The total crypto market cap (TOTAL) and Bitcoin ($BTC) have stabilized and recovered slightly over the last 24 hours after the previous week closed in the red. Altcoins seem to be picking up pace as well, with Monero ($XMR) rising by 24% to form a new ATH.

In the news today:-

- South Korea’s Financial Services Commission finalized guidelines allowing listed companies and professional investors to trade cryptocurrencies, ending a nine-year ban on corporate participation. The policy aligns with the government’s 2026 Economic Growth Strategy, which also includes stablecoin rules and recently announced spot crypto ETF approvals.

- Coinbase may withdraw support for a proposed U.S. crypto market structure bill if it restricts stablecoin rewards beyond disclosure rules, according to Bloomberg. The exchange is increasing lobbying efforts as lawmakers prepare to advance the bill, citing the importance of stablecoin rewards to its business model.

The Crypto Market Sees A Surge In Value

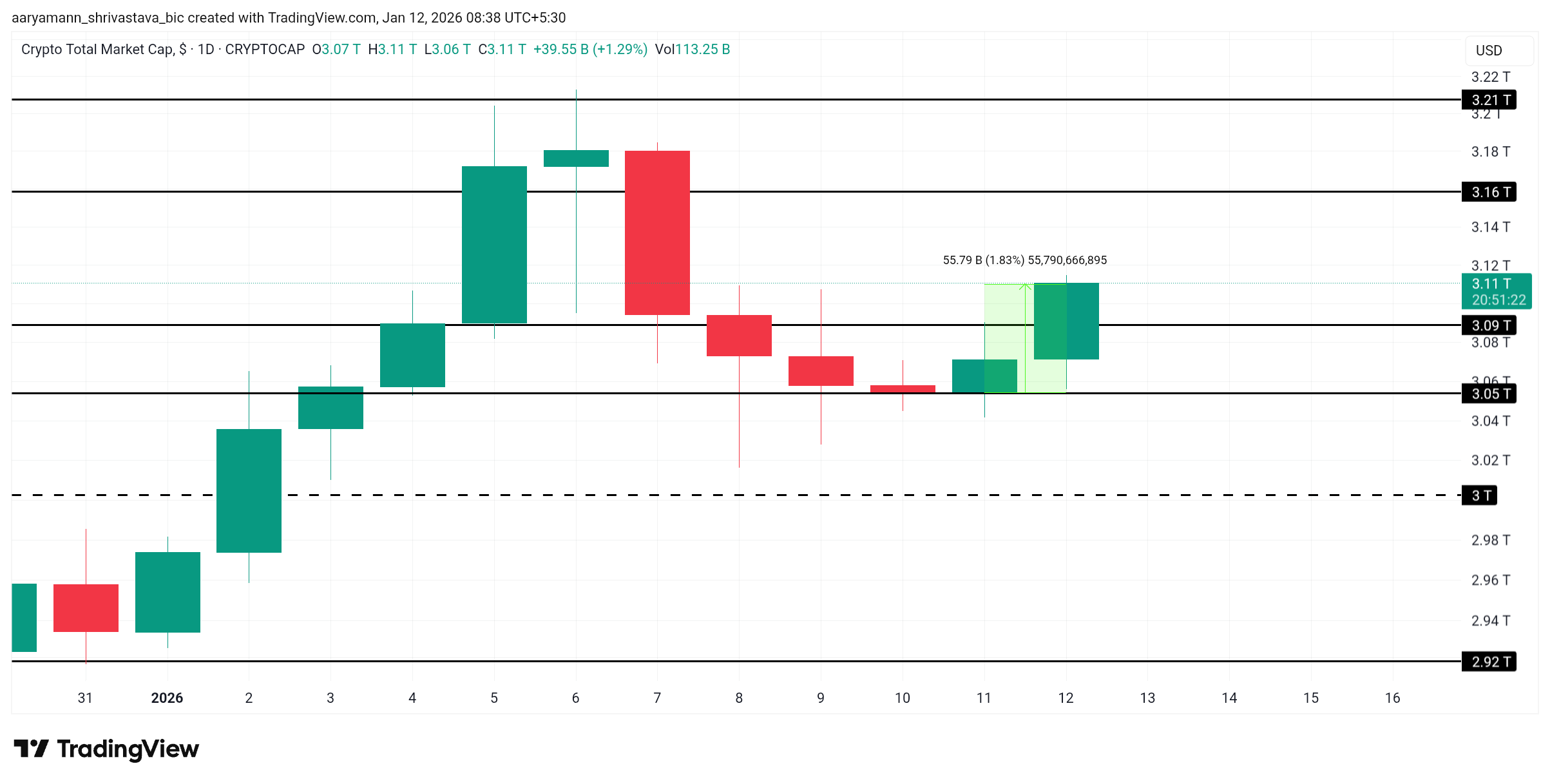

The total crypto market cap is showing early recovery signs after last week’s bearish phase. TOTAL added $55.8 billion in the past 24 hours, driven by renewed investor demand. Rising capital inflows suggest improving sentiment, though broader market conviction remains fragile amid recent volatility.

TOTAL now stands near $3.11 trillion, holding firmly above the $3.09 trillion support level. Sustained buying pressure could extend the rebound in the short term. However, reclaiming last week’s losses requires a decisive move above the $3.16 trillion resistance zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risks remain present if market sentiment weakens again. A resurgence of profit-taking or macro pressure could push TOTAL below $3.09 trillion. Losing this support would likely send the total crypto market cap toward $3.05 trillion, delaying a broader recovery.

Bitcoin Bounces Back

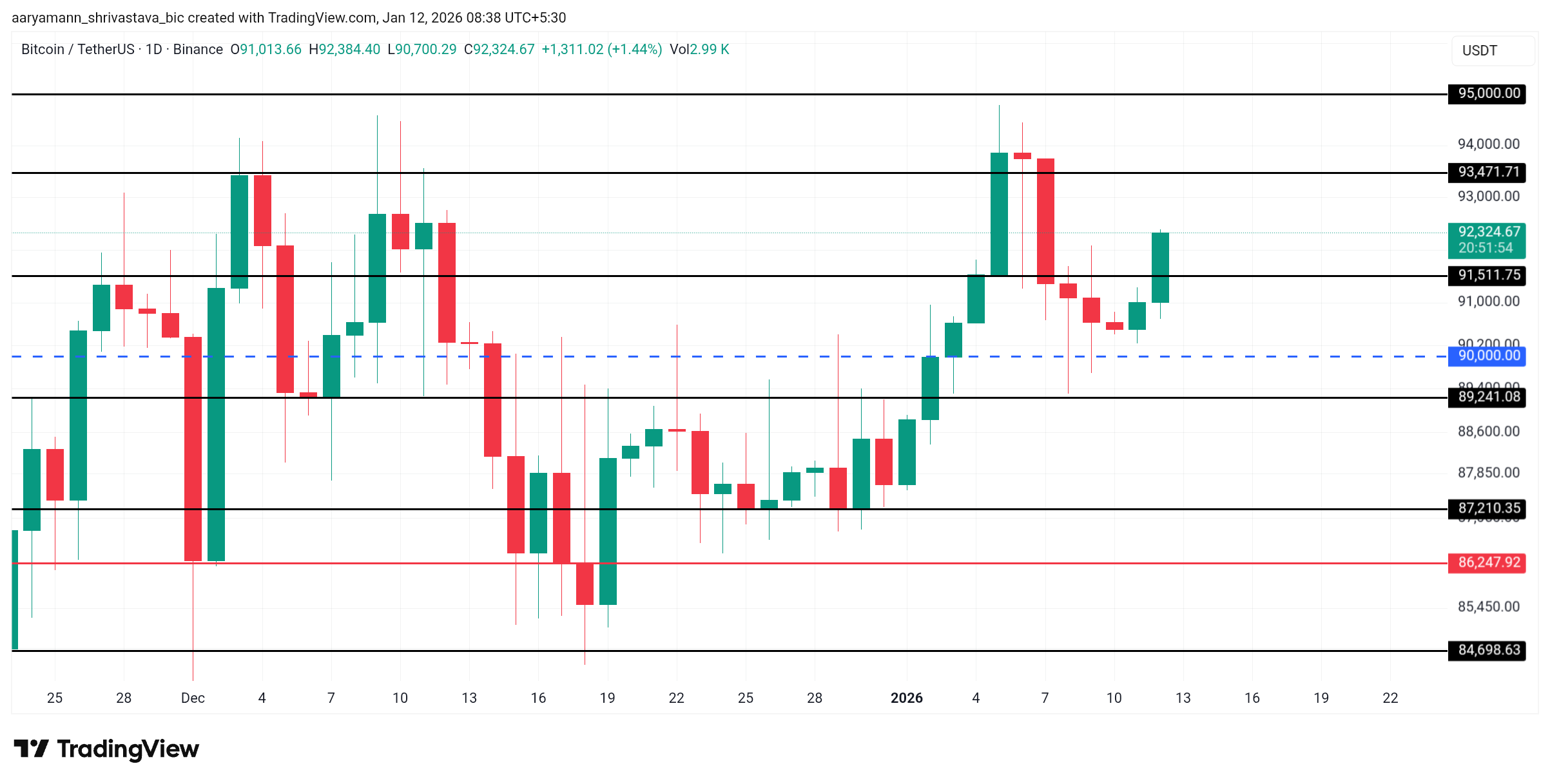

Bitcoin price showed renewed strength on the daily chart, climbing to $92,324 at the time of writing. The recovery follows several days of downside pressure, during which $BTC appeared poised to retest $90,000. Renewed buying interest suggests short-term sentiment is stabilizing after recent weakness.

In the past 24 hours, Bitcoin rebounded sharply and crossed the $91,511 level. This move shifts focus toward the $93,471 resistance zone. Securing this level of support remains critical, as it would open a clearer path toward $95,000 amid improving technical structure.

Failure to sustain bullish momentum would quickly weaken the outlook. A drop back below $91,511 could reintroduce selling pressure. Under such conditions, Bitcoin may revisit the $90,000 support area, invalidating the near-term bullish thesis and restoring downside risk.

Monero Continues To Form History

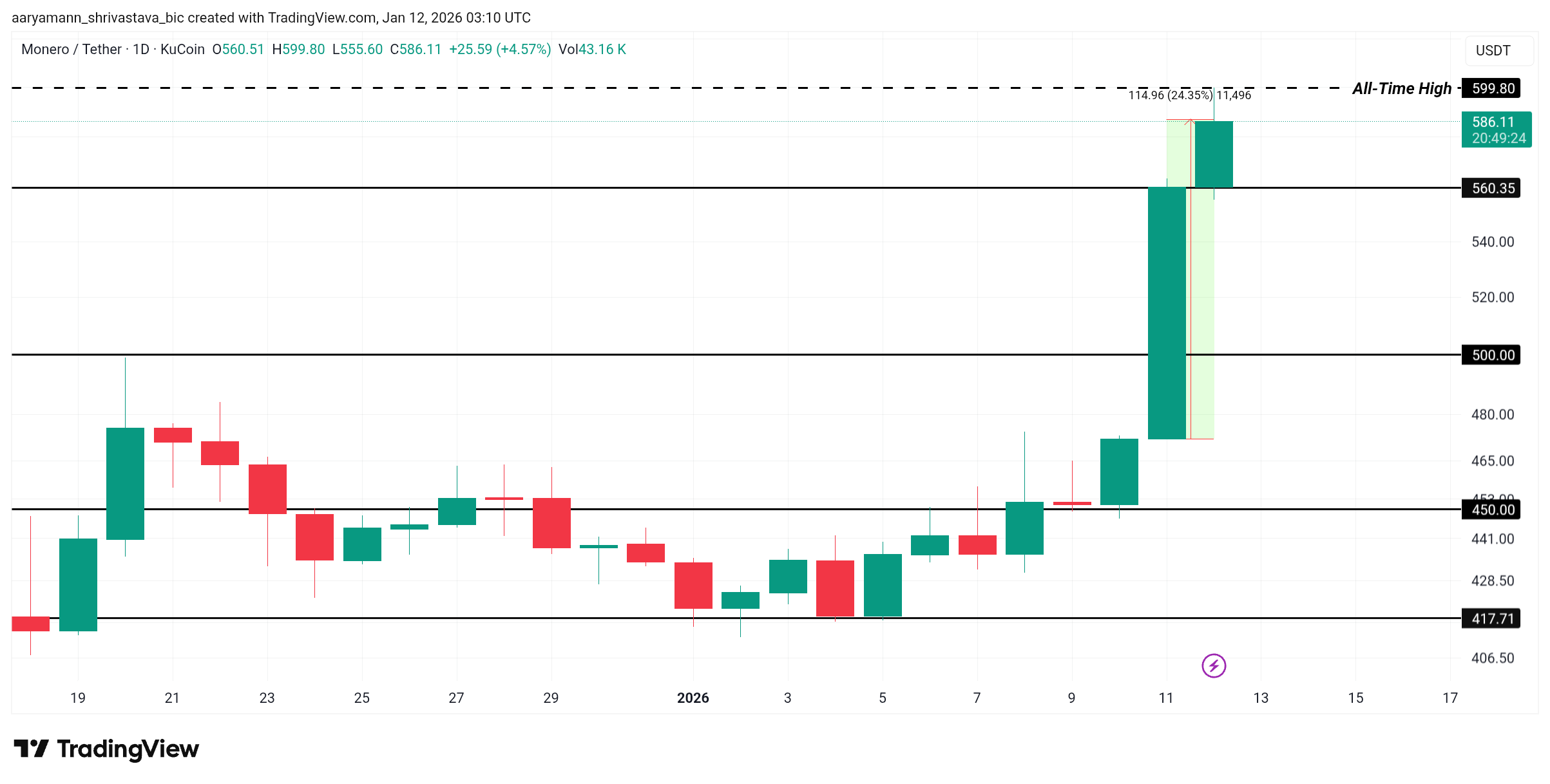

Monero emerged as the best-performing altcoin of the day, posting gains exceeding 24% in the last 24 hours. The strong rally pushed $XMR to trade near $586, reflecting heightened investor interest. Rising volume and renewed demand suggest Monero is benefiting from broader momentum within the privacy-focused crypto segment.

The sharp advance also drove $XMR to an intraday high of $599.80, marking a new all-time high. This breakout indicates strong bullish conviction. As long as capital inflows remain elevated and buying pressure persists, the Monero price could maintain its upward trajectory in the near term.

$XMR Price Analysis. ">

$XMR Price Analysis. ">

Despite the strength, downside risks remain. If investors begin locking in profits after the rally, $XMR could slip below the $560 level. A breakdown there would expose the price to deeper losses, potentially dragging Monero toward the $500 zone and invalidating the current bullish thesis.

The post Why Is The Crypto Market Up Today? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com