After a brief upward move at the start of the year, the XRP (XRP) price has predominantly remained under pressure, mirroring the broader market-wide downturn.

As the crypto market faces ongoing headwinds, a key signal from the derivatives market suggests a potential bullish recovery once investor interest returns.

XRP Price Struggles, But Derivatives Setup May Favor Recovery

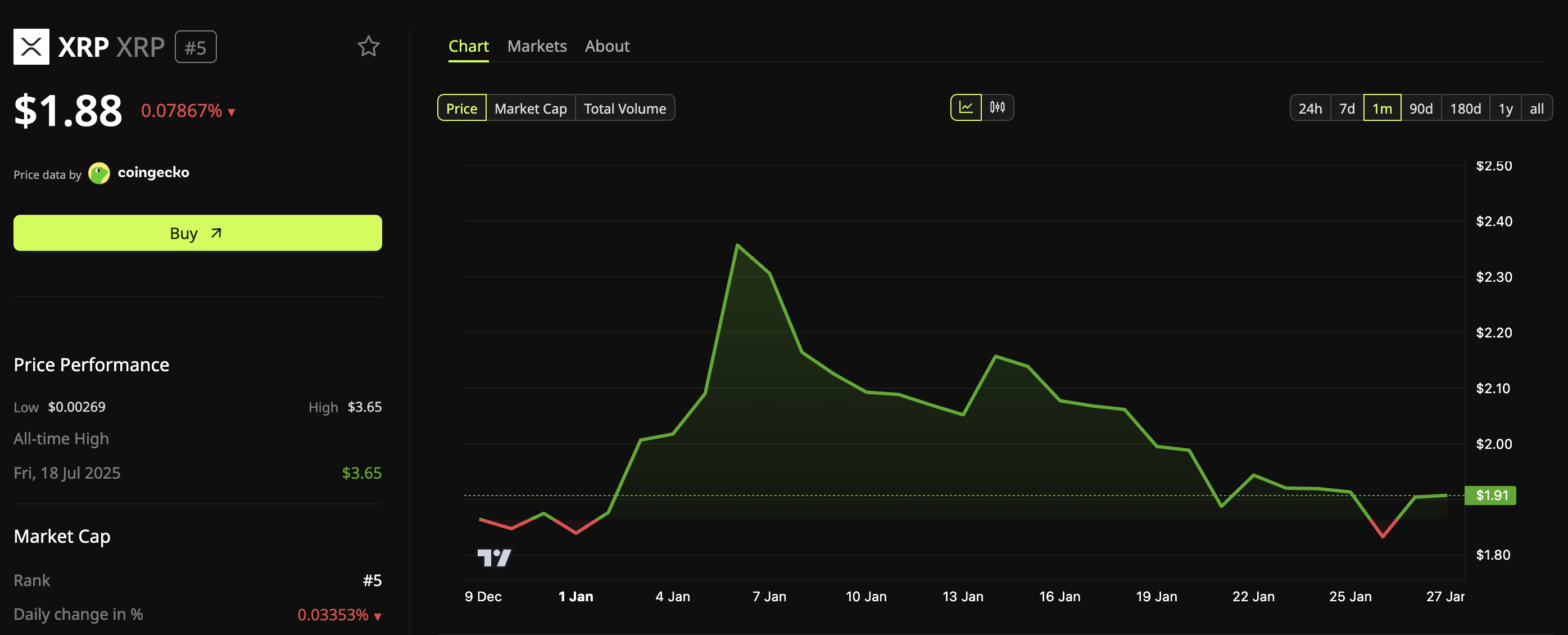

BeInCrypto Markets data showed that XRP started 2026 strongly, climbing more than 27% in the first five days of January. However, the momentum quickly faded, and the altcoin changed course, giving back most of its early gains.

Over the past 24 hours, XRP has extended its downtrend, posting a modest 0.078% loss. At the time of writing, it was trading at $1.88. While price action remains subdued, developments in the derivatives market are drawing closer attention.

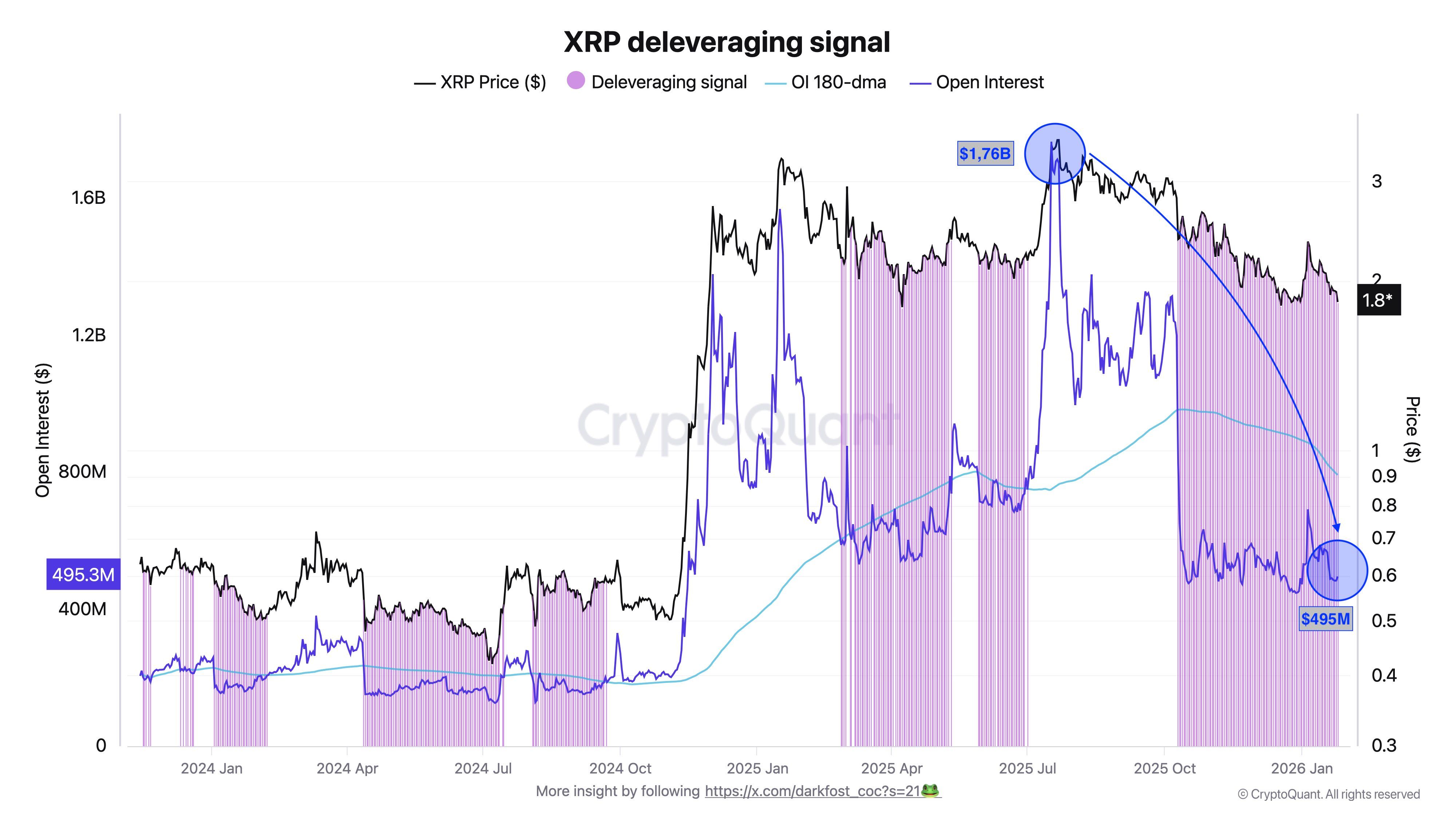

In a recent post, analyst Darkfost pointed to a pronounced decline in XRP’s open interest after it reached a peak of $1.76 billion on Binance on July 17.

The analyst added that the downturn coincided with a sharp price correction in XRP. The altcoin slid from $3.55 to around $1.83, wiping out nearly half of its value.

“As positions were liquidated or voluntarily closed, open interest on Binance continued to decrease, recently dropping below the $500M threshold. This level had now persisted since the exceptional liquidation event that occurred on October 10,” the post read.

XRP Open Interest Decline">

XRP Open Interest Decline">

The open interest contraction highlights a significant reduction in liquidity in the derivatives market, especially after the October market crash. The analyst also noted that falling prices mechanically compress open interest figures, intensifying the overall drop.

Despite the severity of the pullback, Darkfost emphasized that such deleveraging phases play a critical role. They help flush out excess leverage and reset market structure to healthier levels.

“Such periods are highlighted when XRP open interest on Binance falls below its semi-annual average. Historically, these cleanup phases have often been followed by a bullish recovery, once investor interest gradually returns to the derivatives market,” the analyst stated.

In addition to the derivatives market, BeInCrypto also identified potential recovery signals. The analysis shows the Liveliness metric has declined, indicating increased accumulation by long-term holders. This shift typically lessens sell-side pressure.

The Relative Strength Index (RSI) recently recovered from oversold levels below 30, a common marker of exhausted downward momentum. Furthermore, XRP trades within a descending wedge pattern, a setup that often precedes bullish breakouts if confirmed.

A trend reversal is approaching for the $XRP sub-indicator.

— CW (@CW8900) January 27, 2026

Convergence has been broken, and the trend is reversing. pic.twitter.com/nqpyASwoJN

The mix of derivatives market signals, long-term accumulation, and oversold technical indicators creates a potentially positive setup for a recovery. Yet, headwinds persist that might challenge the bullish outlook.

Data shows that XRP reserves on Binance and Upbit rose in January, together accounting for nearly 10% of the circulating supply. This concentration, especially after price declines, can indicate heightened selling pressure as coins move to exchanges for likely liquidation.

Overall, the coming weeks will determine if the deleveraging phase has cleared enough excess to support a true recovery or if further declines are likely.

The post XRP Price Action Stalls While Derivatives Market Flashes Key Bullish Signal appeared first on BeInCrypto.

beincrypto.com

beincrypto.com