Key takeaways:

- Tezos price prediction suggests a recovery to $1.04 by the end of Q1 2026.

- $XTZ could reach a maximum price of $3.56 by the end of 2029.

- By 2031, $XTZ’s price may surge to $6.21.

Tezos started strong as a platform for smart contracts and decentralized apps. After being released in 2018, its price touched an all-time high of $9.12 in 2021. However, throughout this time, it faced issues like lawsuits and power struggles, causing a loss of investor trust.

Eventually, the overall market’s effects plummeted the coin’s price, and it has failed to recover to the same mark since then. However, collaborations and innovations are growing on the Tezos network, bringing it into close competition with other smart contract platforms like Ethereum and Solana.

Many crypto enthusiasts ask questions like, “Can the Tezos coin hit $50 in the long term?” or at least, “Will Tezos survive?”

Let’s get into Tezos price prediction and technical analysis.

Overview

| Cryptocurrency | Tezos |

| Ticker | $XTZ |

| Current price | $0.5865 |

| Market cap | $629.33M |

| Trading volume (24-hour) | $32.14M |

| Circulating supply | 1.073B $XTZ |

| All-time high | $9.18 on October 04, 2021 |

| All-time low | $0.3505 on December 7, 2018 |

| 24-hour high | $0.6005 |

| 24-hour low | $0.575 |

Tezos price prediction: Technical analysis

| Metric | Value |

| Volatility (30-day Variation) | 8.91% (High) |

| 50-day SMA | $0.5197 |

| 14-Day RSI | 54.86 (Neutral) |

| Sentiment | Bullish |

| Fear & Greed Index | 24 (Extreme Fear) |

| Green days | 17/30 (57%) |

| 200-day SMA | $0.6274 |

Tezos price analysis

TL;DR Breakdown:

- $XTZ is consolidating after a ~22% rebound, not breaking down.

- Momentum has cooled, but no strong bearish signal is active.

- The $0.54–$0.56 support zone remains key to price direction.

Tezos price analysis 1-day chart

$XTZ is trading around $0.586, up roughly +1.2% on the day, after a strong January push from the late-December low near $0.48, marking a recovery of about +22% peak-to-trough. The price is now compressing just above the 20-day SMA near $0.58, while the Bollinger Bands are tightening after previously expanding, signaling reduced volatility.

The rejection from the upper band near $0.62 shows buyers losing short-term dominance, but structure remains constructive as long as $0.56–$0.54 holds. The RSI sits in the mid-50s, cooling from prior highs without breaking bearish territory, while MACD has rolled slightly negative, reflecting momentum fatigue rather than trend reversal.

Tezos price analysis 4-hour chart

On the 4-hour timeframe, $XTZ is consolidating tightly between $0.575 and $0.59, with price oscillating around the Alligator averages, confirming a neutral, non-trending phase. The lack of candle expansion suggests indecision, but OBV remains elevated and stable, implying no aggressive distribution despite the stall.

Repeated defenses above $0.575 indicate short-term buyers are still present, though upside attempts toward $0.60 continue to fade without volume expansion, keeping the market boxed in.

Tezos technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $0.5781 | BUY |

| SMA 5 | $0.5706 | BUY |

| SMA 10 | $0.5768 | BUY |

| SMA 21 | $0.5662 | BUY |

| SMA 50 | $0.5197 | BUY |

| SMA 100 | $0.5427 | BUY |

| SMA 200 | $0.6274 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $0.5798 | BUY |

| EMA 5 | $0.5697 | BUY |

| EMA 10 | $0.5476 | BUY |

| EMA 21 | $0.5219 | BUY |

| EMA 50 | $0.5187 | BUY |

| EMA 100 | $0.5541 | BUY |

| EMA 200 | $0.6121 | SELL |

What to expect from $XTZ price analysis next?

$XTZ is in a classic post-rally digestion phase. Continued sideways action is more likely than an immediate breakout, with a move above $0.62 needed to reignite upside momentum. At the same time, a loss of $0.54 would shift focus toward a deeper pullback.

Is Tezos a long term investment?

Tezos could be a good investment as its price movements in the past and recent times reflect opportunities for massive gains. Of course, there have been significant bear markets, but the price recoveries that followed put money in the pockets of traders.

Also, the platform is quite developed and supports DeFi solutions, decentralized applications, and NFTs, so there are utilities that can keep the coin’s price afloat and upward. However, as always, you should always do your research because crypto can be extremely volatile.

Will Tezos recover?

Yes, Tezos is likely to recover by the end of this year. Expert forecasts suggest that $XTZ will approach $1.5 by then.

Will Tezos reach $10?

Yes, Tezos can reach $10. Its all-time high was $9.18; significant bullish momentum will be required to recapture this level.

Will Tezos reach $50?

Based on expert analysis, Tezos may not reach $50 anytime soon. A huge market cap will be required to reach that point. However, mass adoption and integration with new systems could make this possible.

Does Tezos have a good long-term future?

Tezos seems to have a good long-term future because the platform regularly brings updates, and development is ongoing. It also fits into the larger narrative of decentralized finance and decentralized applications.

Recent news/opinion on Tezos

- Tezos’ EVM-compatible layer on Etherlink sees an average DAA growth of 33.8% QoQ in Q3 2025.

On @Etherlink, the EVM compatibility layer for Tezos, average DAA (unique addresses that sent at least one transaction) grew 33.8% QoQ in Q3 2025. pic.twitter.com/vWvKnuyQnu

— Tezos (@tezos) December 10, 2025

Tezos price prediction January 2026

If the bulls back $XTZ, the token could break out, reaching a peak of $0.70 while maintaining an average trading price of $0.59 in January 2026. Traders can expect a minimum price of $0.48.

| Tezos price prediction | Minimum price ($) | Average price ($) | Maximum price ($) |

| $XTZ price prediction January 2026 | 0.48 | 0.59 | 0.70 |

Tezos price prediction 2026

Experts believe the overall outlook for Tezos ($XTZ) by the end of Q1 2026 is positive. Investors can expect a minimum market price of $0.41, an average price of $0.60, and a maximum price of $1.04.

| Tezos price prediction | Minimum price ($) | Average price ($) | Maximum price ($) |

| Tezos price prediction 2026 | 0.41 | 0.60 | 1.04 |

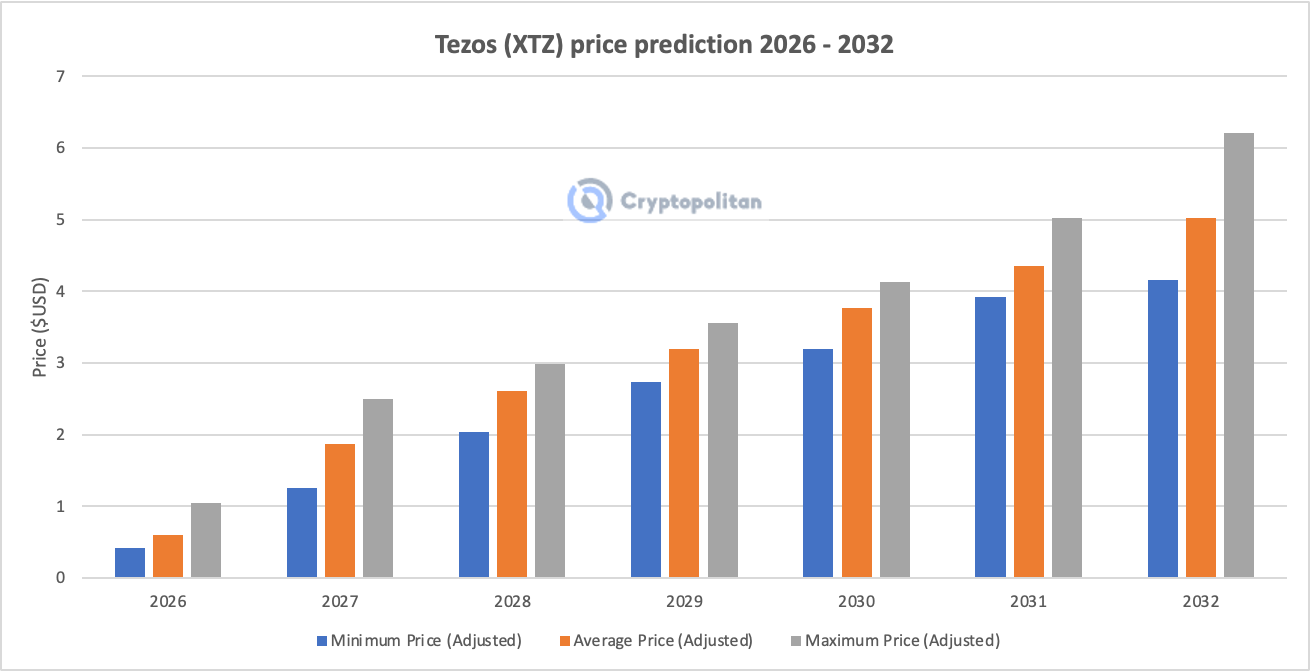

Tezos price prediction 2027-2032

| Year | Minimum Price | Average Price | Maximum Price |

| 2027 | $1.25 | $1.87 | $2.50 |

| 2028 | $2.03 | $2.61 | $2.98 |

| 2029 | $2.74 | $3.19 | $3.56 |

| 2030 | $3.19 | $3.77 | $4.13 |

| 2031 | $3.92 | $4.35 | $5.02 |

| 2032 | $4.15 | $5.02 | $6.21 |

Tezos price prediction for 2027

The $XTZ price prediction for 2027 indicates a continued rise, with minimum and maximum prices of $1.25 and $2.50, respectively, and an average price of $1.87.

Tezos price prediction for 2028

Tezos’s price is expected to reach a minimum of $2.03 in 2028. The maximum expected $XTZ price is $2.98, with an average price of $2.61.

Tezos price prediction for 2029

The $XTZ price prediction for 2029 estimates a minimum price of $2.74, a maximum price of $3.56, and an average price of $3.19.

Tezos price prediction for 2030

The Tezos price prediction for 2030 suggests a minimum price of $3.19 and an average price of $3.77. The maximum Tezos price is set at $4.13.

Tezos price prediction for 2031

The $XTZ price prediction for 2031 anticipates a surge in price, resulting in a maximum price of $5.02. Based on expert analysis, investors can expect an average price of $4.35 and a minimum of $3.92.

Tezos price forecast for 2032

According to the $XTZ price forecast for 2032, Tezos is anticipated to trade at a minimum price of $4.15, a maximum price of $6.21, with an average price of $5.02.

Tezos market price prediction: Analysts’ $XTZ price forecast

| Firm | 2026 | 2027 |

| Changelly | $0.837 | $1.19 |

| DigitalCoinPrice | $0.96 | $1.33 |

| CoinCodex | $0.6997 | $0.6896 |

Cryptopolitan’s Tezos ($XTZ) price prediction

Per the Cryptopolitan team, Tezos is expected to reach $1.2 by Q1 2026, and forecasts up to 2032 give a positive outlook for $XTZ to break above the $5 mark. For that to happen, future price movements and an increase in Tezos’ adoption must be bullish.

Tezos historic price sentiment

- Tezos mainnet went live in September 2018 and immediately gained popularity for dealing with the environmental impact of blockchain technologies at that time with its PoS model.

- $XTZ’s price peaked during the bullish cycle of 2021, reaching above $9.0.

- After 4 April 2022, $XTZ’s price plummeted below $4.0; by 9 May, it had sharply fallen below the $2 mark.

- $XTZ surged to about $1 at the beginning of December 2022, but the bears reclaimed the market by the end of the month, resulting in a drop to $0.73. The coin recovered in 2023, averaging a market price of $0.8.

- Despite its partnership milestones, Tezos ($XTZ) had a bearish 2024. The coin peaked at $1.4 in April but dropped about 60% by August.

- Buyers returned in September, driving the price to $0.7015, and momentum carried into November with a peak of $1.856. The rally extended to December, when $XTZ reached $1.909 before corrections brought the year-end close to $1.286.

- $XTZ peaked at $1.49 in January 2025 before dropping to an average of $0.72 in February. From March to May, it consolidated below $0.70 with an overall average of $0.66.

- In June, it traded between $0.4752 and $0.6362, while July averaged $0.7232. August opened at $0.7605 and averaged $0.8212.

- September saw a minimum of $0.6437, a maximum of $0.8292, and an average of $0.7261. In October, $XTZ traded between $0.5986 and $0.4692.

- In November, Tezos ($XTZ) traded between $0.4758 – $0.7454, and in December, it traded between $0.4223 and $0.5300. In January 2026, the coin is trading between $0.575 – $0.6005.

cryptopolitan.com

cryptopolitan.com