Dogecoin has broken key resistance levels, but can it hold above support and sustain bullish momentum?

Notably, Dogecoin ($DOGE) has recorded a strong bullish session over the past 24 hours, trading at $0.1483 after posting a 7.2% daily gain. The price action remained firmly bid throughout the session, with $DOGE moving within a 24-hour range of $0.1384 to $0.1500, reflecting expanding volatility and renewed buying pressure.

The intraday chart shows a sharp upside impulse followed by consolidation above the mid-range. This suggests that buyers are defending recent gains rather than exiting aggressively.

From a performance perspective, $DOGE has outperformed on multiple short-term timeframes. The asset is up 0.5% across seven days, and 20.7% over the past 14 days, confirming accelerating upside momentum in the near term. Over the past month, $DOGE has gained 8.5%.

Whether this move extends further will likely depend on $DOGE’s ability to hold above recent breakout zones. Can $DOGE hold these zones?

Can Dogecoin Hold Breakout Zones

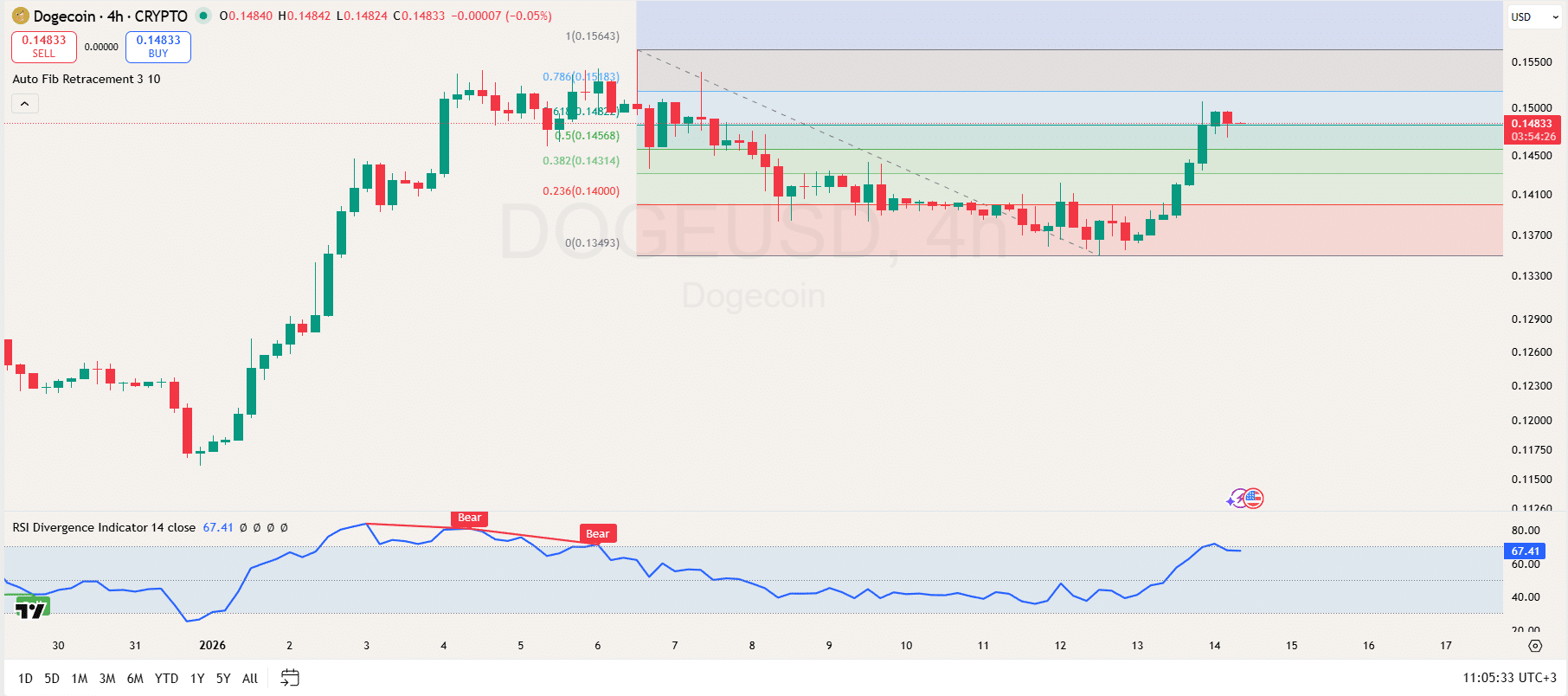

The 4-hour chart for Dogecoin shows a strong breakout above several key resistance zones. Dogecoin has surged past the 0.236, 0.382, and 0.5 Fibonacci levels, reaching and holding above the 0.618 retracement level around $0.1482.

This level now serves as crucial support, and the key question is whether $DOGE can hold above it to sustain its bullish momentum for further upside.

Further, the RSI Divergence Indicator shown in the chart is highlighting a bearish divergence pattern, albeit being flat towards the end. Given that the RSI is currently at 67.41, it is near the overbought territory, which could signal that Dogecoin is at risk of a pullback if the bears prove stronger.

Ultimately, a sustained hold above the 0.618 support could lead to further breakouts, possibly targeting the next resistance at the 0.786 level near $0.15183. However, a failure to hold this support could result in a pullback towards lower Fibonacci levels like 0.5 or 0.382.

Dogecoin Longs Vs Shorts

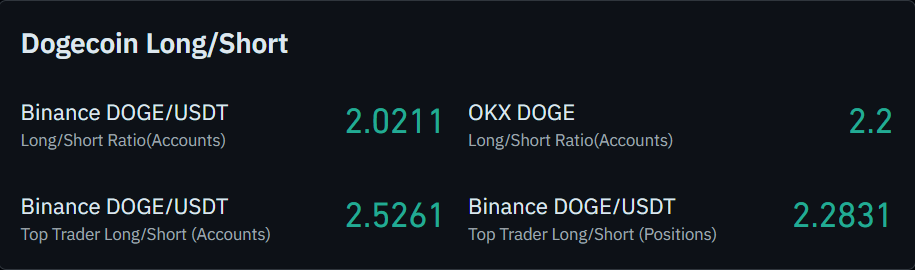

Elsewhere, the CoinGlass Long/Short ratio for Dogecoin shows a bullish sentiment in the market. On Binance, the $DOGE/USDT ratio is 2.0211, indicating that more accounts on Binance are long $DOGE.

This trend is confirmed by the Top Trader Long/Short ratio on Binance accounts, which stands at 2.5261, showing that top traders are also leaning towards long positions. Similarly, for OKX accounts, the ratio is 2.2, further supporting the overall bullish outlook for Dogecoin.

thecryptobasic.com

thecryptobasic.com