Ripple’s expansion through acquisitions and regulatory progress has changed how most $XRP community members see the company.

Instead of seeing Ripple as only a blockchain payments firm, several commentators now call it an emerging competitor to traditional banks, especially in treasury services, cross-border payments, and custody.

Key Points

- Ripple’s Expanding Business Strategy Alters Community Perception: Ripple is increasingly seen not just as a blockchain payments firm, but as a potential challenger to traditional banks in treasury, cross-border payments, and custody services, due to its acquisitions and regulatory progress.

- Major Acquisitions in 2025 Boost Ripple’s Scope: Throughout 2025, Ripple acquired Hidden Road for $1.25 billion, Rail for $200 million, GTreasury for $1 billion, and Palisade, while gaining conditional approval for a bank charter, significantly expanding its financial infrastructure.

- Ripple’s Regulatory Moves Signal a Potential Threat to Banks: By securing a bank charter and expanding its services, Ripple is seen as positioning itself to challenge established banks’ revenue streams from treasury operations, remittances, and custody, raising concerns within the banking industry.

- Community and Market Views on Ripple as a Bank Competitor: Some $XRP community members believe Ripple threatens traditional banking revenues and could become a major financial player, especially if it gains a strong banking position amid industry resistance.

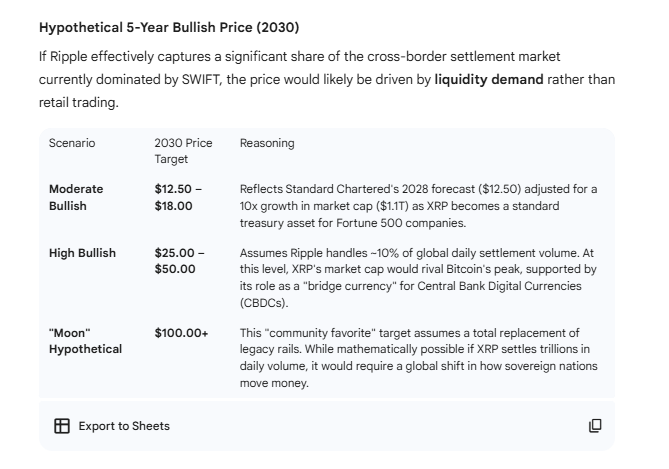

- $XRP Price Outlook if Ripple Disrupts Banking Systems: Google Gemini predicts $XRP could reach $12.50 to $18 in a moderate scenario, and potentially $25 to $50 or even over $100 in more bullish cases if Ripple successfully captures a significant share of global settlement volume and replaces legacy payment systems.

Ripple Pushes Ahead in 2025

Throughout 2025, Ripple moved to broaden its scope. In April, the company agreed to acquire Hidden Road for $1.25 billion, completing the deal in October. Hidden Road operates as a multi-asset prime brokerage that processes roughly $3 trillion in transactions each year. Ripple later rebranded the business as Ripple Prime.

In August, Ripple announced the $200 million acquisition of Rail, a Toronto-based stablecoin payments platform. Two months later, Ripple acquired GTreasury for $1 billion. In November, Ripple then added Palisade to its portfolio for an undisclosed amount.

Ripple also made a major regulatory move in December by securing conditional approval to operate under a bank charter. This move, alongside the company’s acquisition strategy, led to discussions within the $XRP community about Ripple becoming a serious challenge to established banks.

Could Ripple Pose a Threat to Major Banks?

For instance, earlier this month, $XRP community figure Vincent Van Code said Ripple now threatens the multi-trillion-dollar revenue banks earn from treasury operations, remittances, and custody services. According to him, Ripple faced delays for years but has now aligned the necessary elements to compete at scale.

Meanwhile, in July, when a group of banks attempted to block Ripple’s effort to secure a banking charter, $XRP community member Pumpius claimed major U.S. banking associations felt alarmed by Ripple’s move toward becoming a national trust bank.

If Ripple does enter a solid position where it could pose a major threat to traditional banks, the $XRP price could feel the impact. Now, while most believe Ripple’s expansion could support higher valuations for $XRP, the market response remains uncertain. As a result, we asked Google Gemini for its assessment.

$XRP Price if Ripple Threatens Traditional Banks

Responding, Google Gemini based $XRP’s valuation on global liquidity rather than short-term speculation. Considering $XRP’s price of $1.91, the chatbot presented a hypothetical five-year outlook that assumes Ripple successfully disrupts parts of the traditional banking system.

Notably, in a moderately bullish scenario, Gemini believes $XRP could trade between $12.50 and $18.00, aligning with Standard Chartered’s $12.50 forecast for 2028 and assuming a market cap of about $1.1 trillion as $XRP gains adoption among large corporations.

In a more bullish case, where Ripple captures around 10% of global daily settlement volume, Gemini suggested $XRP could reach $25 to $50, placing its valuation near Bitcoin’s historical peak. A more speculative scenario places $XRP above $100 if it replaces legacy payment rails worldwide.

Gemini also called attention to the importance of liquidity. According to the chatbot, higher $XRP prices would reduce volatility when settling large transaction volumes.

However, it cautioned that growth could face limits from competition with stablecoins such as Ripple’s own RLUSD, resistance from central banks that favor private ledgers, and new U.S. stablecoin rules under the GENIUS Act passed in July 2025, which would allow banks to issue their own digital tokens.

thecryptobasic.com

thecryptobasic.com