The crypto community seems to be at a crossroads as engagement on X drops sharply following a major algorithm change that disrupted the platform’s crypto content.

Rumors that the new recommendation system was suppressing crypto-related posts sparked backlash, with many in larger, influential accounts, often referred to as KOLs, claiming their reach had been slashed and traffic diverted to politics and low-value content.

But the fight has also raised a bigger question: is the drop in engagement just a side effect of X’s algorithm change or the market is truly heading into a bear market?

The debate caught fire on Jan. 10, when X’s head of product, Nikita Bier, weighed in. In a now-deleted thread, Bier argued that many crypto accounts “burn through” their daily reach with low-value activity — such as endless “gm” replies, which stand for “good morning” — before landing on a line that ricocheted across Crypto Twitter (CT):

“CT is dying from suicide, not from the algorithm.”

The response from the crypto community was swift, with users accusing Bier of blaming creators to deflect from deeper platform problems, including bot surges, the proliferation of AI-generated content, algorithm changes, and a flood of low-quality promotions.

Bier later dropped a short, almost dismissive post on Jan. 13 saying “gm it’s fixed,” which some interpreted as an attempt to wave away the backlash, even as complaints on algorithm changes continued to pile up.

Finally, just yesterday, X’s head of product revealed that the platform is revising its developer API rules, banning so-called information finance (InfoFi) projects, which reward users for posting. Bier argued that this phenomenon led to a “tremendous amount of AI slop & reply spam on the platform.”

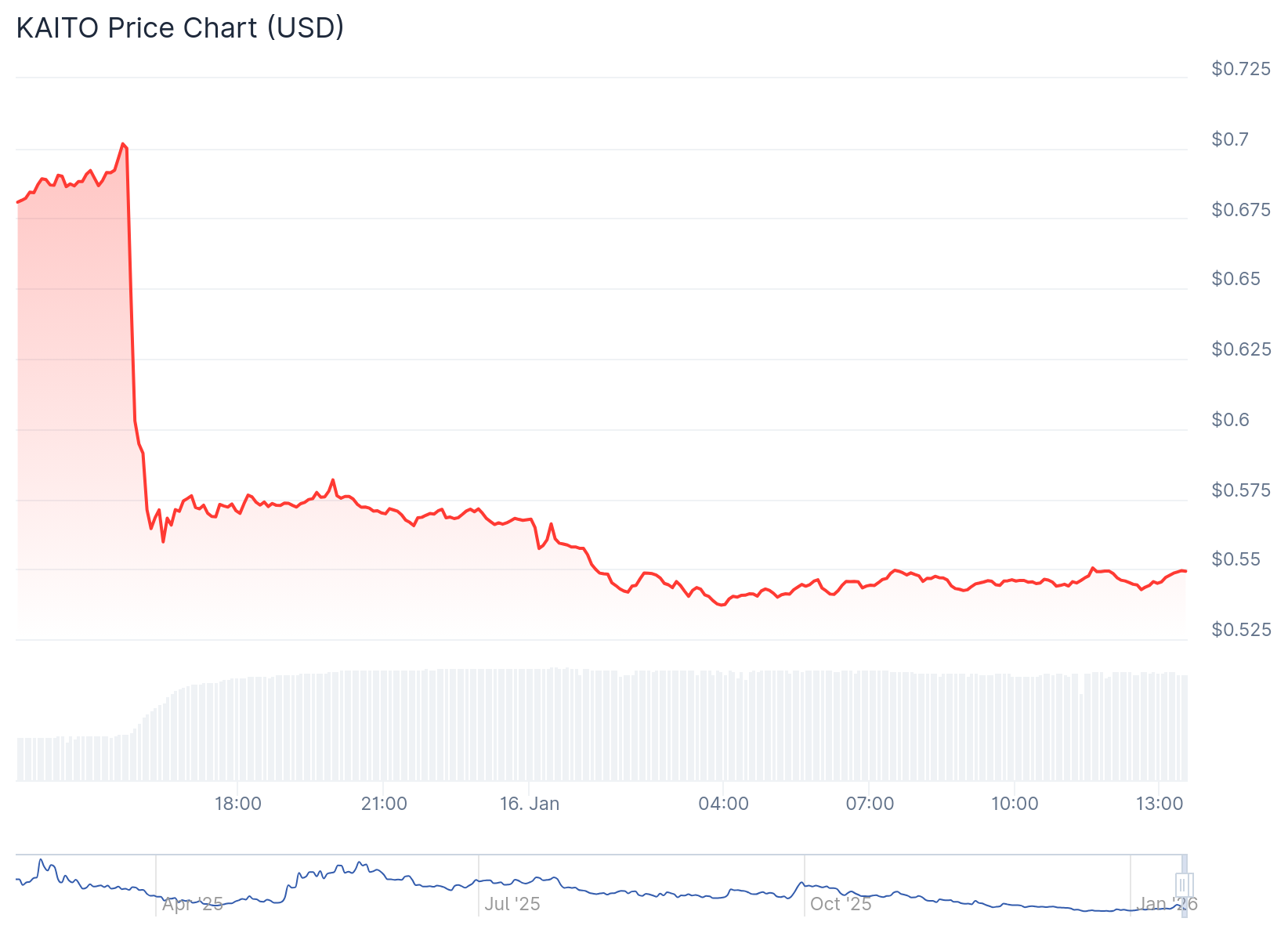

Amid the move, one of the most popular InfoFi apps, Kaito, saw its native token $KAITO drop by nearly 20% in minutes, per data from CoinGecko.

Nic Carter, partner at Castle Island Ventures, suggested in an X post on Jan. 13 that the shift reflects changing priorities, with growth now concentrated in “stablecoins and financial infra.” He also implied that years of high-quality content are now being ignored, pushing creators to alternative platforms like Substack to reach a more engaged audience.

“You create a financial incentive for someone to post, it creates more of it. Combine this with AI you get tons of slop. Now the median CT post is kaito slop. Much more noise,” Carter wrote.

Retail Cools

Part of that disengagement may be psychological. The market’s largest single-day liquidation event on Oct. 10 last year wiped out roughly $20 billion in leveraged positions, affecting over 1.5 million traders — and leading to an extended market slump, meaning all crypto participants took a hit, not just those trading with leverage. That only accelerated fatigue after months of scams, the memecoin sector crash, and opaque DeFi schemes.

November and December crypto market sentiment was marked primarily by “fear” and “extreme fear” levels, per the Crypto Fear & Greed Index, which the markets are just beginning to get relief from since the start of the new year.

But several industry executives argue that the shift runs deeper than post-10/10 trauma. Speaking with The Defiant, Javed Khattak, co-founder and CFO of cheqd, a Cosmos-based payment infrastructure, said the pullback reflects a broader macro reset rather than a simple loss of interest or retail fear.

“Retail interest in crypto has cooled materially relative to prior cycle peaks, with engagement, search data, and trading activity all pointing to a retrenchment in speculative participation,” Khattak said.

Khattak also noted that tighter financial conditions and higher real yields have raised the opportunity cost of holding volatile, non-yielding assets, making speculative participation less attractive. At the same time, Khattak stressed that the current cycle is unfolding on different terms — largely driven by the influx of TradFi institutions into crypto:

“[...] this is not a retail-driven cycle; it is institution-led, and the signals need to be interpreted accordingly. Current conditions are consistent with muted retail engagement alongside continued build-out by regulated institutions.”

Others point to regulatory momentum. Markus Levin, co-founder of XYO, a geospatial oracle network, told The Defiant that falling retail participation should be viewed in the context of a maturing market rather than a collapse. Levin also echoed Khattak’s point that indications of meaningful interest and participation are waning across platforms, not just on X.

“Retail participation across crypto has stepped back noticeably from previous cycle peaks, with trading volumes, online engagement, and search interest all indicating a cooling of speculative activity,” Levin told The Defiant, adding that higher rates have forced a more disciplined approach to risk.

Benjamin Cowen, a data-driven crypto analyst and founder of the blockchain analytics platform Into the Cryptoverse, told The Defiant that crypto interest has “cooled down a lot,” blaming everything from restrictive monetary policy to investor fatigue after repeated memecoin rug pulls.

One metric Cowen highlighted is the notable decline in new YouTube subscribers to popular crypto channels just this year alone.

Cowen also noted that people are “tired of being rugged,” adding that many altcoins have “overpromised and underdelivered,” while still failing to show utility that fits into everyday life.

“The Advance Decline Index of the top 100 cryptocurrencies has been dropping since 2021. The entire bull market from 2023-2025 was mostly just $BTC going up, which masked the weakness in alts,” he said, adding that with the weak Bitcoin movements, altcoin weakness is “more obvious and harder to ignore.”

What On-Chain Data Shows

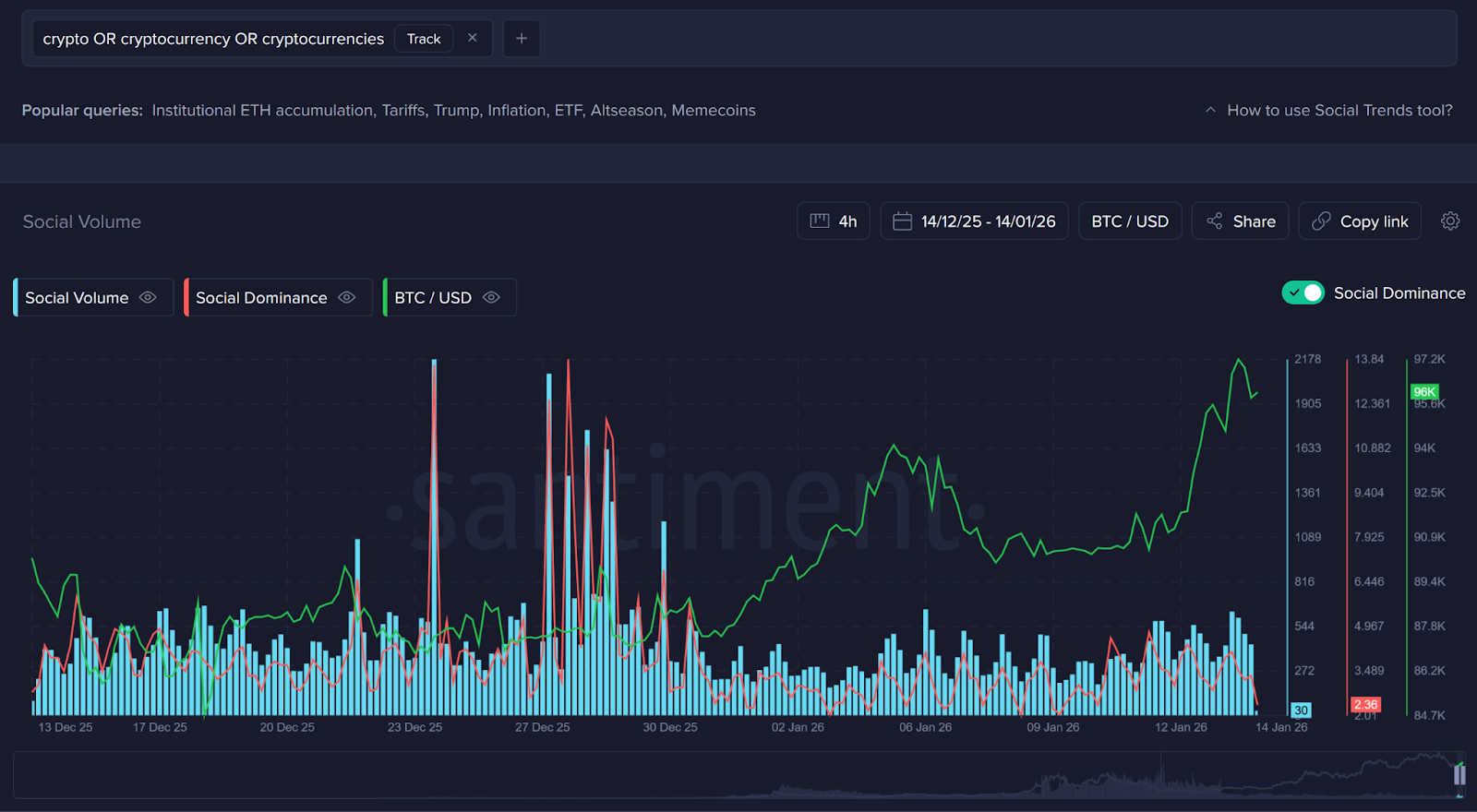

On-chain and social data reinforce that picture. In comments to The Defiant, blockchain intelligence firm Santiment said it has observed clear “evidence of retail traders stepping back” since Bitcoin’s early October all-time high near $126,000.

“We see evidence of that through declining social mentions of cryptocurrency across social media, the least amount of social volume toward Bitcoin in the past 3 months, and even a net decline of -37,159 total non-empty wallets on the Bitcoin network since January 11, 2026,” Santiment said.

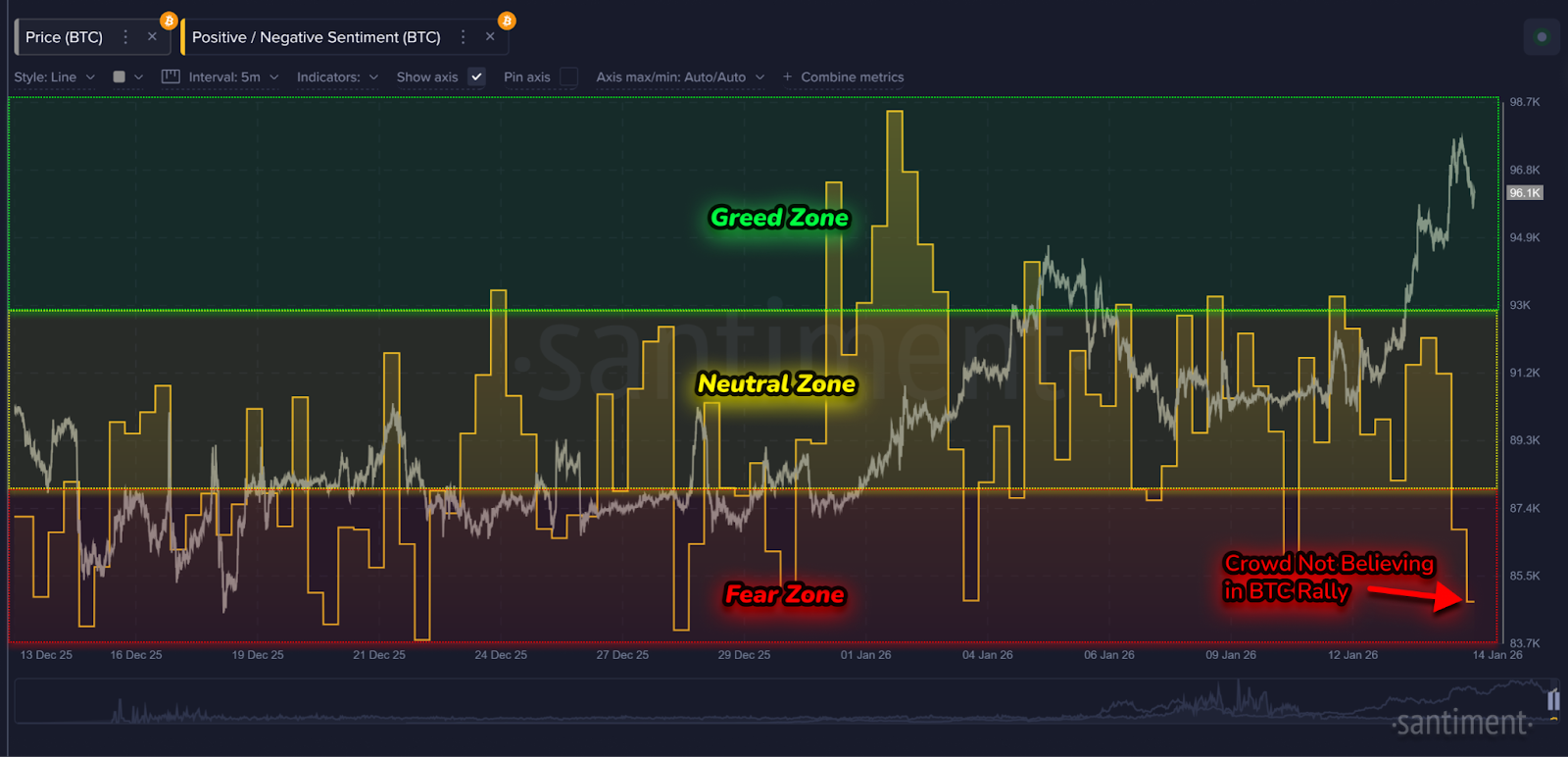

In terms of trading data, the Santiment team also observed a divergence between large and small holders in recent months, as Bitcoin’s price retraced from October’s all-time high, in a pattern the analytics firm characterized as “very bearish.”

During the sharp drawdown from mid-October through late November, so-called “whale” and “shark” wallets — addresses holding between 10-10,000 $BTC collectively — reduced exposure to Bitcoin, while “small retail wallets” collectively accumulated, the firm explained.

However, Santiment also noted that in the past week, markets have reached “a key turning point,” as the pattern reversed.

What’s Ahead

Taken together, the data paints a somewhat mixed picture. On the one hand, institutional participation and ETF flows continue to anchor price action, but on the other, the attention-driven retail engine that powered earlier cycles is far weaker now. And what’s more important is that channels that once thrived on hype are now struggling.

So if a bear market is defined by retail disengagement and collapsing social signals, numbers speak for themselves. But if it’s judged by price resilience and institutional demand, the picture is far murkier.

As for what to watch next, Santiment suggested tracking Bitcoin’s Market Value to Realized Value (MVRV) — a metric that compares the market price to the average price at which coins last moved on-chain — alongside shifts in positive and negative sentiment to assess whether the current rebound has room to run or risks turning into a more extended correction.