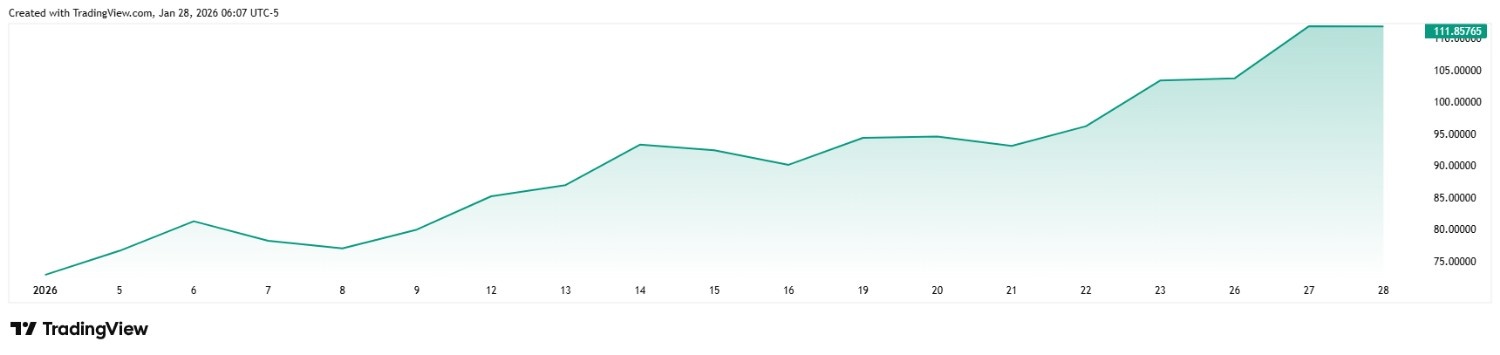

Beyond a shadow of a doubt, Silver has been the most exciting major asset in the world in 2026. After a generally strong performance in the commodity market through 2025, the argent metal went parabolic in 2026 and is already up 53.71% year-to-date (YTD) and changing hands just under $112.

Such a remarkable upsurge leaves much room for doubt about whether the upswing can be maintained to the point that one of the most bullish investors in the world regarding silver – Robert Kiyosaki – previously warned that he recommends a pause in buying after the $100 threshold is crossed.

Between the bullish momentum and the possibility that a price cure may be coming fast – after all, a common corrector of high prices is high prices themselves – Finbold consulted the advanced artificial intelligence (AI) of ChatGPT about where silver might find itself at the start of February.

ChatGPT sets Silver price target for the start of February

ChatGPT was quick to note just how rapidly silver has been rallying, but OpenAI’s flagship platform found that such an upsurge is unlikely to be sustainable.

Thus, the AI estimated that the bullish and bearish forces are likely to remain in relative equilibrium by February 1 – or, rather, February 2, as the markets will be closed on the first day of the month – and that the argent metal will be changing hands at $113.50.

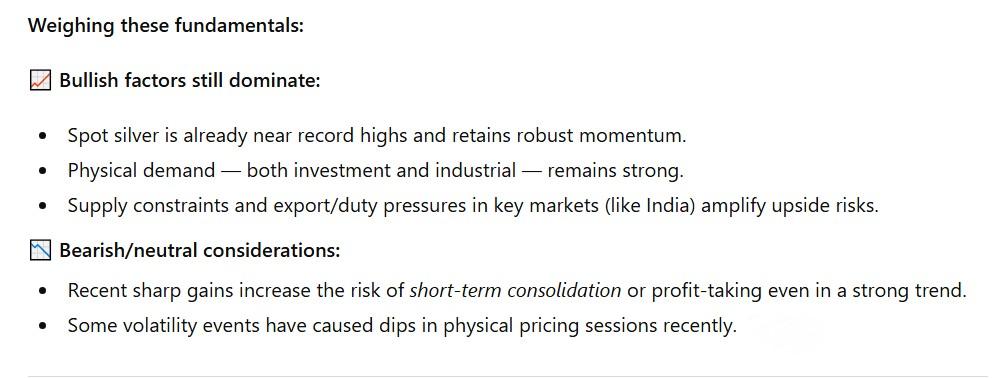

ChatGPT explained its forecast by noting that the commodity is driven by a powerful upward momentum, major demand in the Indian market, and a flight to safety observable among numerous investors. It also noted that industrial demand remains as strong as retail interest.

On the other hand, the AI also noted that the ‘recent sharp gains increase the risk of short-term consolidation or profit-taking even in a strong trend,’ but also that market volatility already caused multiple drops in recent trading.

Perhaps the most notable examples of such dips have been the January 26 correction after silver hit $117 and the January 28 fall following a climb to $116.

ChatGPT provides Silver price roadmap by February 2, 2026

When asked to map the likely closing prices for the commodity between press time on January 28 and the morning bell of February 2, ChatGPT explained that it mostly expects silver to trade sideways.

Specifically, it forecasted a moderate rise to $114 on January 29, followed by a pre-weekend drop back to $113 and, finally, a slight rise to $13.50 at the start of the next month.

Interestingly, ChatGPT explicitly proposed including a quote of its making as it wrote:

After a historic rally, silver is likely to remain elevated but consolidating, with spot closing near $114 on the next two trading days and settling around $113.5 on the first trading session of February 2026.

Lastly, the AI was less certain about silver’s performance through the rest of 2026, first forecasting a range between $90 and $135 but ultimately settling at a December 31 price target of $112 – almost squarely at the commodity’s press time level.

finbold.com

finbold.com