Solana has spent the past several months in a clear macro downtrend, weighed down by broader market weakness and declining risk appetite. The altcoin has struggled to regain sustained momentum since early September.

However, the coming month may mark a turning point as both institutional and retail participants increasingly align toward a bullish outcome for the Solana price in February.

Solana Institutions Are Bullish

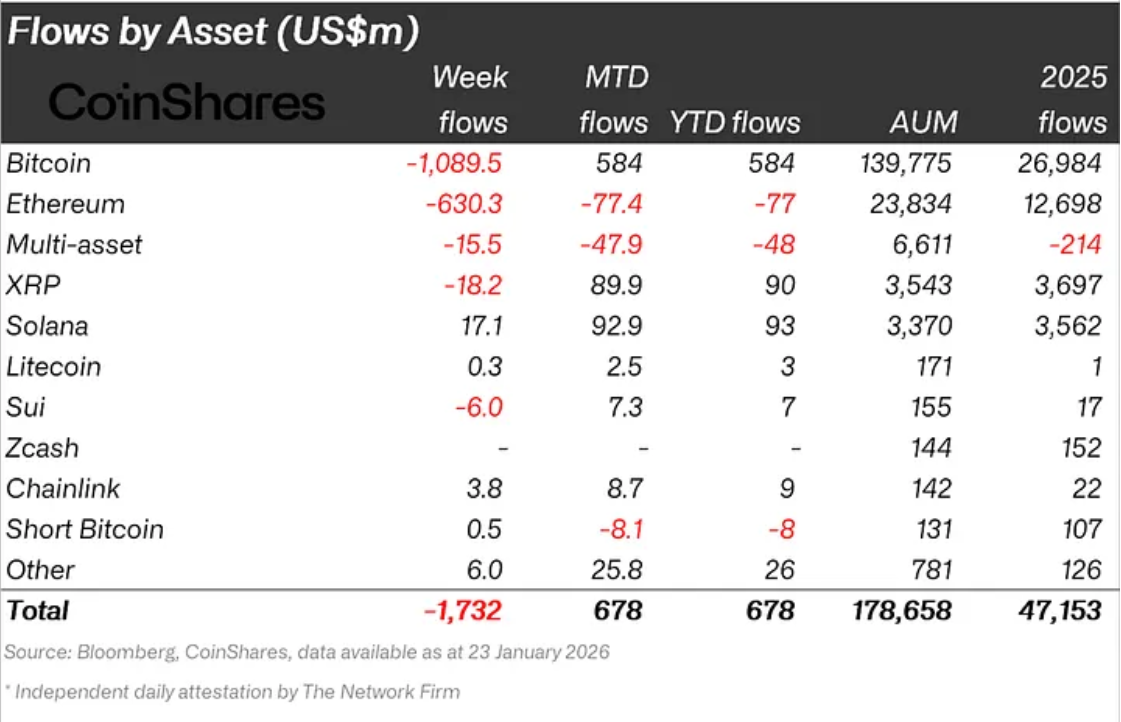

Institutional demand for Solana has remained resilient despite recent price weakness. From the start of January through January 23, Solana recorded inflows totaling $92.9 million. This made $SOL the second-highest recipient of institutional capital after Bitcoin during that period. Such positioning highlights growing confidence among large investors.

The trend strengthened further on a weekly basis. For the week ending January 23, Solana emerged as the only major altcoin to register net inflows. Other top assets posted outflows. This divergence highlights the relative strength of Solana’s institutional narrative and suggests sustained support heading into February.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Conviction Of Recovery Is Strong Among $SOL Holders

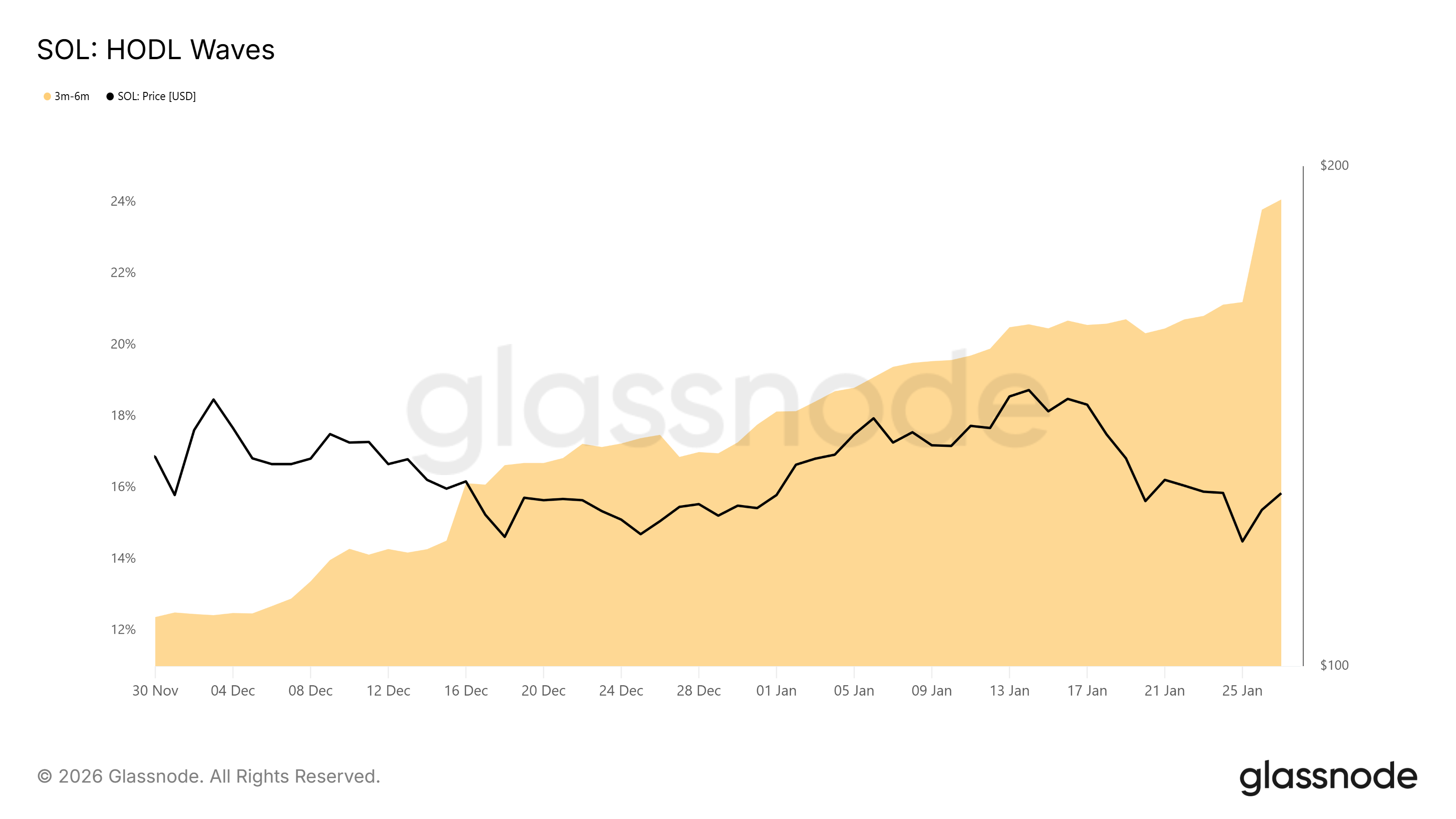

Retail and long-term investors are also signaling patience. HODL Waves data shows a notable increase in the 3-month to 6-month holding cohort. Within just 48 hours, this group’s share of Solana supply rose from 21% to 24%. This cohort largely consists of investors who entered positions around October 2025.

Many of these holders are currently underwater. Despite this, they have chosen to hold rather than sell into losses. Such behavior often reflects expectations of recovery. The unwillingness to distribute supplies during drawdowns reduces selling pressure and supports price stabilization.

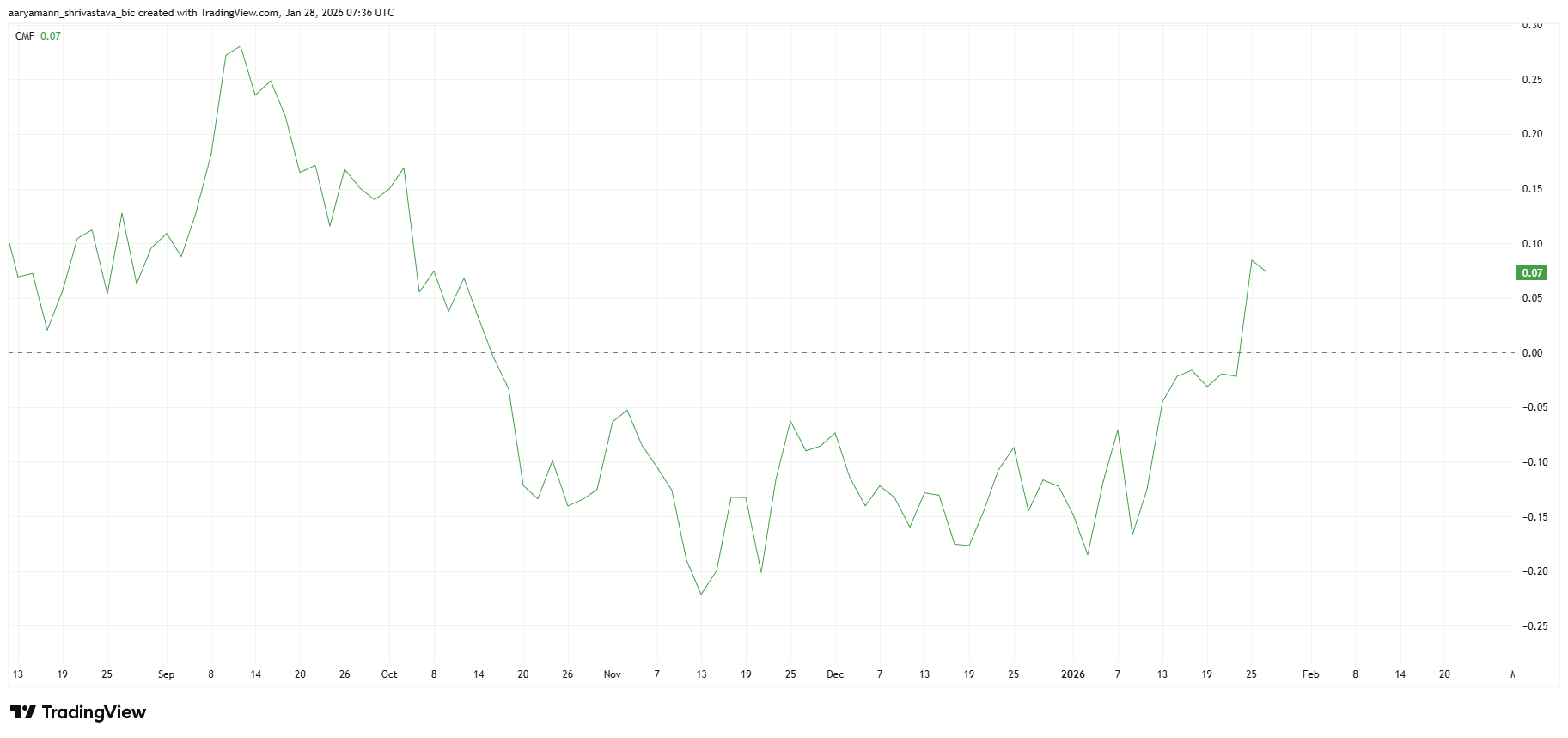

Momentum indicators are beginning to align with this improving sentiment. The Chaikin Money Flow has recently moved into positive territory above the zero line. This marks the first such shift since early October. CMF tracks capital moving in and out of an asset using price and volume.

A positive CMF reading indicates net inflows are returning to Solana. This shift suggests renewed demand and improving confidence. When combined with strong institutional participation and holder conviction, the data support a constructive outlook for the coming month.

$SOL Price Has a Positive February To Look Forward To

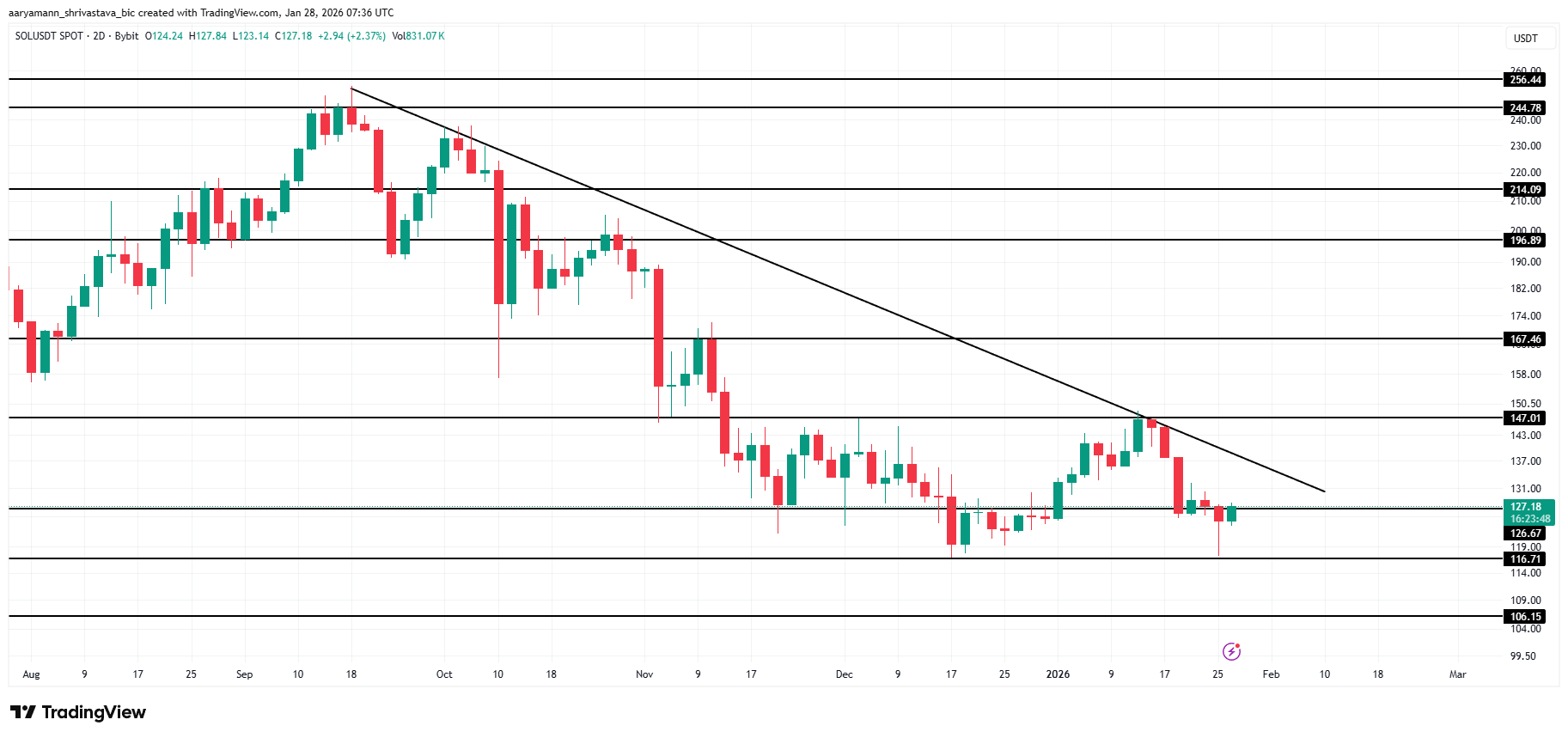

Solana trades near $127 at the time of writing, maintaining support above the $116 level on a macro basis. This zone has acted as a critical floor during recent volatility. While $SOL remains below its long-term downtrend line, price action has stabilized, reducing immediate downside risk.

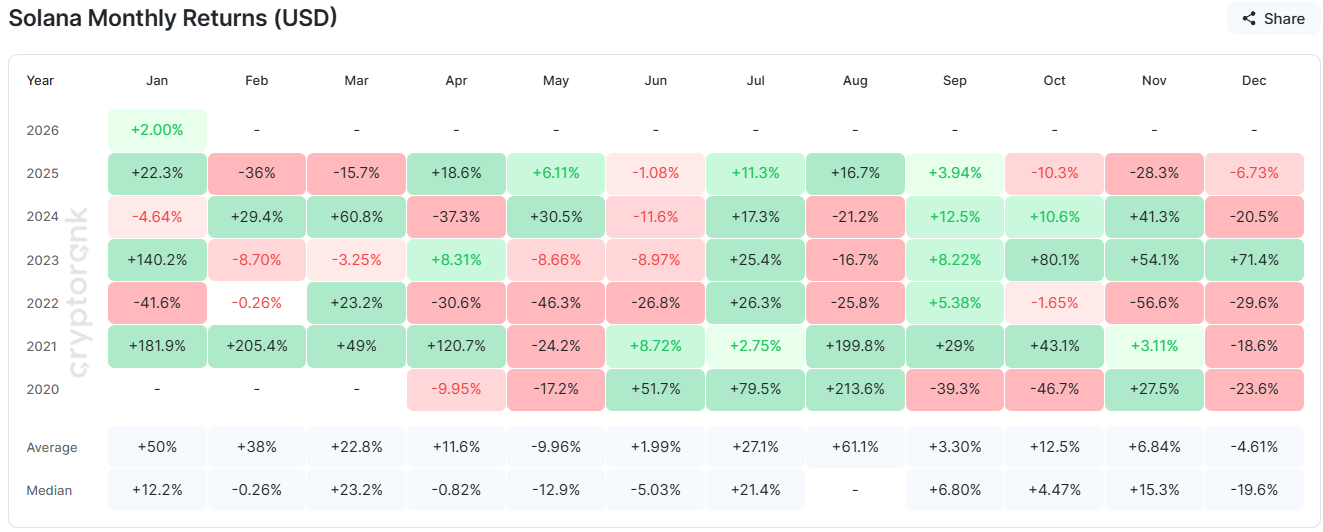

Breaking the downtrend is increasingly plausible given the supporting factors. February has historically been a strong month for Solana. On average, $SOL has posted returns of roughly 38% during February, making it one of its best-performing months historically.

If seasonal strength repeats, Solana could advance toward the $147 resistance. This level represents a key confirmation zone. Flipping it into support would signal a successful recovery. From there, $SOL could target $167, with a broader objective of reclaiming levels above $200 later in the cycle.

The bearish scenario remains relevant if conditions deteriorate. Failure to sustain buying interest or renewed macro stress could pressure price action. A breakdown below $116 would expose $SOL to further downside. Under that outcome, Solana could fall toward $106 or even below $100, invalidating the bullish thesis.

The post What To Expect From Solana Price In February 2026? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com