By Francisco Rodrigues (All times ET unless indicated otherwise)

Crypto prices are recovering after tensions between the U.S. and its NATO allies eased in what's become known as a taco (Trump always chickens out) trade, while bond yields are falling.

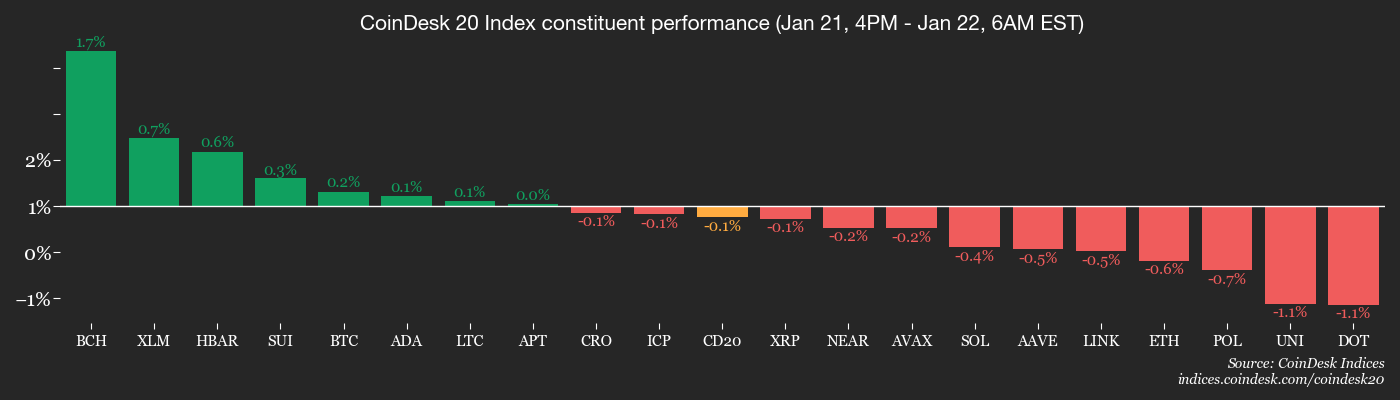

Bitcoin $BTC$89,967.18 rose 0.75% to reclaim the $90,000 level, while ether topped $3,000 after advancing 1.25%. The broader CoinDesk 20 (CD20) index gained 1.56% in the past 24 hours.

A key driver of the rebound was the recovery in Japan’s long-dated government bonds. After surging to multidecade highs, yields on the government's 10- and 30-year debt fell for a second consecutive session, helped by public reassurances from Tokyo officials. When bond yields fall, prices rise.

That brought some relief to global borrowing markets and, by extension, crypto, which tends to suffer when traders become more defensive and liquidity conditions worsen.

Adding to the recovery was a shift in tone from U.S. President Donald Trump at the World Economic Forum in Davos. In a classical example of the taco trade, the president spooked markets with threats of new tariffs against NATO allies over the status of Greenland before reversing course to say a “framework of a future deal” had been worked out.

Denmark, which controls Greenland, said ceding control of the territory is off the table, yet security and investments are to be negotiated.

Markets reacted decisively. Global equities rallied, gold prices cooled and risk sentiment improved, giving crypto traders breathing room after days of turbulence.

Bond yields and geopolitical tensions remain key pressure points. It’s unclear what exactly the Greenland deal entails, and the situation could change rapidly.

Crypto prices are meanwhile still threatening a bearish continuation. A break below “high 80s levels” for bitcoin would set lower highs, Jasper De Maere, desk strategist at Wintermute, said in an emailed note. Stay alert!

Read more: For analysis of today's activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Jan. 22: Stellar’s X-Ray protocol mainnet launches.

- Macro

- Jan. 22, 8:30 a.m.: U.S. Q3 GDP growth rate QoQ final est. 4.3%

- Jan. 22, 8:30 a.m.: U.S. jobless claims for week ended Jan. 17 (Prev. 198K); Continuing for week ended Jan. 10 (Prev. 1884K)

- Jan. 22, 8:30 a.m.: U.S. PCE prices QoQ final for Q3 est. 2.8%; Core PCE QoQ final for Q3 est. 2.9%

- Jan. 22, 10:30 a.m.: Elon Musk to speak at the World Economic Forum in Davos for the first time.

-

Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Jan. 22: NEAR Protocol to launch the first-ever edition of its Intents Day.

- Jan. 22: Nexus Mutual to host a DeFi Risk Briefing X Spaces session.

- Unlocks

- Jan. 22: $MBG ($MBG) to unlock 12.13% of its circulating supply worth $10.11 million.

- Token Launches

- Jan. 22: Immunefi (IMU) token generation event to occur.

- Jan. 22: Fight Foundation’s FIGHT token generation event to occur.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 4 of 4: Web3 Hub Davos (Switzerland)

Market Movements

- $BTC is up 0.11% from 4 p.m. ET Wednesday at $89,952.17 (24hrs: +0.70%)

- $ETH is down 1.22% at $2,986.43 (24hrs: +0.69%)

- CoinDesk 20 is down 0.35% at 2,774.56 (24hrs: +1.64%)

- Ether CESR Composite Staking Rate is up 1 bps at 2.85%

- $BTC funding rate is at 0.0083% (9.0743% annualized) on Binance

- DXY is unchanged at 98.70

- Gold futures are down 0.20% at $4,827.70

- Silver futures are up 1.05% at $93.61

- Nikkei 225 closed up 1.73% at 53,688.89

- Hang Seng closed up 0.17% at 26,629.96

- FTSE is up 0.67% at 10,206.13

- Euro Stoxx 50 is up 1.30% at 5,959.33

- DJIA closed on Wednesday up 1.21% at 49,077.23

- S&P 500 closed up 1.16% at 6,875.62

- Nasdaq Composite closed up 1.18% at 23,224.82

- S&P/TSX Composite closed up 0.31% at 32,851.53

- S&P 40 Latin America closed up 2.78% at 3.465,21

- U.S. 10-Year Treasury rate is down 0.4 bps at 4.249%

- E-mini S&P 500 futures are up 0.59% at 6,950.50

- E-mini Nasdaq-100 futures are up 0.87% at 25,692.00

- E-mini Dow Jones Industrial Average Index futures are up 0.34% at 49,433.00

Bitcoin Stats

- $BTC Dominance: 59.72% (unchanged)

- Ether-bitcoin ratio: 0.03336 (0.06%)

- Hashrate (seven-day moving average): 1,017 EH/s

- Hashprice (spot): $38.77

- Total fees: 2.69 $BTC / $239,530

- CME Futures Open Interest: 120,460 $BTC

- $BTC priced in gold: 18.5 oz.

- $BTC vs gold market cap: 6.0%

Technical Analysis

- The top chart shows the ratio of bitcoin market cap to that of the 10 biggest altcoins.

- The ratio appears to be at a major weekly support with no further breaks in spite the market wide weakness over the past few weeks.

- Interestingly, there is bullish RSI divergence forming in the lower panel, with the index creeping up while the price ratio stays flat

- That dynamic implies there may a potential breakout for the 10 altcoins relative to $BTC in the short to medium term.

Crypto Equities

- Coinbase Global (COIN): closed on Wednesday at $226.93 (–0.35%), +0.99% at $229.18 in pre-market

- Galaxy Digital (GLXY): closed at $32.45 (+1.09%), +2.28% at $33.19

- MARA Holdings (MARA): closed at $10.56 (+1.83%), +0.95% at $10.66

- Riot Platforms (RIOT): closed at $17.25 (–4.70%), +1.97% at $17.59

- Core Scientific (CORZ): closed at $18.20 (–0.87%), +1.10% at $18.40

- CleanSpark (CLSK): closed at $12.81 (+0.39%), +1.64% at $13.02

- Exodus Movement (EXOD): closed at $15.73 (–4.55%)

- CoinShares Bitcoin Mining ETF (WGMI): closed at $47.91 (–0.62%)

- Circle Internet Group (CRCL): closed at $72.64 (–0.08%), +1.51% at $73.74

- Bullish (BLSH): closed at $38.37 (–1.54%), +0.60% at $38.60

Crypto Treasury Companies

- Strategy (MSTR): closed at $163.81 (+2.23%), unchanged in pre-market

- Strive Asset Management (ASST): closed at $0.892 (+0.80%), -0.27% at $0.89

- SharpLink Gaming (SBET): closed at $9.97 (+0.20%), +0.60% at $10.03

- Upexi (UPXI): closed at $2.10 (+3.45%)

- Lite Strategy (LITS): closed at $1.32 (+0.76%)

ETF Flows

Spot $BTC ETFs

- Daily net flows: -$708.7 million

- Cumulative net flows: $56.61 billion

- Total $BTC holdings ~1.3 million

Spot $ETH ETFs

- Daily net flows: -$287 million

- Cumulative net flows: $12.41 billion

- Total $ETH holdings ~6.14 million

Source: Farside Investors

While You Were Sleeping

New trade map takes shape in Davos as world adjusts to Trump tariffs (Reuters): Davos leaders are scrambling to diversify trade as Trump’s tariff threats rattle allies. After floating new levies tied to Greenland, Trump walked them back with a NATO “deal framework.”

Dow Futures, Global Stocks Rise After Trump Tariff U-Turn (The Wall Street Journal): Global stocks and U.S. futures climbed after Trump backed off tariff threats against Europe over Greenland, sparking a relief rally. Tech and chip shares led premarket gains as gold eased.

Bitcoin and ether fall, then rebound as Trump retreats from Greenland tariffs (CoinDesk): Bitcoin dipped below $88,000 before rebounding near $90,000 in Asia after Trump softened tariff threats tied to Greenland at Davos. $ETH and majors followed, with the whipsaw underscoring how closely crypto remains tethered to macro headlines and bond yields.

coindesk.com

coindesk.com