Chainlink (LINK) traded in a short-term bearish correction on the 4-hour chart after a sharp drop from the recent swing high near $14.39. The sell-off pushed LINK below its main EMA cluster, which often signals that sellers still control near-term momentum. Price has started a bounce attempt near $12.38, but bulls still need stronger follow-through to shift sentiment.

LINK Tries to Stabilize After the Drop

The rebound attempt has held above the first support zone around $12.37. This level matches the Fib 0.236 area and acts as the first test for buyers. However, downside pressure still matters if price fails to regain key resistance levels.

If LINK loses $12.37, traders will likely watch the $12.00–$11.89 demand zone next. A deeper breakdown could expose $11.75, which stands as the key line that separates support from further downside risk.

Besides the technical levels, the market structure still shows a cautious tone. LINK needs stronger momentum to reduce rejection risk at overhead zones. Hence, the next moves around resistance will likely shape the short-term trend.

LINK faces immediate resistance near $12.44, which now acts as a reaction zone. Additionally, the $12.60 area sits near the EMA region and could slow any recovery. A clean breakout above $12.76 would improve confidence, since it aligns with the Fib 0.382 level. That move would also suggest buyers gained control over the bounce.

Related: River Price Prediction: RIVER Retreats From Highs as Open Interest Hits New Peak

Consequently, the next challenge stands at $13.07, the Fib 0.5 mark, where sellers may defend aggressively. If LINK clears that barrier, the upside path opens toward $13.38, the Fib 0.618 pivot.

Significantly, reclaiming $13.38 would shift structure toward a more bullish setup. Above that, the $13.88–$14.00 zone remains a heavy supply area before the $14.39 peak.

Open Interest and Spot Flows Signal Caution

Open interest data has shown a boom-and-cooldown cycle across the past year. It climbed during rallies and then fell sharply after major spikes. This pattern often reflects leverage builds followed by washouts during volatility.

The latest reading shows open interest stabilizing near $559 million, while price trades around $12.38. Moreover, this steadier base suggests traders are rebuilding exposure without extreme leverage.

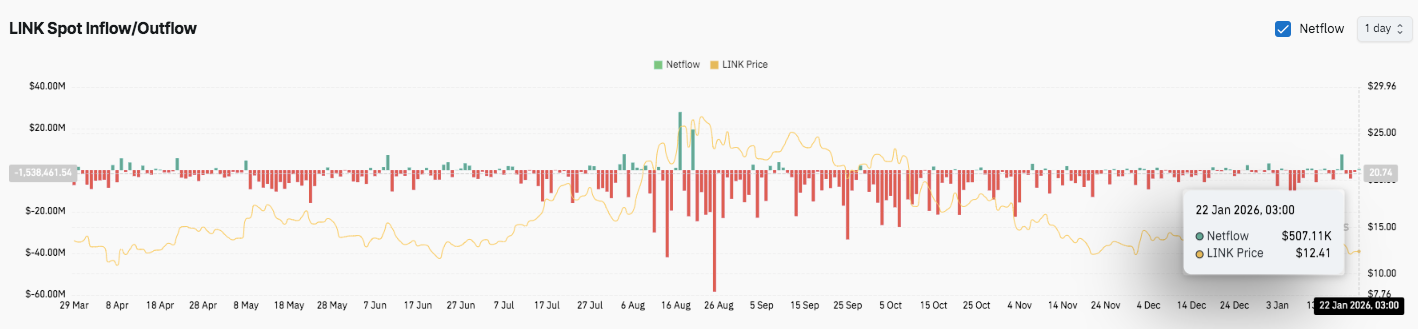

Spot flow data has leaned negative across the period, with repeated outflow dominance. During the August to early September rally, netflows turned positive briefly. However, that shift did not last, and stronger outflows returned during the pullback. The latest figure showed a small inflow near $507,000, yet overall flow still favors sellers.

Technical Outlook For Chainlink Price

Key levels remain well-defined for Chainlink (LINK) after the sharp sell-off from the $14.39 swing high.

- Upside levels: $12.44 and $12.60 stand as immediate hurdles, followed by $12.76 as the key breakout trigger. A clean move above $12.76 could extend toward $13.07 and $13.38, where sellers may defend aggressively.

- Downside levels: $12.37 is the first support holding the bounce attempt, followed by the $12.00–$11.89 demand zone. The breakdown level sits at $11.75, and losing it risks a deeper continuation move. The technical picture suggests LINK is trying to stabilize below the EMA cluster, where momentum still favors sellers.

Will Chainlink Go Up?

LINK’s next direction depends on whether bulls can defend $12.37 long enough to reclaim $12.60–$12.76. Stronger inflows and rising open interest could support a recovery push.

However, failure to clear resistance may send price back to $12.00 and lower. For now, LINK remains in a pivotal zone.

Related: Seeker (SKR) Price Prediction 2026: Can Solana’s Mobile Token Challenge Apple and Google?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com