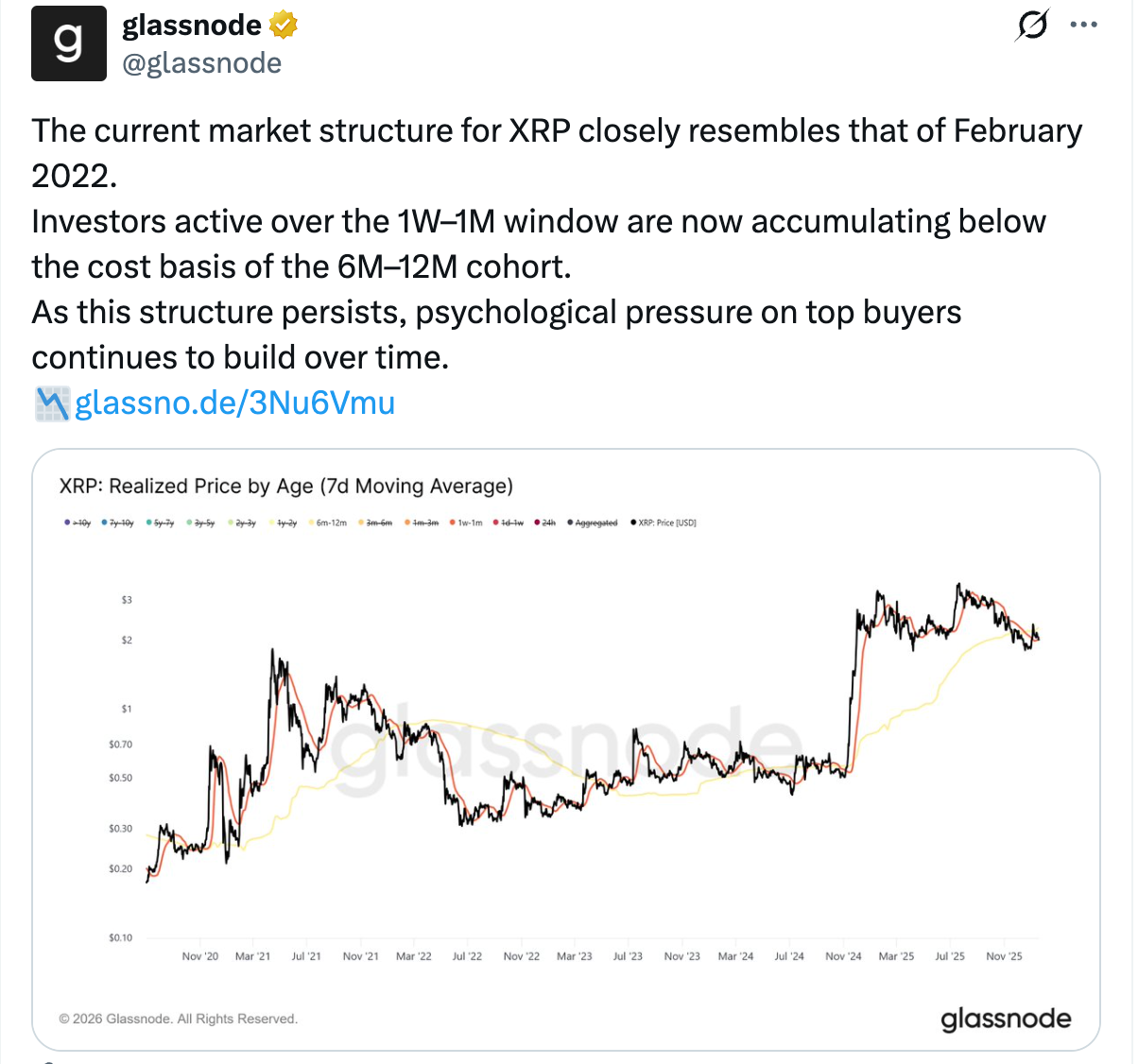

$XRP’s on-chain setup is beginning to resemble early 2022, a period that ultimately preceded months of weakness, according to data from blockchain analytics firm Glassnode.

Glassnode said the current market structure shows investors active over the past one week to one month accumulating $XRP at prices below the cost basis of holders who bought six to twelve months ago.

That gap matters because it places newer buyers in profit while leaving older holders sitting on losses, a dynamic that can build selling pressure over time if prices fail to move higher.

A similar pattern emerged in February 2022, when $XRP was trading near $0.78 before entering a prolonged decline that eventually pushed prices toward $0.30 by mid-year.

The setup is forming as $XRP continues to struggle around the $2 level, a price zone that has repeatedly shaped holder behavior.

Since mid-2025, Glassnode data shows that each retest of $2 has coincided with roughly $500 million to $1.2 billion in realized losses per week, suggesting many investors use the area to exit positions rather than add exposure.

That history has made $2 a key psychological threshold for the market. When prices trade below it, pressure builds on higher-cost holders waiting for a chance to break even, while short-term buyers accumulate at lower levels.

As such, the pattern does not guarantee a repeat of 2022’s drawdown, but the longer this cost-basis split persists, the more strain it puts on investors who bought near recent highs.

For now, $XRP remains caught between fresh demand from short-term buyers and lingering overhead supply from longer-term holders still looking for an exit.

coindesk.com

coindesk.com