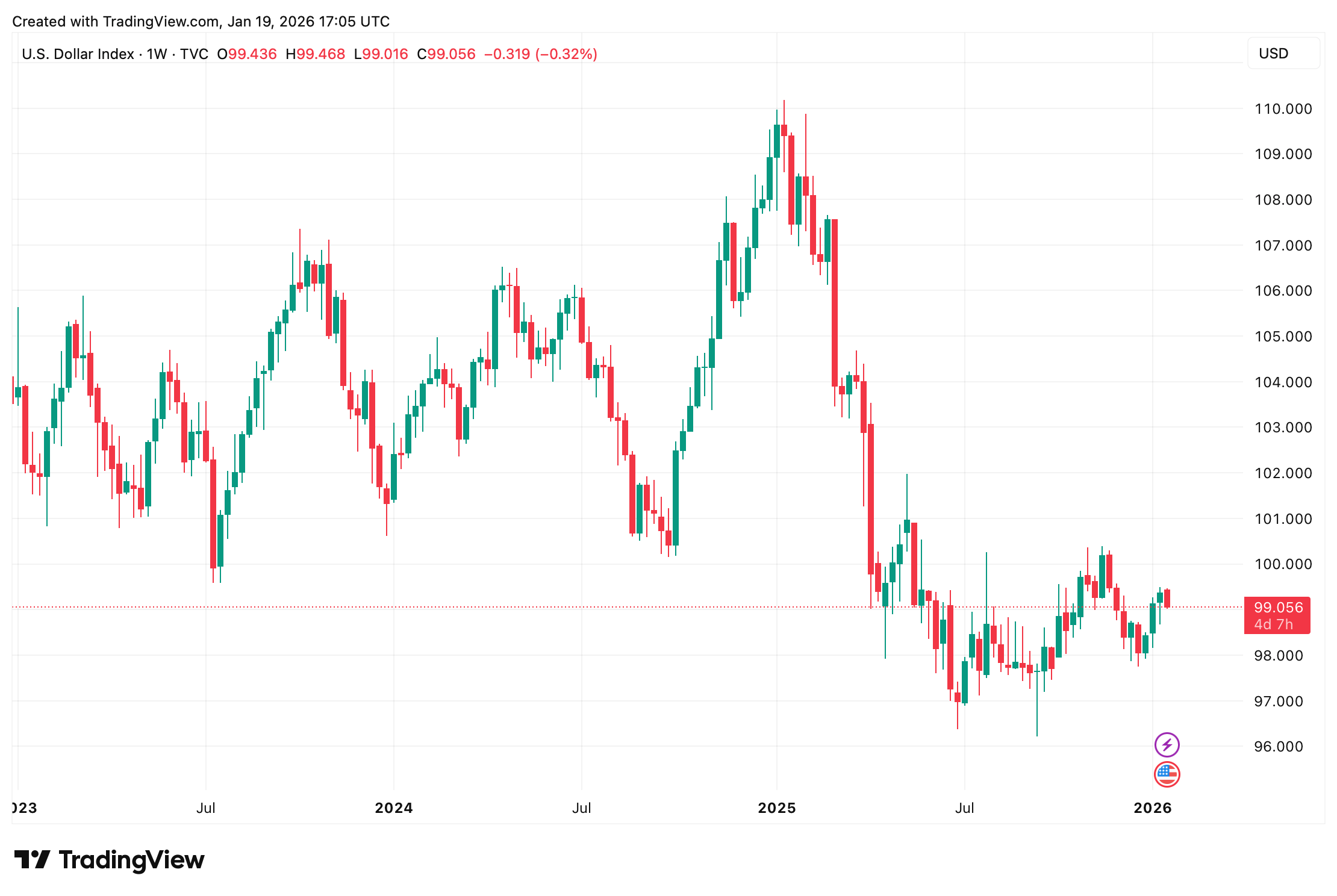

On Monday, the U.S. dollar is sliding, with the Dollar Index (DXY)—which pits the greenback against a mix of heavyweights like the euro, yen, onshore yuan, and pound—tilting lower. Market watchers chalk it up to the “Sell America” trade, a strategy getting extra fuel from U.S. President Donald Trump’s run-ins with the Federal Reserve and his latest tariff warnings aimed at several European countries.

Markets Flinch as Fear Grips the Greenback and Risk Assets Wobble

U.S. equities and bond markets are closed on Jan. 19 in observance of the Martin Luther King Jr. Day holiday. Still, the markets that are open are flashing unease, the kind that has a habit of sneaking into trading desks once U.S. markets swing back open on Jan. 20.

First off, crypto markets are in the red on Monday following Sunday evening’s sell-off, with 24-hour figures showing the crypto economy lower by 2.54%. Bitcoin is sitting below the $93,000 range and is also off more than 2% against the greenback. Precious metals, meanwhile, are stealing the spotlight, with gold higher by 1.63% and silver jumping 4.11%.

Gold is changing hands at $4,679 per ounce, while silver sits at $94.55 per ounce. The U.S. dollar, meanwhile, is having a rough Monday, with the main catalyst appearing to be rising geopolitical tension after President Trump rolled out fresh tariff threats over the weekend targeting eight European countries, layered on top of his ongoing spat with the U.S. central bank.

The episode has flipped global markets into a “risk-off” mood, pushing investors toward perceived havens—and, notably, ones viewed as steadier than the U.S. dollar. Reuters reports the greenback slipped against the euro, pound, and Norwegian crown. Reuters journalist Amanda Cooper notes that “the initial reaction among investors has been to sell the dollar, as they did when Trump unveiled sweeping tariffs on the world last April,” sparking what she described as a crisis of confidence in U.S. assets.

A CNBC report is also pinning the dollar’s slide this week on the so-called “Sell America” trade. The phrase gained real traction last April, neatly capturing a wider investor mood of shedding U.S. assets and the greenback in favor of diversification, with some treating it as a quiet rebuke of erratic U.S. policy moves. The report points to Krishna Guha, head of global policy and central bank strategy at Evercore ISI, who says the Sell America trade could be setting up a familiar replay of last year’s pattern.

“This is unambiguously risk off,” Guha remarked in CNBC’s report. The report, authored by Alex Harring, adds that financial heavyweight JPMorgan is flagging the very same pattern. “Combined, the ‘Sell America’ theme may be the dominant narrative,” JPMorgan analysts are quoted by CNBC’s Harring as saying. In the same breath, while the “Sell America” narrative can jolt markets in the short term, critics argue its shelf life is limited, pointing to the U.S. economy’s underlying strength and yield appeal, which tend to lure investors back once the initial panic fades.

Also read: NYSE Joins Tokenization Race With New Digital Trading Venue

As markets brace for U.S. trading to resume on Tuesday, the greenback finds itself on uneasy footing, squeezed by politics, policy friction, and a revived “Sell America” mantra. Crypto has taken a hit, metals are flexing, and investors are clearly playing defense. Whether this bout of dollar weakness sticks or fizzles will hinge on how much faith returns once Wall Street lights up again—and how loud policy noise remains. One thing is certain: Tuesday’s equity open could be bloody.

FAQ 🇺🇸

- What is the “Sell America” trade? It refers to investors cutting exposure to U.S. assets and the dollar in favor of diversification amid policy uncertainty.

- Why is the U.S. dollar falling? Renewed tariff threats, Federal Reserve tensions, and risk-off positioning are weighing on the greenback.

- How are crypto and metals reacting? Crypto markets are lower while gold and silver are drawing defensive flows.

- What could happen when U.S. markets reopen? Lingering global stress may spill into equities when Wall Street resumes trading.

news.bitcoin.com

news.bitcoin.com