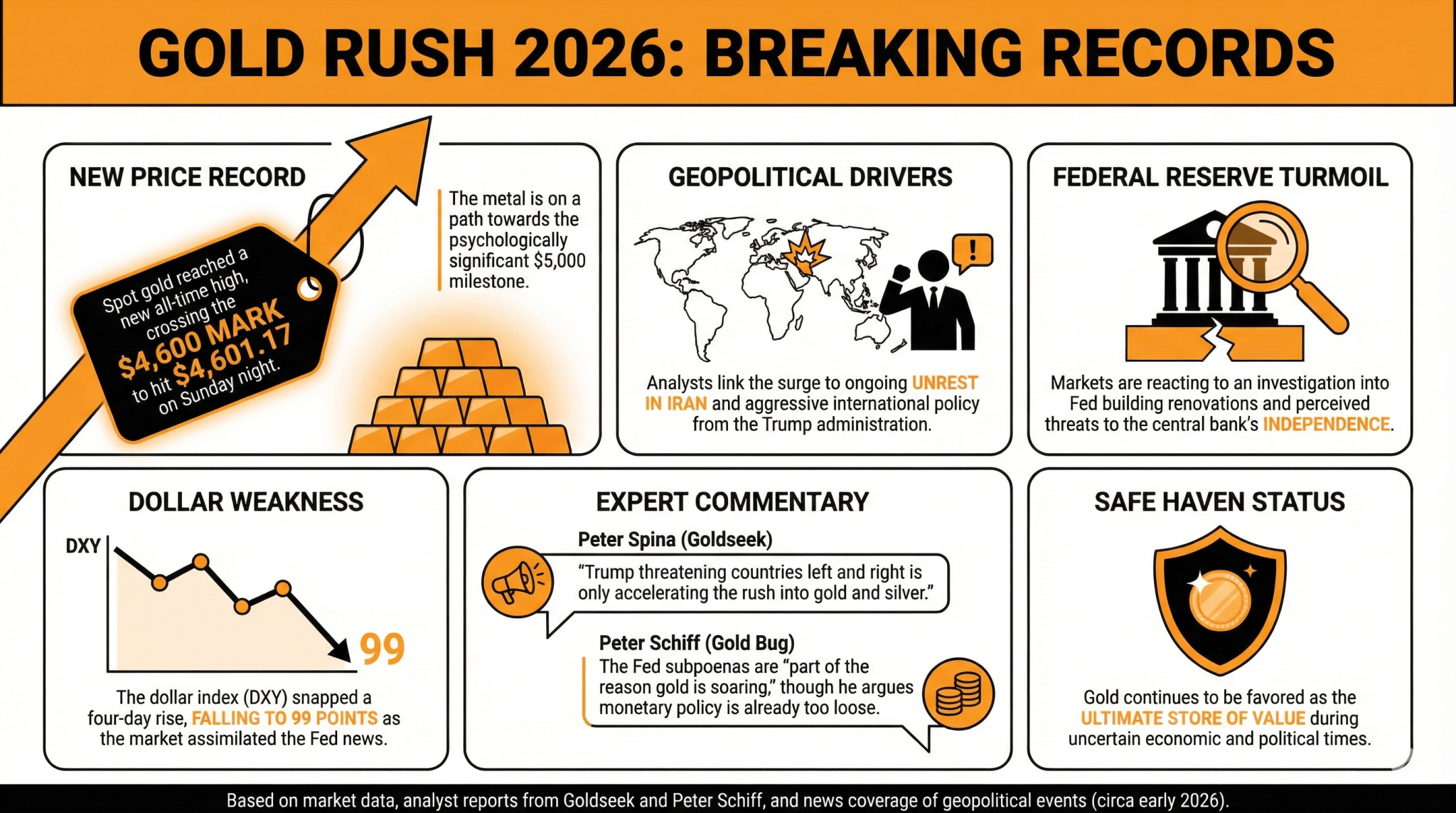

Analysts attributed these movements to developing geopolitical events in Venezuela and Iran, and to the DOJ probe into Fed Chair Jerome Powell, which was interpreted as a blow to the institution’s independence. Gold crossed the $4,600 mark, and the dollar index fell to 99 early Monday.

Markets Fly to Gold’s Safety as Fed Chair Jerome Powell Says Fed Independence Is at Stake

The precious metal rally has given no signs of stopping while geopolitical and economic factors keep propping up gold demand.

Gold, one of the most favored commodities in 2025, reached yet another price record, crossing the $4,600 mark on its path to $5,000. Spot gold reached as high as $4,601.17 during Sunday night hours, in a push that analysts have linked to the unrest in Iran and the reveal of an ongoing investigation into the Federal Reserve’s historic building renovations.

The dollar index (DXY) also fell after rising for four days, dropping to 99 points as the market assimilated what Powell considered a threat to the Federal Reserve’s independence from the Trump Administration.

Goldseek’s Peter Spina stated that this market move was related to Trump’s aggressive international policy. “Trump threatening countries left and right is only accelerating the rush into gold and silver,” he stressed. “This is also adding some fuel to the fire… the Federal Reserve hit with subpoenas,” he added.

Gold bug Peter Schiff also considered this one of the causes for the gold price’s acceleration during late Sunday hours. “This is part of the reason gold is soaring to record highs this evening. In truth, Powell and Trump are wrong: monetary policy is too loose, and interest rates are too low,” he assessed.

Gold has been considered one of the ultimate stores of value in uncertain times, given its safe haven properties. The rally is consistent with what analysts have been predicting for the precious metal in 2026.

UBS recently raised its gold price prediction, claiming that it could reach $5,000 in Q1. In the same way, economist Jim Rickards believes that gold can rise to $10,000 in 2026.

Read more: Federal Reserve Gets Probed by DOJ, Chair Powell Alleges Fed’s Independence Is at Stake

FAQ

-

What recent price record did gold achieve in 2025?

Gold surpassed $4,600, with spot prices reaching a high of $4,601.17, as it moves toward a target of $5,000. -

What geopolitical factors are influencing gold demand?

Analysts link the rally to unrest in Iran and an ongoing investigation into the Federal Reserve’s renovations, affecting market confidence. -

How has the dollar index reacted to these developments?

The dollar index (DXY) fell to 99 points after a four-day rise, reflecting market reactions to concerns about the Federal Reserve’s independence. -

What are analysts predicting for gold prices in the near future?

UBS predicts gold could reach $5,000 in Q1, while economist Jim Rickards forecasts a rise to $10,000 by 2026, reinforcing gold’s reputation as a safe haven.

news.bitcoin.com

news.bitcoin.com