$XRP is flashing a fresh technical warning after a potentially bearish candlestick pattern appeared on its weekly chart.

This outlook comes as the cryptocurrency struggles to hold the $2 support zone, which has remained fragile in recent sessions.

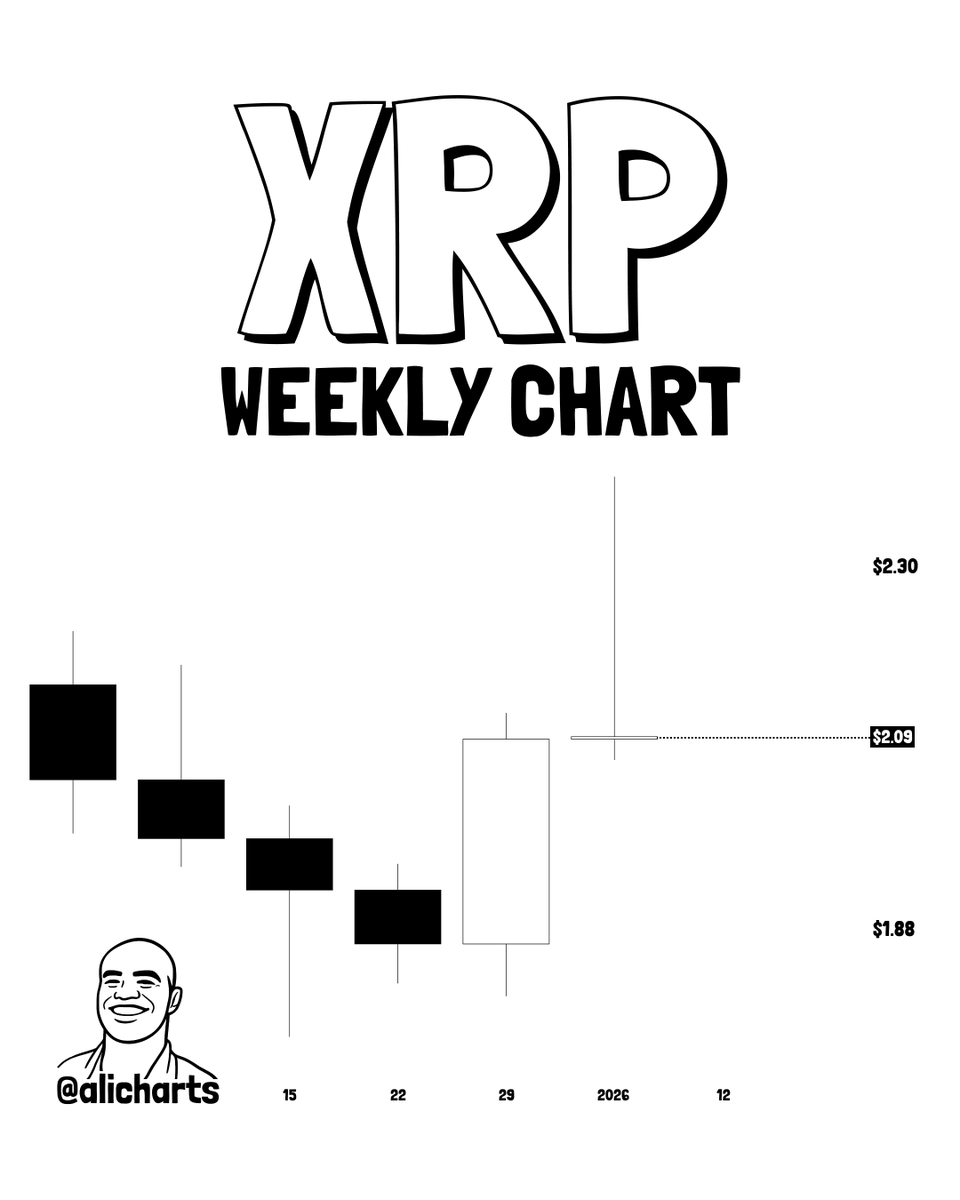

According to crypto analyst Ali Martinez, $XRP appears to be forming a gravestone doji, a pattern that typically occurs when buyers initially push prices higher, but sellers regain control and force a close near the opening level.

The result is a long upper wick with a small real body near the bottom, signaling rejection of higher prices.

In his January 11 outlook, $XRP has attempted to move above $2, briefly reaching the $2.09–$2.30 range before encountering selling pressure. The long upper wick reflects that rejection, indicating bulls failed to sustain the move.

On a weekly chart, this carries added significance, as it reflects broader market sentiment rather than short-term volatility.

Technically, a gravestone doji often forms near resistance and signals weakening bullish momentum. While it does not confirm a reversal on its own, it serves as an early warning, with confirmation typically coming from continued downside or failure to reclaim rejected levels.

For $XRP, the pattern appears after a multi-week decline and a rebound attempt, making it notable. The inability to hold above the $2 psychological level suggests sellers remain in control, pointing to further consolidation or a pullback before any sustainable upside emerges.

$XRP price analysis

By press time, $XRP was trading at $2.09, down about 0.33% over the past 24 hours, while weekly gains remained below 0.1%.

At current levels, $XRP is trading slightly above its 50-day SMA at $2.03, indicating short-term support. However, the price remains well below the 200-day SMA at $2.56, keeping the broader trend bearish.

Meanwhile, the 14-day RSI stands at 53.9, a neutral reading that reflects weak momentum and a lack of strong buying pressure.

Featured image via Shutterstock

finbold.com

finbold.com