The $XRP ETFs recently recorded their largest daily outflow figure in history after the markets returned from the Monday hiatus.

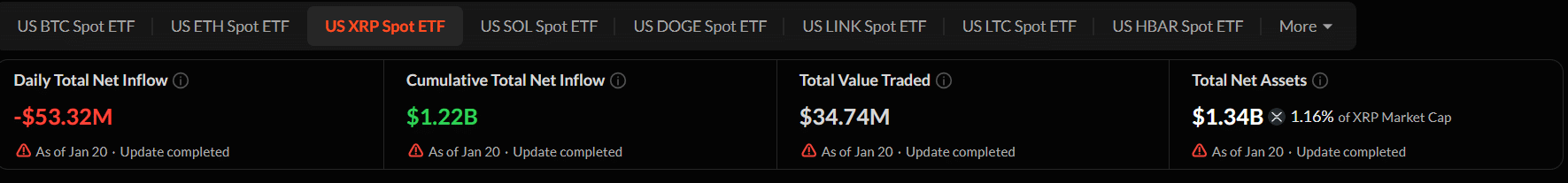

According to market data, the $XRP-linked ETF products witnessed over $53 million worth of outflows on Tuesday, Jan. 20, representing their second-ever daily capital outflow and the largest outflow figure since they began trading in November 2025.

However, the recent underwhelming performance was not specific to $XRP funds. Rather, it reflected a broader downturn in sentiment across U.S. markets, driven largely by renewed concerns following President Donald Trump’s tariff threats targeting Europe and Greenland.

With U.S. markets closed on Monday in observance of Martin Luther King Jr. Day, the market postponed its reaction to these developments, ultimately unfolding on Tuesday.

Key Points

- $XRP ETFs recorded more than $53 million worth of outflows on Tuesday, Jan. 20.

- This marked the products’ second-ever daily outflow and the largest since they began trading in November 2025.

- Cumulative total net inflows have dropped to $1.22 billion, representing levels from Jan. 9.

- Bitcoin and Ethereum ETFs saw larger outflows, with only Solana and Chainlink products bucking the trend.

- The latest performance was largely due to President Trump’s tariff threats, which led to an adverse reaction across U.S. markets.

$XRP ETFs Record Largest Daily Outflow

According to market data provided by Sosovalue, the $XRP ETFs saw exactly $53.32 million in capital outflows on Jan. 20, marking their largest daily outflow ever. This comes after the products recorded seven consecutive days of inflows from Jan. 8 to 16, pulling in around $70.48 million within this period.

With the latest performance, the $XRP ETFs now boast a cumulative inflow figure of $1.22 billion, representing levels last seen on Jan. 9. The $53 million outflow came solely from the Grayscale $XRP ETF (GXRP), which lost $55.39 million worth of capital on Tuesday. In contrast, Franklin’s XRPZ saw $2.07 million in inflows, reducing the overall outflow figure. Other products saw no flows.

How Other Crypto ETFs Performed

The recent bearish spell was not unique to $XRP, as most other crypto ETFs also saw outflows. Specifically, the Bitcoin ETFs recorded $426.52 million worth of outflows on Jan. 20, building on a previous outflow figure of $394 million on Jan. 16. These outflows began after four consecutive days of inflows from Jan. 12 to 15.

Meanwhile, Ethereum ETFs witnessed $229.95 million in capital outflows on Jan. 20, ending a five-day inflow streak that also began on Jan. 12. Only Solana ETFs (+$3.08 million) and Chainlink ETFs (+$4.05 million) recorded inflows on Jan. 20, as they bucked the overall bearish trend.

What Triggered These Outflows?

Further, the bearish trend cut across the entire U.S. market, as investors reacted adversely to President Donald Trump’s latest tariff threats against Europe and Greenland, which led to trade tensions between Europe and the United States.

According to Reuters, after the market closed on Monday in observance of Martin Luther King Jr. Day, Tuesday was the closest opportunity for investors to act on their risk aversion. Specifically, data confirms that the U.S. market witnessed its largest intraday decline since October 2025.

thecryptobasic.com

thecryptobasic.com