$XRP is consolidating near a critical support zone as tightening intraday trading, easing whale sell pressure, and steady retail activity point to a potential re-accumulation phase after its sharp pullback.

$XRP Price Holds Tight Range as Volatility Compresses

$XRP is holding a key technical level as intraday trading tightens around the $2.12 mark, drawing attention to short-term support strength. Recent on-chain data show that large holders have reduced exchange inflows since mid-December, easing selling pressure while retail activity remains steady.

Intraday market data from the $XRP/USD pair on Bitstamp showed price trading near $2.12 at 7:35 p.m. on Jan. 8, with activity confined to a narrow range following the broader pullback from late-2025 highs. Over the preceding 24-hour window, $XRP fluctuated between roughly $2.06 and $2.19, reflecting limited directional conviction.

$XRP’s technical indicators reflected consolidation, with the 14-period Relative Strength Index ( RSI) hovering around 44–45, signaling neutral momentum. The Moving Average Convergence Divergence ( MACD) stood in negative territory, at approximately -0.038, while the flattening MACD histogram indicated that downside pressure was easing rather than accelerating. On intraday charts, $XRP traded below its 50-period Moving Average (MA) while holding above the 200-period Moving Average near the low-$2 area. Traders typically interpret this combination as a pause within a broader support zone, with the shorter-term average acting as overhead resistance as the market compresses and waits for a clearer directional catalyst.

Read more: Ripple Confirms $XRP Is Already Cleared in US — Clarity Act Could Unlock the Next Surge

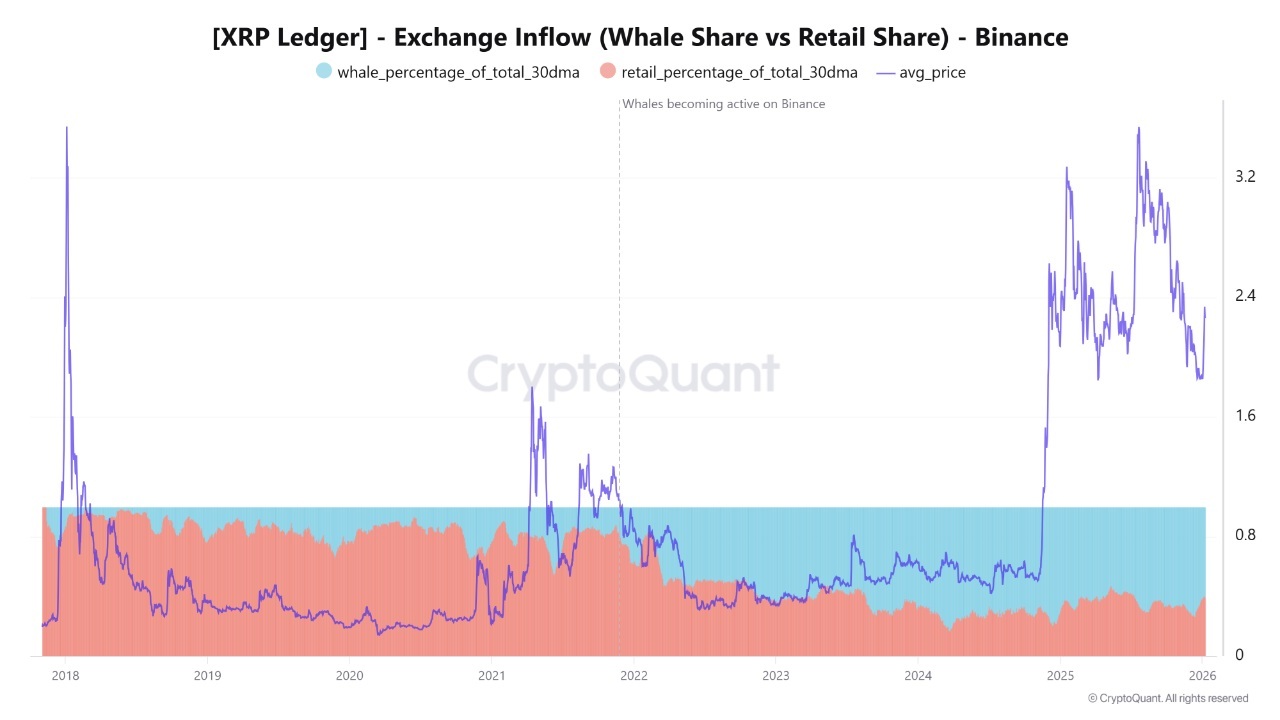

Cryptoquant shared an analysis on Jan. 8 examining $XRP exchange inflows to Binance and how shifting whale behavior may be influencing market structure. The data showed that whales accounted for approximately 60.3% of total $XRP flows to Binance, compared with 39.7% from retail investors, based on 30-day moving averages. Although large holders still dominated exchange transfers, their activity has trended lower since mid-December, signaling a cooling phase after months of elevated participation near the top of $XRP’s rally.

As whale inflows declined, $XRP transitioned from a sharp advance into a corrective and consolidative phase, with prices retreating from the $3.20 area toward the low-$2 range. The analysis noted that this pattern aligns with prior market cycles, where exchange-bound whale activity peaks near local highs and fades as distribution pressure eases. Importantly, the pullback in large-holder transfers was not accompanied by a surge in retail inflows, suggesting that selling pressure did not cascade through the broader market.

The analysis noted: “This balanced behavior from both sides may indicate that $XRP is entering a re-accumulation phase after a strong upward move.” While whale flows remain elevated compared with historical lows, reduced large-holder activity lowers near-term sell-side risk, though the indicator remains critical to monitor for any renewed acceleration that could signal changing market conditions.

FAQ 🧭

-

Why is the $2.12–$2.13 level important for $XRP investors?

$XRP holding this tight intraday range suggests strong short-term support, reducing immediate downside risk and signaling potential base formation for the next move. -

What does declining whale exchange inflows mean for $XRP’s price outlook?

Lower whale inflows since mid-December indicate easing sell pressure, which historically supports price stabilization or re-accumulation phases. -

How do current technical indicators affect $XRP’s near-term trend?

Neutral RSI and a flattening negative MACD suggest waning bearish momentum, pointing to consolidation rather than an aggressive selloff. -

Why does steady retail activity matter for $XRP’s risk profile?

The absence of a retail-driven sell surge implies the pullback is controlled, lowering the probability of a sharp breakdown and improving risk-adjusted positioning.

news.bitcoin.com

news.bitcoin.com