Amid the ongoing recovery effort from $XRP, a prominent market analyst and Elliott Wave specialist has revealed why he believes a rally to $20 remains possible.

For context, $XRP opened 2026 with an impressive comeback, having surged 22.59% during the first seven days of the year. This comes after the downtrend in Q4 2025 resulted in a 35% collapse, pushing $XRP below the pivotal $2 level.

The latest bullish flip, which recovered the $2 mark, has revived discussions about how high $XRP could climb in this cycle. Amid the discussions, XForceGlobal, a South Korean Elliott Wave specialist, recently shared his opinion.

$XRP Has Held Near ATHs for First Time in History

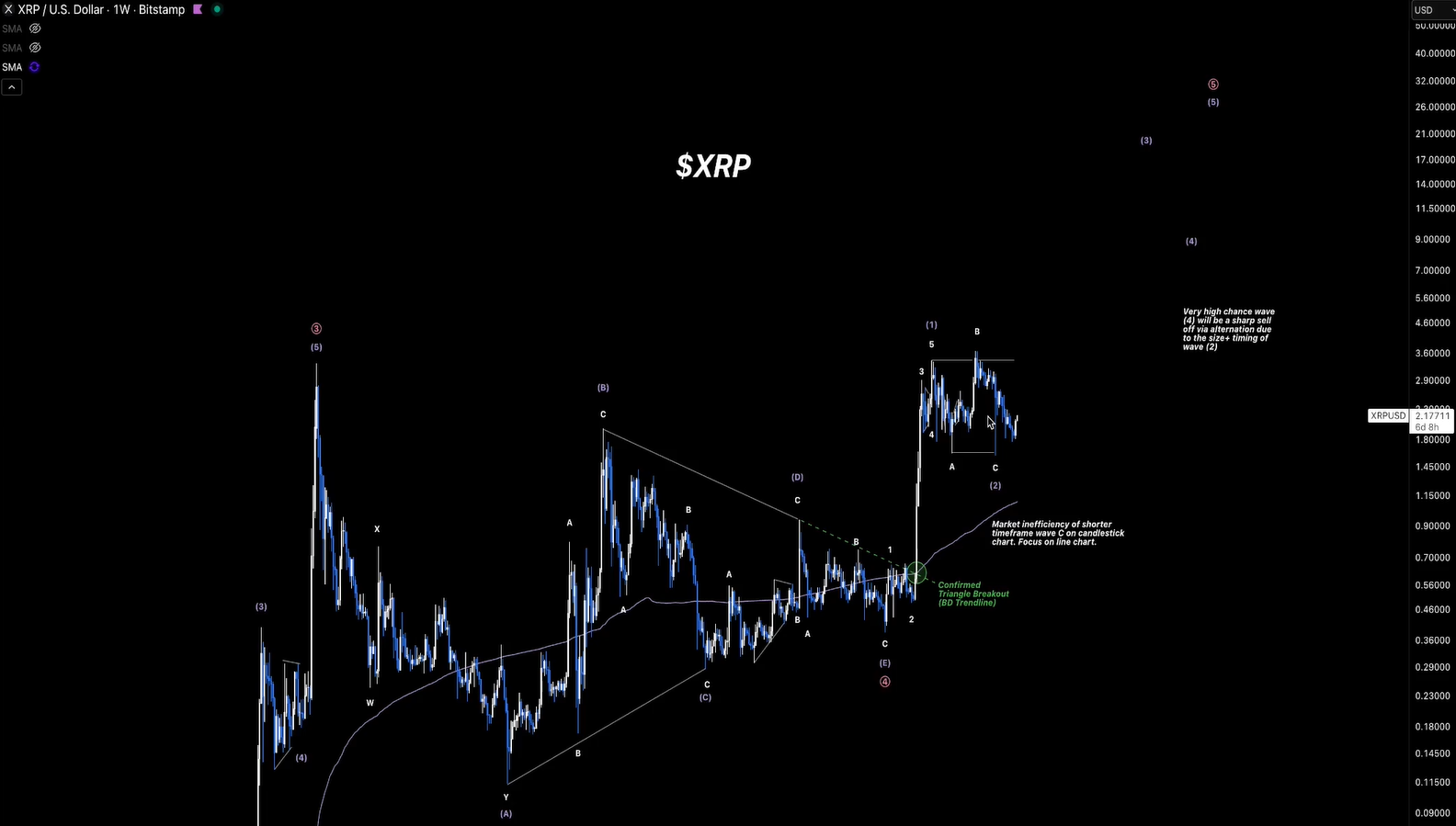

He asked investors not to dismiss the idea of $5 or even $20 during this cycle. The market analyst said his outlook comes from studying price movement daily and linking each move to the larger Elliott Wave map. According to him, the broader picture shows that $XRP now trades in an unusually tight range that goes against what traders have seen throughout its price history.

He explained that this range helped the market set a new price floor that currently holds firm. Specifically, this floor rests around the $2 level. XForceGlobal believes this floor is now undergoing a test phase that should either confirm or reject it.

He then mentioned earlier cycle peaks in 2018 and 2022, where $XRP rallied and then quickly lost ground. According to him, the token did not repeat this pattern after its late-2024 surge. Notably, $XRP held strong levels after the November 2024 run for a full year and did so fairly close to previous all-time highs. XForceGlobal believes this is a sign of strength in the market.

What Corrective Structure is $XRP Currently Witnessing?

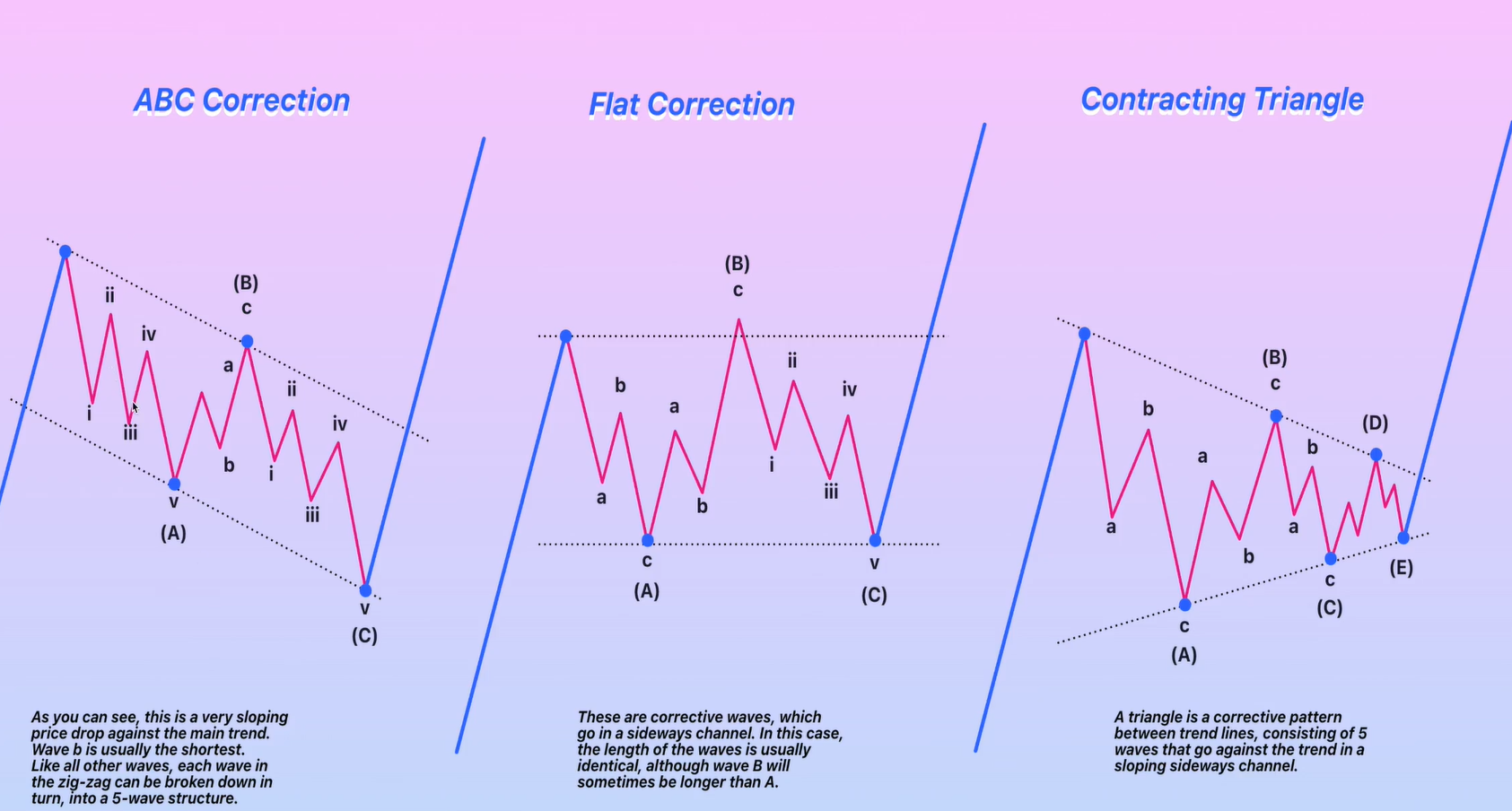

Speaking further, the analyst then highlighted the main corrective structures in Elliott Wave theory. Notably, he said markets usually move through zigzags, flats, or triangles when they pause before the next trend.

For context, zigzags slope against momentum, triangles compress inside narrowing levels, and flats hold inside a steady zone. Considering this, XForceGlobal ruled out the possibility that $XRP’s current corrective structure is a triangle, suggesting that it instead resembles a flat pattern.

According to him, flat structures themselves come in different forms. The standard version looks straightforward, but expanded and running flats create fake swings that trick traders.

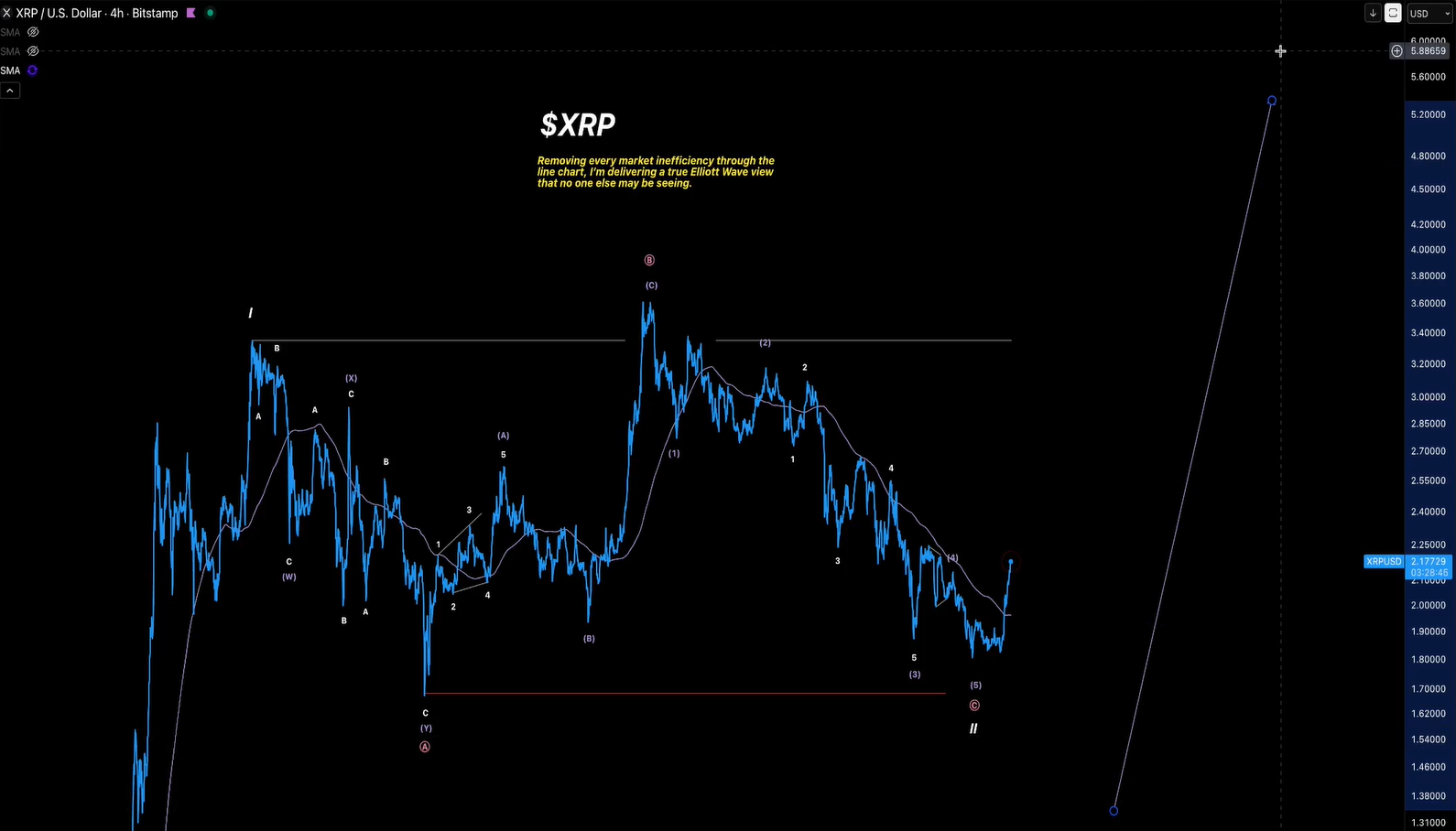

He said $XRP already pushed above a previous high, which leaves two choices: expanded flat or running flat. To him, the more likely option is the running flat, which keeps the previous low intact without breaking support. He called this trend a fake-out inside another fake-out that usually ends with a strong breakout in the direction of the main trend.

Possible Targets as $XRP Nearly Done with Current Correction

The analyst explained that the flat pattern includes three moves down, three moves up, and a final five-wave leg. He believes $XRP already completed that five-wave decline during the 35% collapse in Q4 2025, which would mean the correction ended.

However, XForceGlobal admitted that one last dip could still happen, and a drop to the $1.30 to $1.50 area remains on the table. Despite this, evidence seems to suggest the correction may have run its course. He said the market’s latest leg higher looks like an impulsive move, not a corrective bounce, which usually marks the start of a new upward trend.

With that context, he believes $XRP already sits inside the opening stages of a fresh five-wave push to the upside. He expects more nested impulse moves to build on top of each other and send prices higher as buyers take control.

Considering this, XForceGlobal set $5 as a reasonable low-end target for the cycle. He also said $XRP could reach $10, $20, and possibly even push toward $30 if momentum accelerates during the peak of the cycle.

thecryptobasic.com

thecryptobasic.com