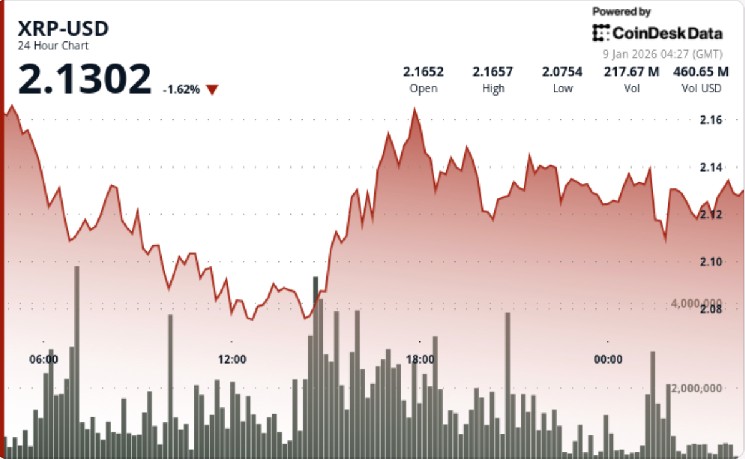

$XRP eased to $2.12 after a rare two-sided liquidation sequence on Binance Futures flushed leverage from both directions, leaving spot price pinned in a $2.07–$2.17 range as traders waited for a fresh catalyst to break the consolidation.

News background

- $XRP continues to attract institutional infrastructure interest even as short-term price action remains choppy.

- Evernorth — an $XRP digital asset treasury company supported by Ripple and SBI Holdings — said it has entered into a strategic collaboration with Doppler Finance to explore institutional liquidity and treasury use cases on the $XRP Ledger (XRPL).

- The initiative is positioned as an exploratory phase rather than a product launch, with the companies evaluating frameworks around structured liquidity deployment and treasury management, along with broader commercial and operational considerations.

- The timing is notable: infrastructure narratives remain constructive, but price continues to trade like a derivatives-led market where leverage resets — not fundamentals — dictate the near-term path.

Technical analysis

$XRP fell 2.3% over the 24-hour period ending Jan. 9 at 02:00, sliding from $2.17 to $2.12 as traders absorbed a two-step liquidation reset that left price trapped between $2.07 support and $2.17 resistance.

The leverage reset was unusually symmetrical. Binance Futures saw roughly $4.4 million in short liquidations on Jan. 5, when $XRP surged toward $2.40 and forced late sellers to cover. A day later, the market reversed and triggered about $5.5 million in long liquidations (including about $1 million see-through on Binance), pressuring breakout chasers and pulling price back into the center of the range.

That kind of two-sided liquidation cascade typically signals uncertainty rather than clean trend confirmation. It removes excess leverage — which can reduce tail-risk — but it also reflects a market still searching for direction and willing to punish positioning on both sides.

The clearest technical signal from the latest session was the defense of the $2.07–$2.08 demand pocket. Volume spiked sharply at 14:00 on Jan. 8, with 154.85 million $XRP changing hands (93% above the 24-hour SMA of 66.4 million) as price dipped to the lower bound of the range. Buyers absorbed the sell pressure, triggering a V-shaped rebound that carried $XRP from $2.09 to $2.16 between 15:00–17:00 on sustained activity — but rallies kept stalling near $2.17, confirming supply overhead.

Shorter timeframes remained jumpy. The 60-minute tape showed another mini flush-and-rebound sequence: $XRP dropped from $2.131 to $2.119 between 01:22–01:36 on ~18.2 million in sell flow, then snapped back to $2.141 around 01:30 on a 5.0 million spike — the highest print of that hour. But the rebound faded quickly, and the failure to reclaim $2.135 reinforced that the market is still consolidating rather than breaking out.

Until $2.17 gives way or $2.07 breaks, $XRP is trading like a post-liquidation “reset” market — technical, reactive, and mean-reverting.

Price action summary

- $XRP fell from $2.17 to $2.12, carving a $0.11 range (about 4.9%)

- A high-volume dip to $2.07 triggered a sharp rebound, confirming demand at $2.07–$2.08

- Recoveries repeatedly failed near $2.17, reinforcing that area as the near-term sell zone

- The late session remained choppy, with price oscillating between $2.109–$2.130 after a brief spike to $2.141

What traders should know

This is a leverage-cleared market — and those often consolidate before the next move.

Levels are clean:

- If $2.07–$2.08 holds, $XRP likely keeps grinding inside the range with the next upside test at $2.17, then $2.20. A clean break above $2.17 with follow-through would shift the tape from “reset” to “trend,” opening the door back toward $2.25–$2.30.

- If $2.07 breaks, the range resolves lower and attention shifts to $2.05, then $1.85–$1.90 as the next meaningful demand zone from the prior correction.

The broader read: the market just cleared a lot of leverage in a short timeframe. That reduces the odds of immediate cascading moves, but it also means the next break — up or down — is likely to be driven by a fresh impulse rather than another liquidation loop.

coindesk.com

coindesk.com