors. While the move signals a pause for now, market commentators suggest a path toward monetary easing could still emerge indirectly.

Members of the Federal Open Market Committee (FOMC) voted to hold the federal funds rate steady for the first time since July, keeping it in a range of 3.5% to 3.75%, while cautioning that inflation remains “somewhat elevated.”

Notably, two Fed officials dissented, voting in favor of an additional 25-basis-point rate cut.

The Fed’s wait-and-see approach places it at odds with US President Donald Trump, who has repeatedly called for massive rate cuts. However, some analysts argue that Trump may still get his way through market forces.

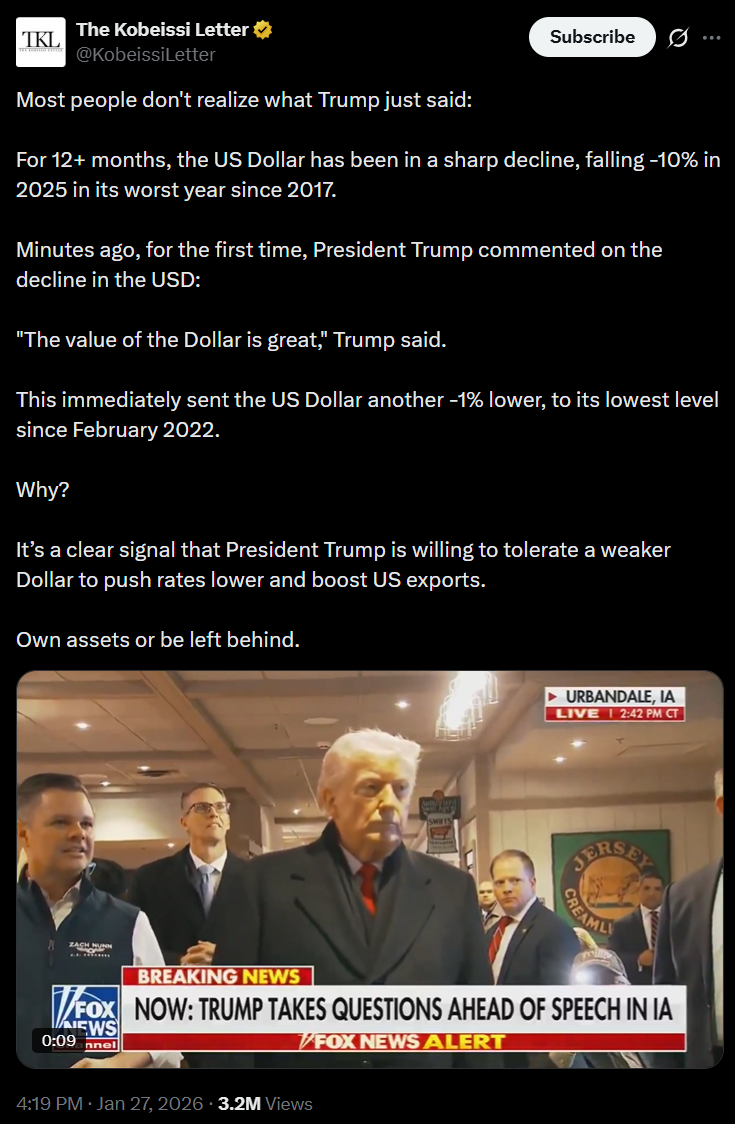

After posting its worst annual performance since 2017, the US dollar has continued to weaken this week, with the Bloomberg Spot Dollar Index sliding to four-year lows.

Asked about the dollar’s decline, Trump downplayed the move, saying, “The value of the dollar is great.”

For markets commentator The Kobeissi Letter, this is “a clear signal that President Trump is willing to tolerate a weaker Dollar to push rates lower and boost US exports.”

That view was echoed by David Ingles, chief markets editor at Bloomberg TV APAC, who said: “President Trump may effectively be cutting rates on the Fed’s behalf by letting the dollar slide.”

Related: Is the Bitcoin-versus-gold chart completely broken?

What it means for Bitcoin and crypto

Bitcoin (BTC) and the broader cryptocurrency market have been volatile as investors debate whether future US rate cuts could revive prices after October's liquidation sent the market sharply lower.

Historically, digital assets have tended to perform well during periods of loose monetary policy. However, analysts say the US dollar's trajectory may be an even more important catalyst than interest rates.

Julien Bittel, head of macro research at Global Macro Investor, has previously described a strong dollar as a “wrecking ball” for risk assets, warning that it can significantly tighten global financial conditions.

Analysts, including those at Hong Kong digital asset platform OSL, have pointed to an inverse relationship between Bitcoin and the US Dollar Index, meaning a stronger dollar tends to weigh on risk assets such as cryptocurrencies. They argue that dollar strength often signals a shift in investors’ risk appetite.

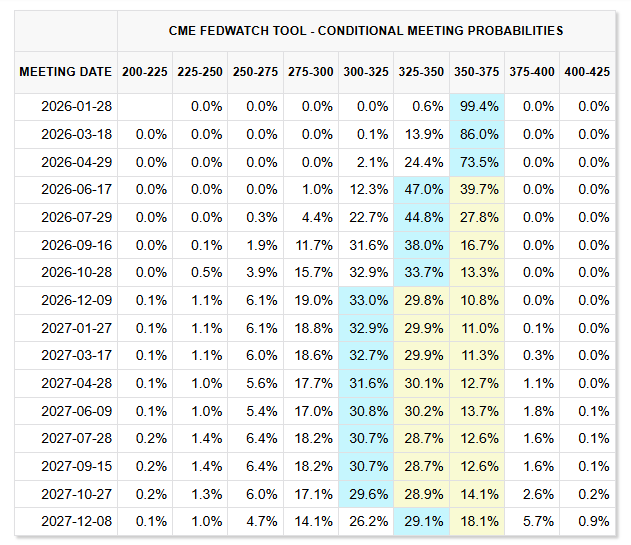

Meanwhile, expectations for further US rate cuts have faded in recent weeks as the Federal Reserve continues to monitor inflation and stronger-than-expected GDP growth. Markets are now pricing the probability of rate cuts at below 50% for the Fed’s next two meetings.

Related: US senators to weigh CFTC, other amendments to crypto market structure bill

cointelegraph.com

cointelegraph.com