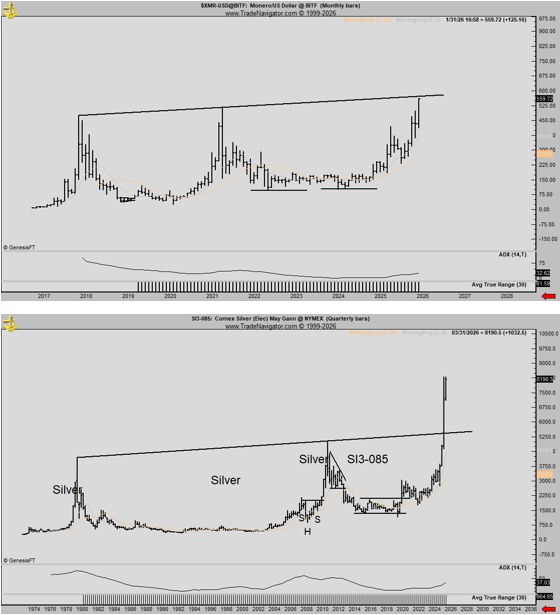

Veteran trader and chart analyst Peter Brandt is drawing a long-term parallel between privacy-focused cryptocurrency Monero $XMR$577.74 and silver, suggesting the token may be approaching a breakout years in the making.

In a pair of charts shared this week, Brandt compared monero’s multi-year price structure with silver’s decades-long setup before its recent historic surge that has seen prices nearly double to $84 per ounce since October.

The common thread isn’t timing, but patience, where prices bounce sideways for ages, slowly hitting higher tops, then blast upward, topping every barrier in the way.

A barrier, called as resistance in technical analysis, is a price zone where rallies keep stalling because early buyers are interested in offloading assets or taking profits in those specific price levels. show up there.

Monero, which has traded largely below its 2018 peak for much of the past seven years, set record highs earlier Monday above $578, eclipsing previous highs of $540.

Price-action has pushed higher steadily since late 2024, reclaiming levels that previously acted as resistance and putting the token closer to its all-time highs than at any point since the last major cycle.

Brandt’s comparison to silver is less about predicting a specific price target and more about market behavior. Silver spent years frustrating traders with false starts and slow recoveries before exploding higher when macro conditions, positioning, and narrative aligned.

Monero, long sidelined by exchange delistings, regulatory pressure, and muted speculation, may be emerging from a similar phase of neglect.

$XMR has risen 33% this year, extending last year's 124% rally, CoinDesk data show. According to analysts, the token has recently benefited from a renewed focus on privacy and anticipation around upcoming protocol upgrades, helping reignite demand despite the regulatory cloud still hanging over the sector.

coindesk.com

coindesk.com