Shiba Inu faces a pullback as it tests key support levels, with mixed market sentiment and futures flows indicating uncertainty.

Shiba Inu ($SHIB) has encountered a pullback after a brief rally, currently hovering around $0.000008443. The meme coin had shown a positive surge earlier, reaching a high of $0.000008731, but the recent price movement indicates a retreat.

$SHIB has experienced a 2.8% decline over the last 24 hours. With a market cap nearing $5 billion and a 24-hour trading volume of over $113 million, Shiba Inu’s market activity is still considerably sufficient.

As it retreats, $SHIB is now testing lower support levels, where the next potential floor could be around the $0.00000838 region. Traders are closely watching whether this support can hold, which could trigger a potential reversal for another bullish attempt. Ultimately, Shiba Inu’s ability to maintain this crucial support level will likely determine its short-term direction.

Can Shiba Inu Find a Floor?

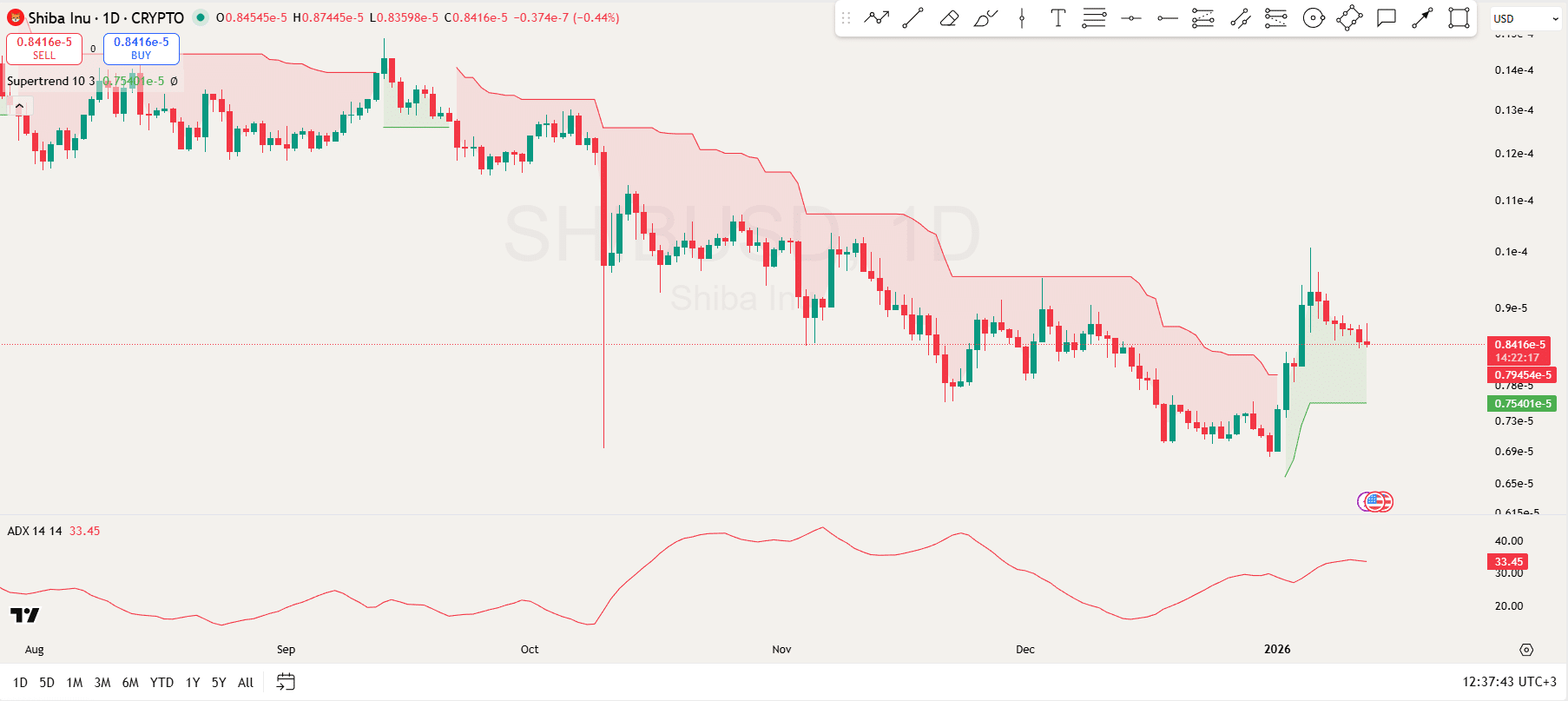

The Shiba Inu chart from TradingView reveals key support and resistance levels that traders should closely monitor. Currently, the Supertrend indicator is providing crucial support, as it sits below the price action at $0.000007540. This suggests that as long as Shiba Inu holds above this level, the trend could flip bullish.

However, if $SHIB falls below this level, further downside could emerge. On the resistance side, Shiba Inu is encountering significant pressure at $0.000009546, where the Supertrend line above is indicating a bearish trend.

The red cloud in the Supertrend suggests that the price could face difficulty breaking above this resistance without a strong push. If Shiba Inu can break above this level, it could lead to a bullish breakout, targeting higher resistance levels.

Further, the ADX indicator at 33.45 indicates that the current trend is fairly strong, but it also suggests that momentum is not yet extreme. This means there’s room for further movement in either direction, depending on how the token tests these support and resistance levels.

Shiba Inu Futures Flows

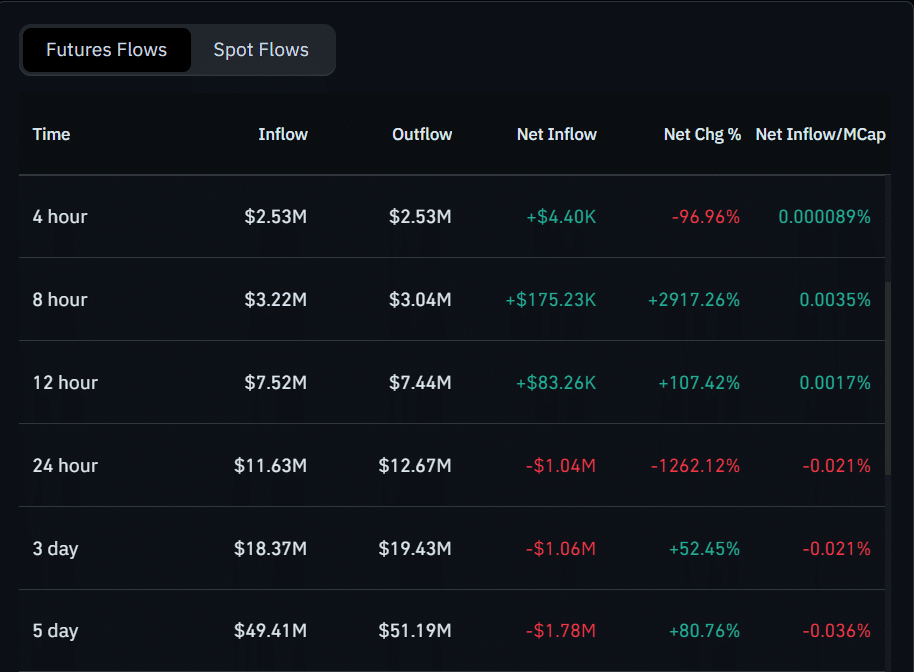

Meanwhile, the Shiba Inu futures flow data shows a mixed sentiment in the market. In the short-term (4-hour and 8-hour periods), there was a notable increase in inflows, especially with a 2917.26% rise in the 8-hour net inflow (+$175.23K). This suggests a temporary shift toward increased activity as more traders seem to enter the market during this timeframe.

However, the 4-hour flow shows a 96.96% drop in net change, indicating a lack of strong momentum. The 12-hour period also saw positive inflows ($83.26K), albeit at a lower rate.

In contrast, the longer-term flows present a more cautious outlook. Over the past 24 hours, there was a significant outflow of $1.04M, indicating less trading activity with a -1262.12% change. Furthermore, the 3-day and 5-day periods also show negative net inflows, with a larger outflow of $1.78M over five days.

thecryptobasic.com

thecryptobasic.com