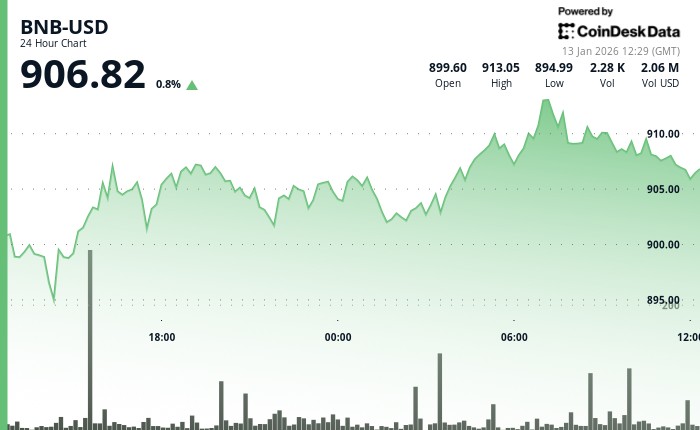

$BNB, the native token of the $BNB Chain, is trading at $908, roughly 1% in the last 24-hour period. The modest rise came in line with the broader CoinDesk 20 (CD20) index, which gained 0.95% over the same period.

Elevated trading volume, up 21.74% from the seven-day average according to CoinDesk Research's technical analysis data model, signals growing market engagement, though price action remains muted. $BNB briefly pushed against resistance near $910 before pulling back, suggesting that sellers are still active at higher levels.

The price is now consolidating just above the $900 support zone, where bulls and bears appear locked in a short-term stalemate.

The gains follow the activation of the Fermi hard fork on the $BNB Smart Chain. The upgrade reduces block times from 0.75 seconds to 0.45 seconds, increasing throughput and improving finality. The change is expected to support more complex decentralized applications and reduce congestion during periods of high activity.

At the same time, institutional interest in $BNB appears to be building. Grayscale recently filed for a $BNB exchange-traded fund (ETF), furthering investment options for investors unwilling to use cryptocurrency rails if the fund is launched.

Meanwhile, the $BNB Chain Foundation has rolled out a $100 million liquidity program aimed at incentivizing token purchases in sectors including DeFi, gaming and AI. The foundation also allocated $200,000 to several smaller projects ahead of the Fermi upgrade.

$BNB continues to trade below its key resistance at $910, with analysts watching for a decisive move above $931 to confirm upward momentum.

Until then, the token remains range-bound as markets weigh technical signals against broader macro and regulatory developments.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

coindesk.com

coindesk.com