$XMR price jumped to a record high today, January 15, as demand for privacy tokens rose.

- $XMR price jumped to a record high on Thursday.

- Data shows that the futures open interest rose to a record high.

- It has formed the highly bullish cup-and-handle pattern, pointing to a jump to $1,000.

Monero ($XMR) token soared to $798, up by 713% above its lowest point in 20233. Its surge has brought its market capitalization to over $12 billion, making it the 12th biggest coin in the crypto industry.

$XMR’s surge was driven by the ongoing demand for privacy tokens. Dash (DASH), another similar coin, has jumped by over 100% this week. Decred and Humanity Protocol have risen by 60% and 30% in the last 7 days, while the market capitalization of all privacy tokens rose to $73 billion.

The rising demand has pushed its 24-hour volume to $465 million, while its futures open interest rose to a record high of over $275 million.

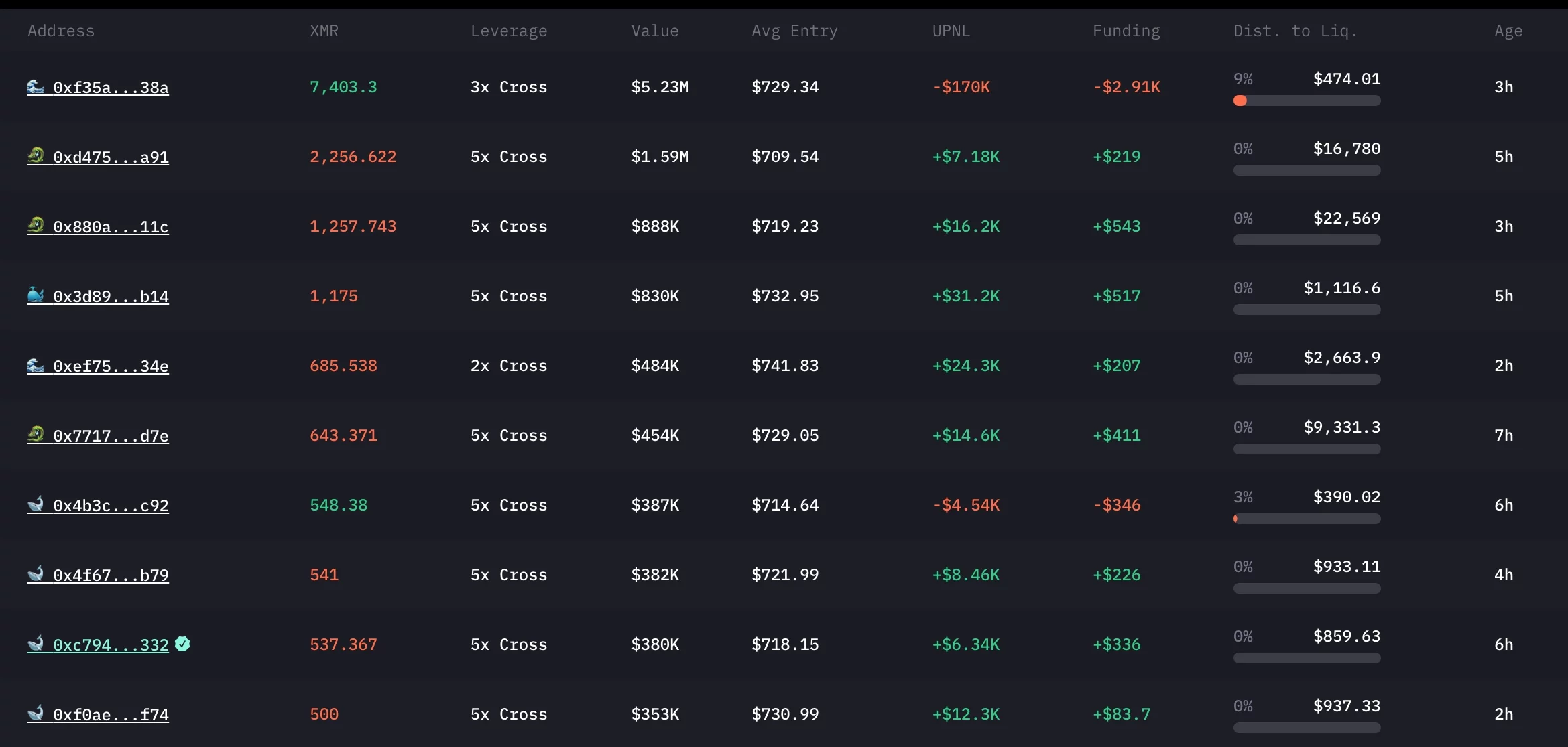

$XMR also soared after Hyperliquid listed it on its platform, allowing traders to long or short with up to 5x leverage. One whale moved reacted to the listing by opening a leveraged trade worth $2.27 million, a sign that he expects it to keep rising. Another trader opened a long trade worth over $5.2 million at the average price of $729.

The ongoing Monero rally started in 2024 as the Tornado Cash case started. US authorities accused of money laundering and sanctioned it. In response, a group of users sued the government, arguing that immutable contracts were not “property”, which the court agreed.

In March this year, the Trump administration lifted the sanctions, in a major win for the privacy industry. The rally then accelerated in the fourth quarter, triggered by the rising demand for Zcash (ZEC).

$XMR price technical analysis

The weekly chart shows that the $XMR token bottomed at $97 in 2024 and then jumped to a record high of $798 today. It moved above the key resistance level at $517, thru upper side of the cup-and-handle pattern, a common bullish continuation sign.

This pattern’s depth was ~85%. Measuring the same distance from the upper side gives a target price of $965. A move to that level would raise the odds of it hitting the psychological level of $1,000. A drop below the upper side of the cup will invalidate the bullish outlook.