Venture investors are increasingly locking horns over DePIN — short for decentralized physical infrastructure networks — as some argue the model is running out of steam.

What began as an ambitious attempt to fund decentralized infrastructure with tokenomics — and as of just last June was projected to grow into a $3.5 trillion market by 2028 — is now under closer scrutiny. The conversation has shifted away from vision and toward fundamentals, such as capital costs, cash flow, and who actually bears the risk when things go wrong.

‘DePIN Is Dying’

Meltem Demirors, founding partner at Crucible Capital, didn’t sugarcoat the issue, writing on X last Monday, “DePIN is dying and i don't see it coming back.” Demirors argued that DePIN’s token models “deny the physics of finance,” referring to the massive surge in centralized, AI-driven infrastructure spending as evidence that markets are choosing efficiency over ideology.

However, Crucible’s founder and general partner went on to argue that crypto has an opportunity to be integrated in the shift from public to private infrastructure financing, adding that “the opportunity for crypto is not bottoms up innovation but top down embedded finance.”

David Choi, co-founder and CEO of the firm behind USDai, a yield-bearing synthetic dollar backed by AI infrastructure, weighed in on the debate, suggesting in an X post that DePIN’s core challenge is financial rather than technical.

Drawing on his firm’s work evaluating dozens types of physical equipment that underpin DePIN networks — such as GPUs, antennas, and networking hardware — Choi said many models start to break down once the cost of that hardware collides with the cost of financing it.

As projects try to scale by relying on cheaper devices, data quality often deteriorates and “without unique data, you cant really produce superior networks,” Choi noted.

That tradeoff, Choi said, creates a counterproductive cycle. “As the more expensive a hardware got, you needed to have a higher pay out to justify a higher cost threshold,” Choi wrote, pushing teams to use lower-quality gear just to make expansion affordable.

Structural Skepticism

But skeptics insist that the flaws are structural. Dan Elitzer, a partner at crypto investment firm Nascent, said in esponse to Choi that his firm avoided the sector altogether, viewing DePIN as “almost entirely thinly veiled shitcoin ICOs” that result in “less efficient infrastructure deployment.”

As Elitzer explained, Nascent ultimately backed USDai not for DePIN exposure, but because its founders “won’t stop until they build something massive that changes capital markets.”

Coordination vs Control

Still, not everyone is ready to call it dead. Sami Kassab, managing partner at Unsupervised Capital, warned in a reply to Demirors’ X post that dismissing DePIN entirely implies “crypto isn’t a coordination technology,” a premise he rejects. Demirors quickly pushed back in a follow-up, replying that “a coordination technology where 50% or more of the share is controlled by one entity is just a dictatorship.”

While venture capital leaders remain divided on how far DePIN can go, the past year has been unforgiving for the sector, to say the least.

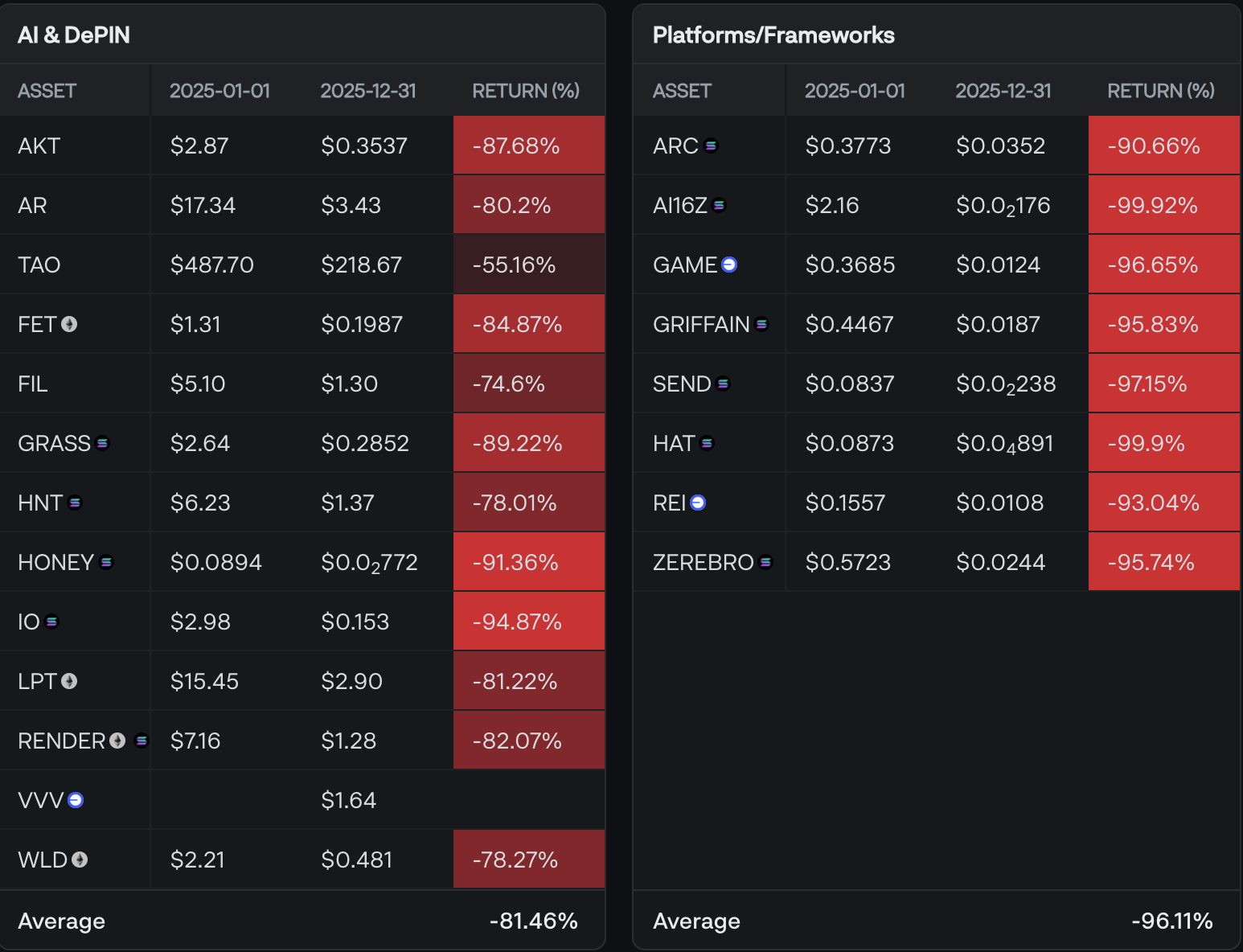

Data from Delphi Digital shows that DePIN and AI-related tokens lost more than 80% on average in 2025, making the category the fifth-worst performer overall and trailing only modular projects, gaming, agents, and frameworks.

But it’s not like all DePIN projects are faring badly. Aethir, a decentralized cloud computing network that pools GPUs, pulled in over $127 million in revenue in 2025, just one year after its debut.

Helium, which was also launched in 2024 and builds real-world wireless networks, also generated over $18 million in annualized network fees in 2025, per DefiLlama data.

Road to Fundamentals

Some still see the ongoing chatter less as a death spiral and more as a necessary correction. Naman Kabra, co-founder and CEO of NodeOps, an AI-powered orchestration layer for DePIN, told The Defiant that the sector is moving from hype toward fundamentals.

“The DePIN sector is maturing,” Kabra said, noting that “initial excitement moved faster than fundamentals, and we're now seeing the natural evolution from hype to substance.”

In Kabra’s view, the projects gaining traction today are those that built products people actually wanted and found revenue before obsessing over token mechanics.

“The companies that thrive will be chosen because the service works well, not because of blockchain architecture. This transition from novelty to utility represents progress,” Kabra concluded.

Lex Sokolin, a partner at Generative Ventures, sees the whole debate as a distribution problem, writing in an X post in response to Demirors that unlike crypto, big tech can allocate capital “efficiently across things they own, including distribution.”

But DePIN finances only part of the chain and can’t capture demand directly, leaving projects stuck between ideology and economics until they secure users, Sokolin added.