XRP price has been in a downtrend for nearly three weeks, falling over 20% in the period. Can it backtrack its losses as technicals start leaning in favor of bulls?

- XRP price fell over 20% from its January high.

- Demand for XRP among investors remains steady despite recent volatility.

- XRP price action has confirmed a bullish reversal pattern on the 4-hour chart.

According to data from crypto.news, XRP (XRP) price dropped to a monthly low of $1.81 earlier today, continuing a downtrend that began on Jan. 6 when it traded around $2.39. Zooming out the charts, the losses put it nearly 48.4% below its all-time high hit in July last year.

XRP price fell amid a market-wide downturn triggered by geopolitical concerns surrounding the U.S. tariff drama with its major trading partners, and renewed concerns around a potential government shutdown.

Against this backdrop, delays around the U.S. crypto market structure bill and a hawkish Fed rate policy expected this year have also impacted XRP performance over the past weeks.

Despite these challenges, multiple positive factors have emerged that could catalyze a notable relief rally over the coming week.

First, the total market cap of stablecoins held on the XRP ledger network has increased by another $100 million over this month, now standing at $407 million. An increase in the stablecoin supply on a blockchain typically suggests investors are preparing to deploy capital into the ecosystem.

Second, XRP ETFs have experienced only two outflow days this month, bringing the total cumulative inflow for this month to $67.8 million, even as the crypto market continued to be impacted by macro forces.

These modest but steady numbers show that institutional investors are still treating XRP as a must-have for the long haul, regardless of the recent price swings.

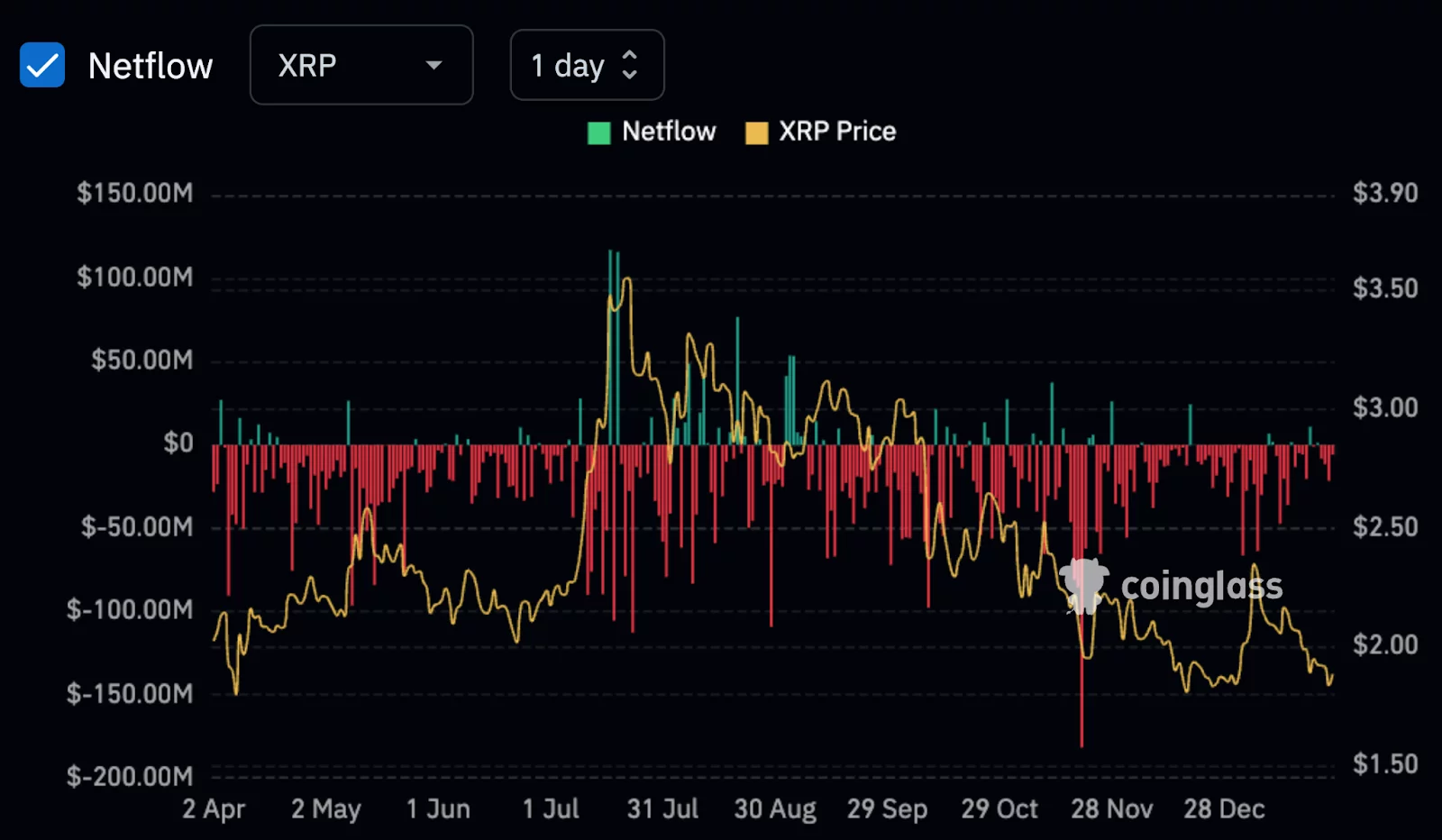

Investors have also been moving XRP out of exchanges. According to Coinglass data, XRP outflows from exchanges have consistently surpassed inflows over the past few weeks. See below.

XRP spot inflow/outflow from exchanges.">

XRP spot inflow/outflow from exchanges.">

At the same time, on the technical front, XRP price has confirmed a bullish reversal pattern on its chart that has historically been a precursor to corrective pullbacks.

XRP price analysis

On the 4-hour chart, the XRP price has broken out from a descending trendline that had been acting as resistance since the start of 2026. Whenever an asset breaks out from such a pattern, as in the case of XRP today, it typically suggests that bulls have the strength to dictate the market direction at least in the short term.

More importantly, the descending trendline mentioned is part of a falling wedge pattern, a formation characterized by two descending and converging trendlines.

As XRP broke out of the upper descending trendline, it successfully confirmed a breakout from the bullish reversal pattern. This puts it at a significant technical advantage for further gains.

Hence, XRP price could potentially rally to as high as $2.23, the target calculated by measuring the height of the falling wedge pattern and adding it to the breakout point. If bullish momentum remains intact, buyers could further push its price back toward its January high of $2.39.

However, if the XRP price fails to hold above the next psychological support at $1.80, the bullish forecast would likely be invalidated. Such a bearish outlook remains a distinct possibility as the crypto market continues to navigate a volatile state with traders largely remaining risk-off at press time.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.