The first week of 2026 offered investors a distinctly unromantic reminder: when the macro narrative shifts from “growth and inflation” to “institutional and governance risk”, performance is no longer about whose story sounds best, but about which assets look most independent under stress.

Gold and silver’s relative strength, alongside the relative weakness of BTC and ETH, captures that repricing. Hard assets are competing for an “independence premium”, while major cryptoassets are increasingly trading like high-volatility dollar risk. This isn’t to argue that crypto has lost its long-term case.

It’s that, in the current framework, the market is focused on three questions: What do you settle in? Who’s the marginal buyer? Which risk bucket do you sit in within a portfolio? On those points, the gap between precious metals and crypto is widening.

USD-Denominated Leverage and “Institutional Risk”

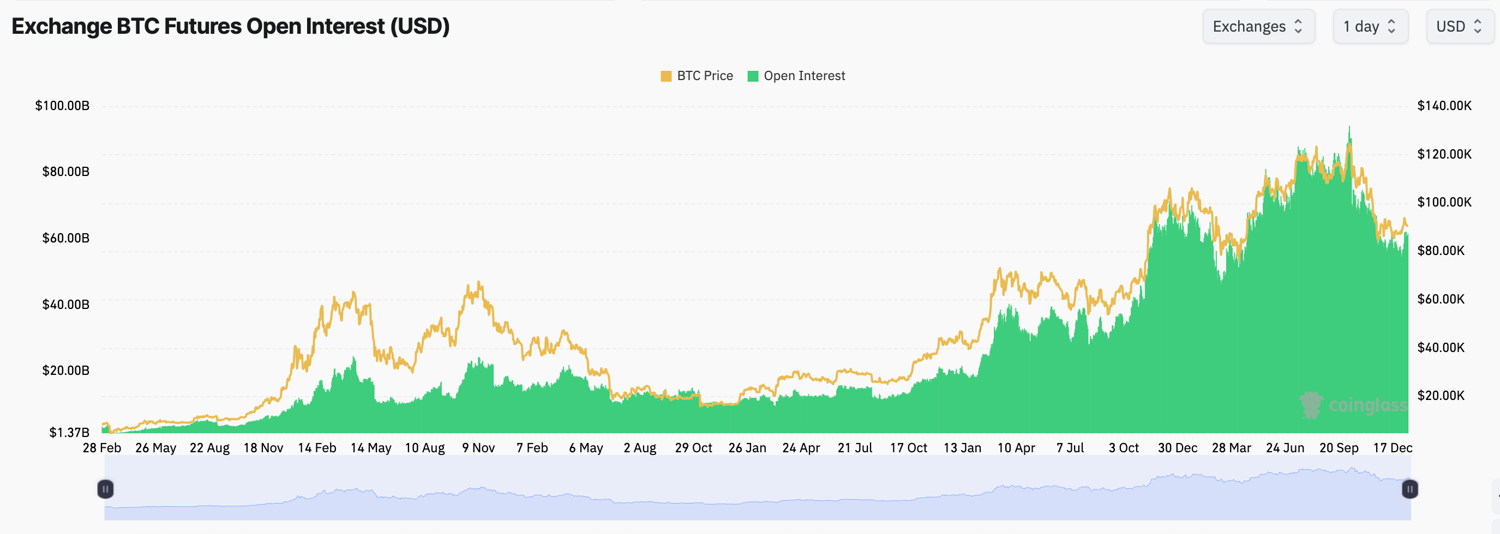

A quick look back at Bitcoin over the past year helps. During last April’s “Liberation Day” rally, BTC stabilised first and then rebounded, printing a new high of $126k six months later. The “digital gold” narrative mattered, but the real afterburner was USD-settled derivatives.

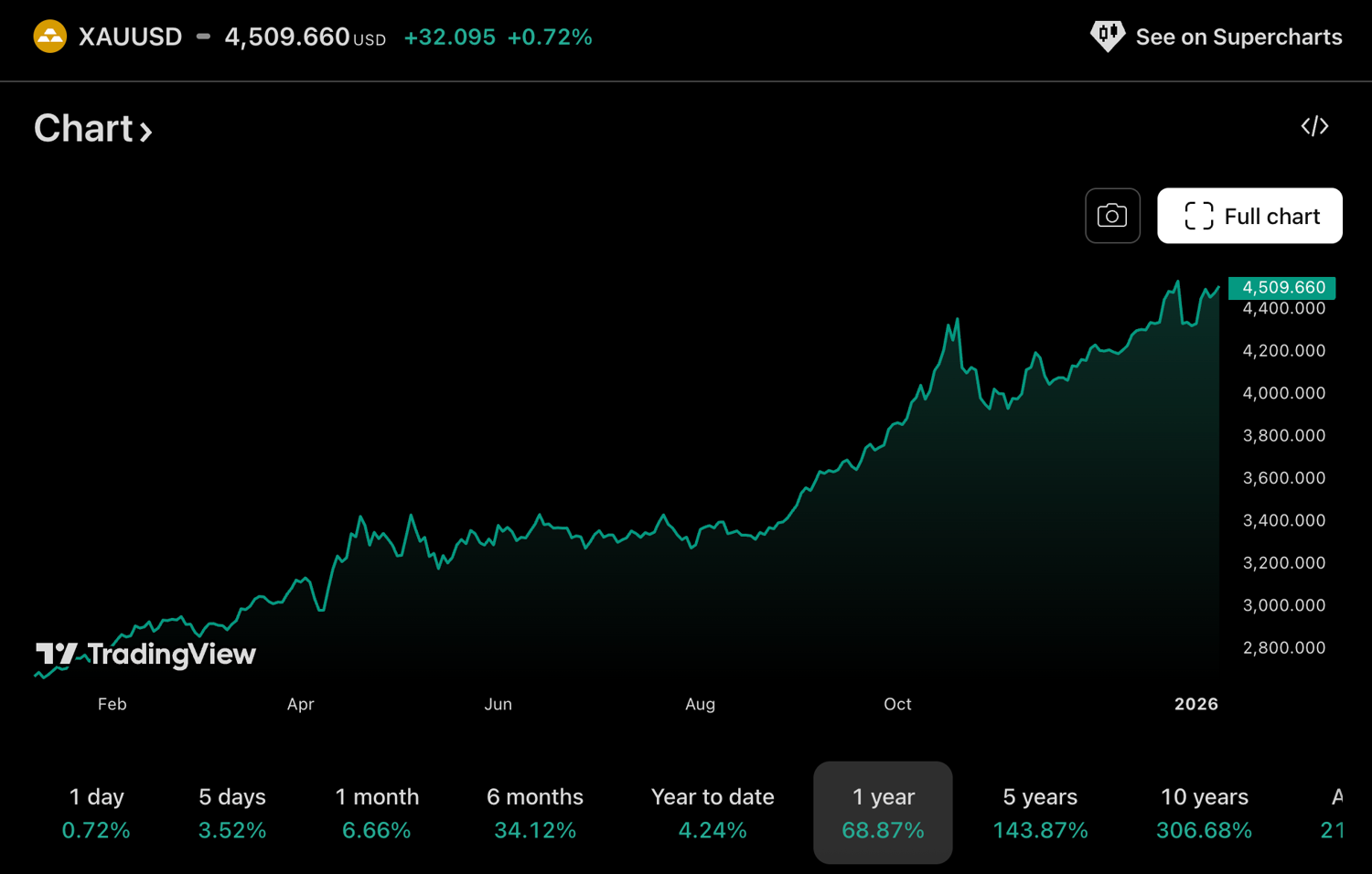

From March to October 2025, open interest in BTC Delta 1 contracts jumped from about $46bn to more than $92bn, giving BTC powerful leverage support and helping it outperform gold in the short run. After the peak, a broad crypto deleveraging and shifting institutional expectations pushed BTC into a sustained drawdown; gold, by contrast, kept grinding higher.

Source: Tradingview

One detail matters: as USDT/USDC and other stablecoins have become entrenched, USD-denominated leverage (not coin-margined leverage) has increasingly driven the marginal move.

As exposure is taken through more standardised, more levered channels—exchanges, perps, structured products—behaviour becomes more “portfolio-like”: add on risk-on, cut as part of a risk-budget reduction.

Whether it’s USD pricing, USD collateral, or cross-asset hedging built around the US rate curve, BTC is easily folded into the same USD-based risk framework. So when dollar liquidity tightens, whatever the trigger, BTC is often among the first to feel the effects of de-risking.

Put differently, the market hasn’t suddenly “stopped believing” in digital gold. It’s increasingly treating BTC as a tradable macro factor—closer to high-volatility dollar beta than a store of value outside the system.

What gets sold isn’t so much spot BTC as USD-denominated BTC exposure. Once leverage becomes large enough for flows to dominate fundamentals, BTC behaves like a classic risk asset, being sensitive to liquidity, real rates, and fiscal policy.

Gold is different—at least for now. Its price is still driven mainly by spot supply and demand rather than leverage. It also retains monetary characteristics and is widely accepted as collateral: a kind of offshore hard currency. That makes it one of the few assets not directly dictated by day-to-day fiscal and monetary settings.

In this environment, that matters. The Trump administration has added to macro and policy uncertainty (think of what happened in Venezuela and Minnesota). For global investors, holding dollar assets and dollar leverage no longer feels like “parking the ship in a safe harbour”; even at the level of pricing and settlement, it carries harder-to-model institutional risk that can challenge the predictability of market rules.

As a result, reducing synthetic exposure to US policy risk is a sensible move. Assets more tightly bound to the dollar system—and which behave like risk assets in stress — tend to be cut first. Conversely, assets that are more clearly detached from sovereign credit and less dependent on “permissioned” financial infrastructure appear more favourable in the same risk model.

That’s a headwind for crypto and a tailwind for precious metals: independence is the point. When markets fear shifting policy boundaries and weaker rule predictability, gold (and other precious metals) earns a higher independence premium.

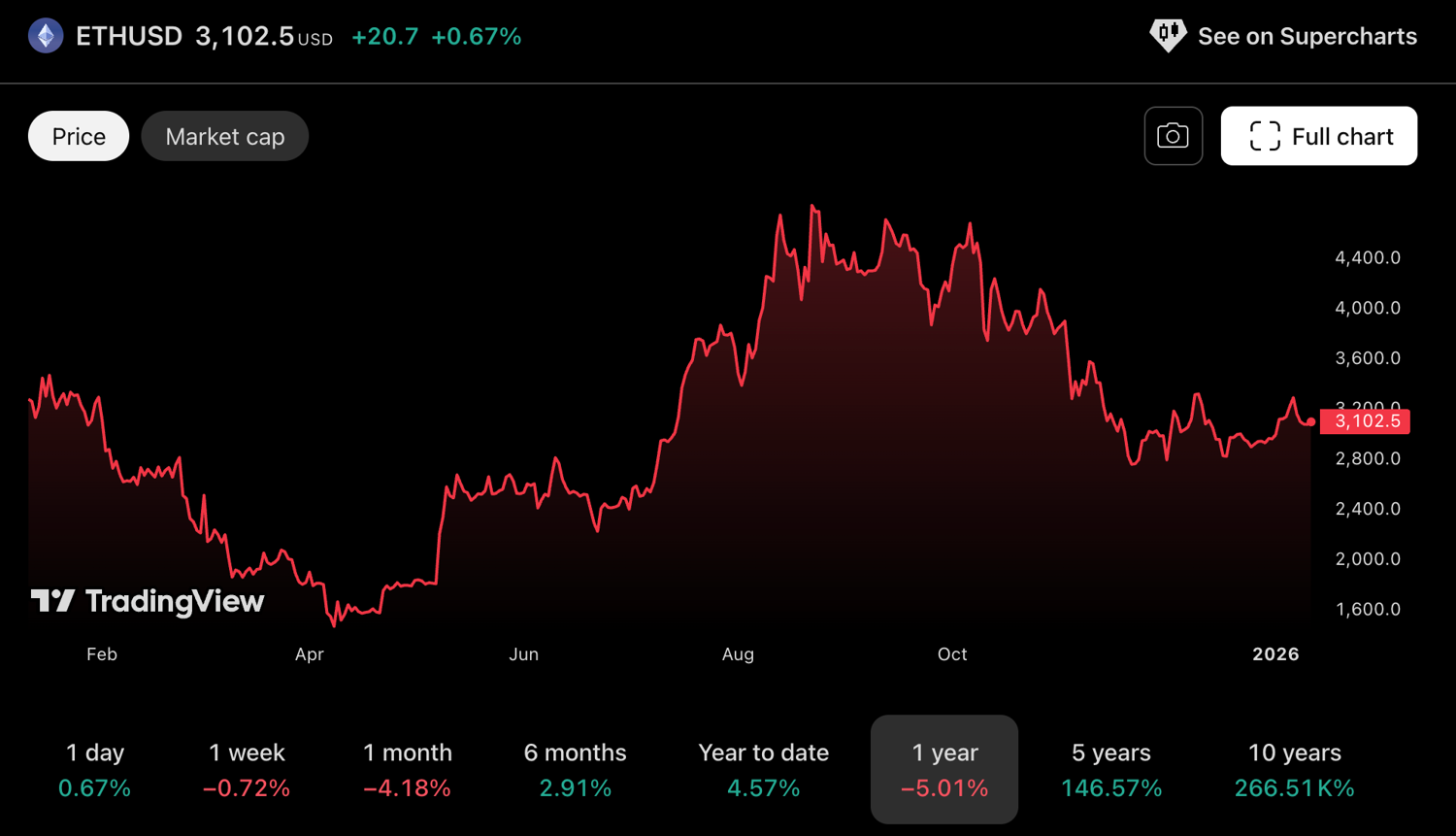

Since 2025, that premium has become more visible. A neat comparison is silver versus ETH. In the public imagination, ETH was once known as “digital silver” (and, in the PoW era, it arguably was). Both have been seen as smaller-cap assets, more prone to squeezes and leverage-driven moves.

But ETH, an equity-like asset deeply tied to the dollar system, has long since lost any independence premium. Silver, as one of the historical “offshore hard currencies”, has not. Investors are clearly willing to pay up for that independence.

The “Dollar Beta Discount”

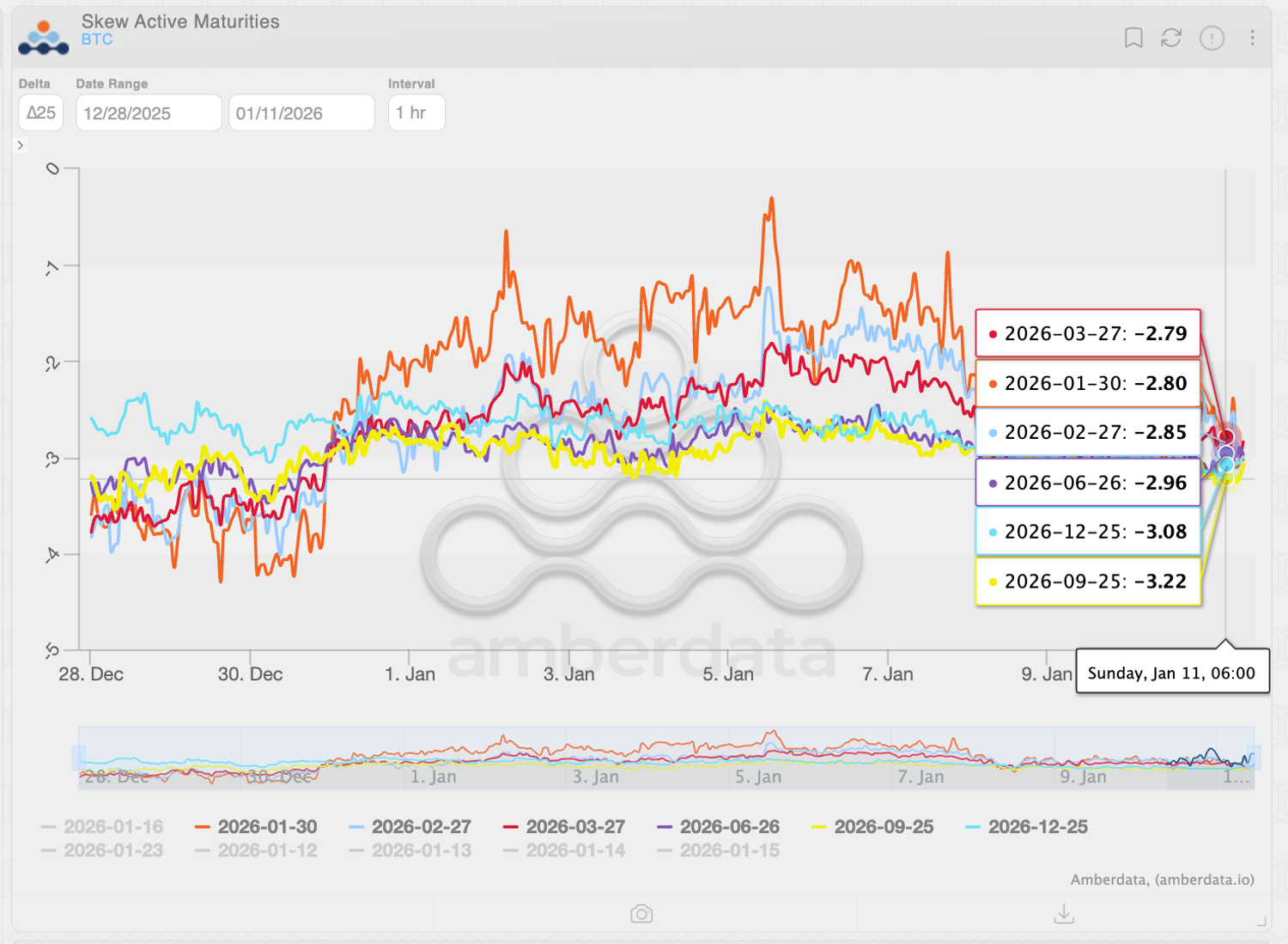

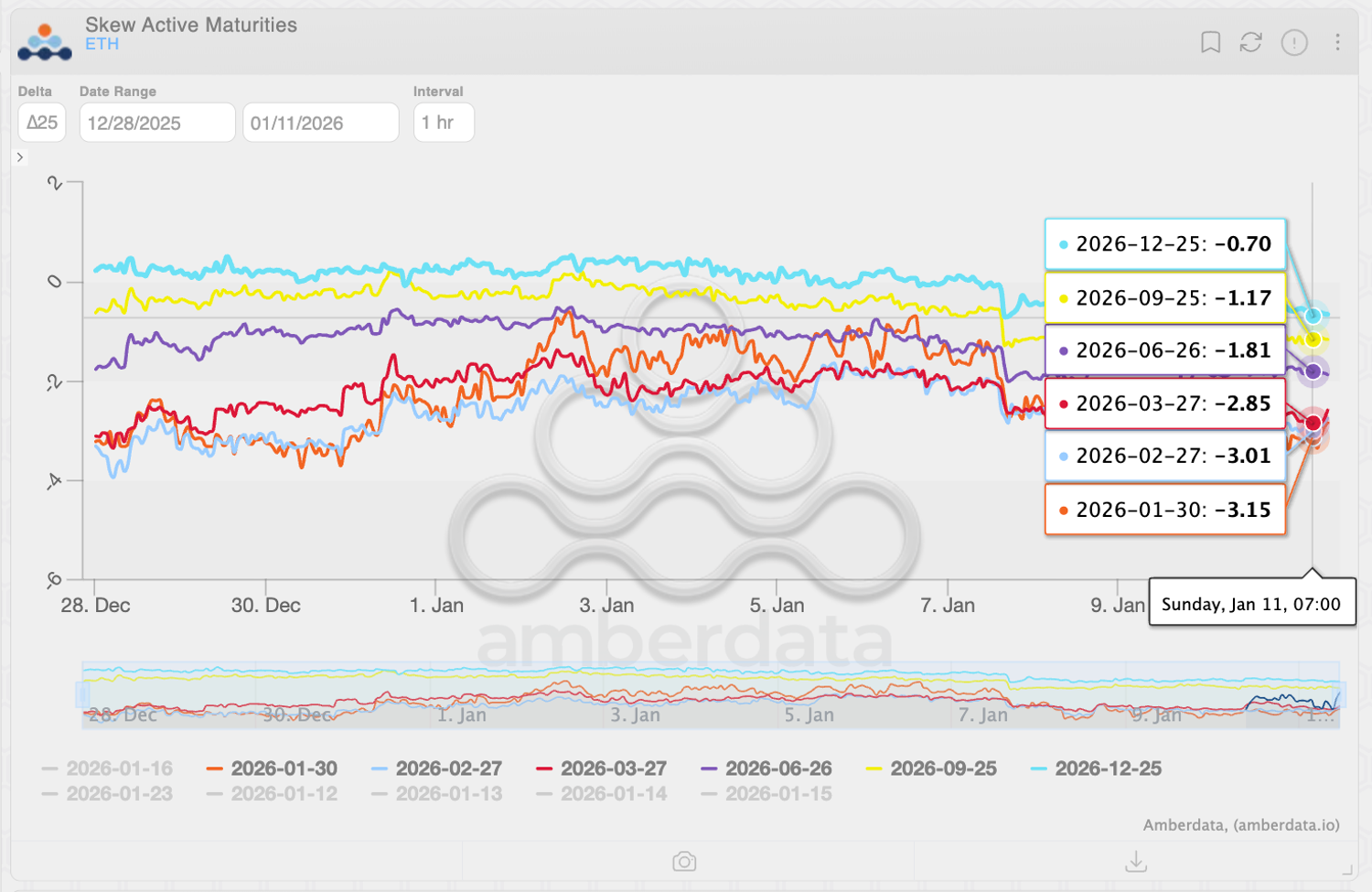

USD-denominated leverage is also a key reason options markets remain structurally bearish on BTC and ETH. The “New Year effect” lifted both briefly in the first few sessions, but it didn’t shift the longer-dated positioning.

Over the past month, as investors have continued to price rising institutional risk in dollar assets, longer-dated bearishness in BTC and ETH has built further. Until the share of USD leverage falls meaningfully, “independence under institutional uncertainty” is likely to stay the market’s organising principle.

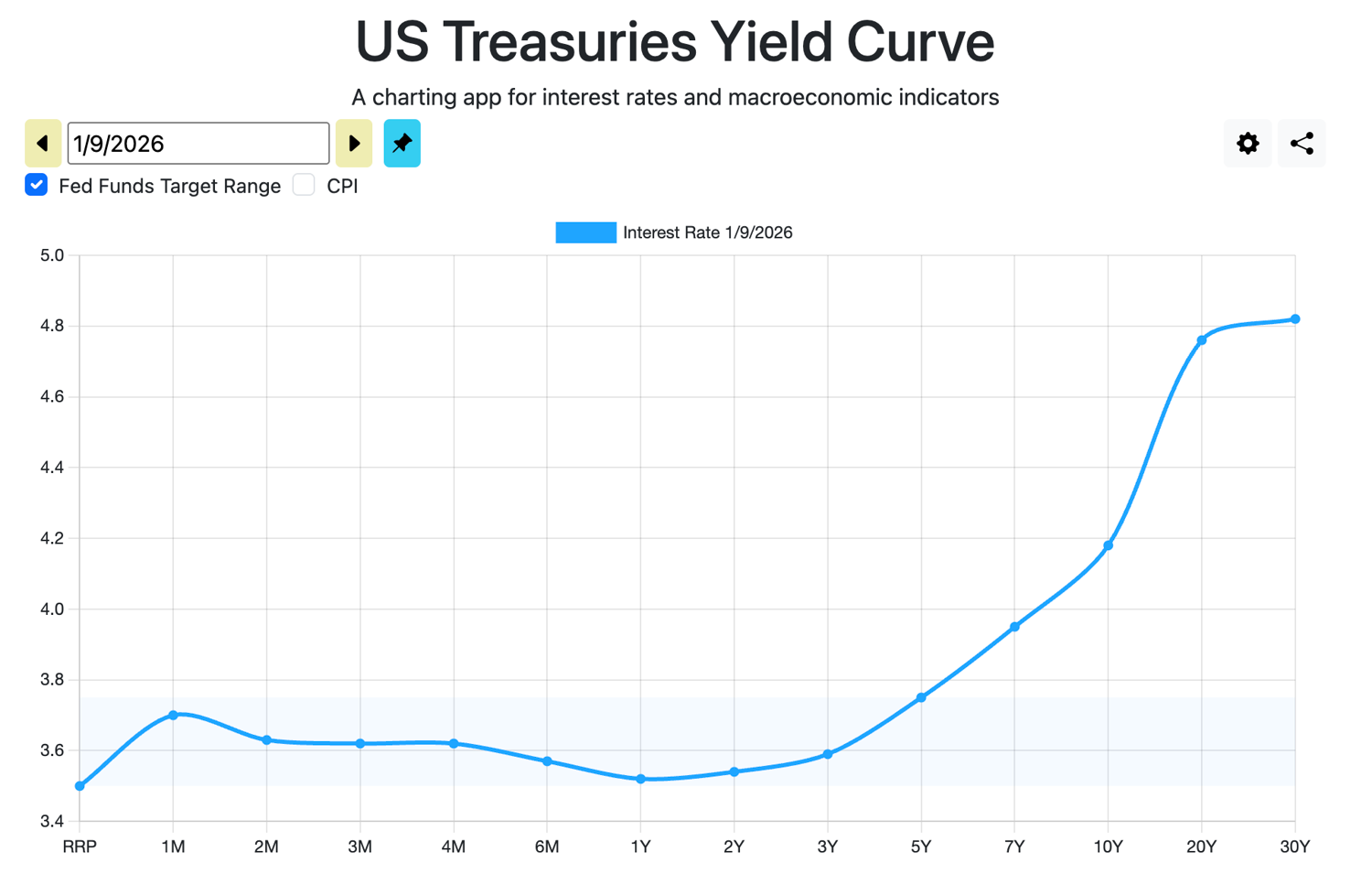

At the same time, as valuation expectations for dollar-linked assets are marked down, investors are demanding more risk premia. The 10-year Treasury yield is still elevated at around 4.2%. With the Treasury and the Fed unable to fully dictate the pricing of 10-year duration, that level raises the hurdle rate for risk assets.

Yet the “dollar beta discount” associated with USD leverage compresses implied forward returns for BTC and ETH (to 5.06% and 3.93%, respectively). BTC may still look tolerable; ETH, much less so. ETH therefore wears a deeper dollar beta discount: yields aren’t competitive, and upside convexity is capped. None of this negates Ethereum’s long-term potential—but it does change allocation choices over a one-year horizon.

Crypto can, of course, bounce back: if financial conditions ease, policy uncertainty fades, or the market pivots back to pricing growth and liquidity, high-volatility assets will naturally respond. But macro investors are focused on taxonomy. When institutional uncertainty dominates, crypto trades like risk assets; precious metals trade more like “exceptionalism assets”.

That’s the message for early 2026: crypto hasn’t “failed”—it has simply, for now, lost its pricing slot as an independent asset in this macro regime.

Disclaimer: The information provided herein does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and should not be treated as such. All content set out below is for informational purposes only.

The post BloFin Research Analysis: A Shift in Capital Preference From Bitcoin to Gold appeared first on BeInCrypto.

beincrypto.com

beincrypto.com