XRP is trading between $2.19 to $2.21 on Jan. 7, 2026, giving the token a market cap of $134 billion, a 24-hour trading volume of $5.97 billion and an intraday range between $2.19 and $2.32. Liquidity remains visibly strong, volatility is very much alive, and the market is behaving like it just finished a sprint and is pretending it does not need a glass of water.

XRP Chart Outlook

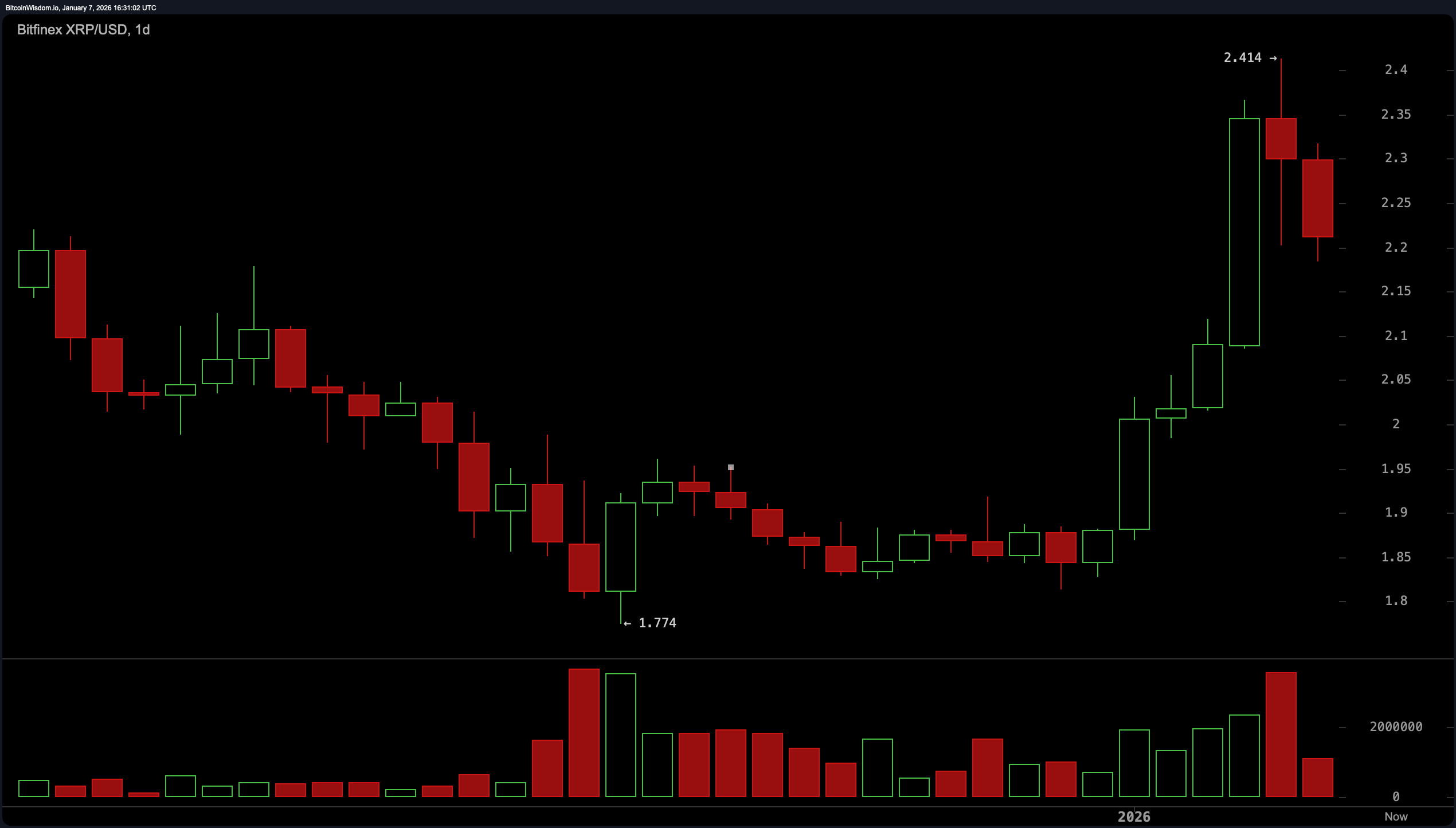

On the daily time frame, price action reflects a market catching its breath after an aggressive rally from roughly $1.80 to a local high near $2.414. Two consecutive daily pullbacks suggest short-term exhaustion rather than structural damage, especially with elevated volume appearing near the top, a classic hallmark of profit-taking.

As long as XRP continues to hold above the $1.95 region, the broader daily trend remains constructive. The current behavior reads as consolidation, not capitulation, and the chart still favors trend preservation over trend reversal.

The four-hour chart sharpens that picture, showing a clear uptrend that began Jan. 2 and peaked on Jan. 6 before transitioning into a corrective phase. Strong red candles during the downturn confirmed a local top, while price has since gravitated toward the $2.18 to $2.22 zone, which is now acting as a short-term equilibrium. This structure resembles a developing continuation pattern, provided support remains intact. A sustained move away from this area would likely dictate the next directional impulse.

The one-hour chart, however, is less forgiving and far more judgmental. XRP slid aggressively from $2.404 to $2.18, and while a modest rebound followed, lower highs and diminishing volume on the bounce suggest a lack of conviction. Volume expanded during the decline and faded during recovery attempts, signaling that downside pressure has not fully released its grip. Until price reclaims the $2.26 to $2.28 region with authority, short-term momentum remains cautious and choppy.

Oscillator readings reinforce that nuanced tone. The relative strength index ( RSI) sits at 62.21730, reflecting healthy momentum without tipping into excess. The Stochastic oscillator at 81.29445 and the commodity channel index (CCI) at 164.40566 both indicate stretched short-term conditions. The average directional index (ADX) at 30.62327 confirms a trend with real muscle behind it. The Awesome oscillator at 0.20094 is largely neutral, while momentum at 0.34647 suggests recent upside energy is cooling. Meanwhile, the moving average convergence divergence ( MACD) shows a positive level at 0.05347, hinting that underlying trend bias has not yet rolled over.

Moving averages (MAs) complete the story with a clear split between short-term strength and long-term resistance. Price remains comfortably above the exponential moving average (EMA) 10 at $2.097, simple moving average (SMA) 10 at $2.041, EMA 20 at $2.028, SMA 20 at $1.961, EMA 30 at $2.022, EMA 50 at $2.069 and SMA 50 at $2.020, reinforcing near-term support. However, the EMA 100 at $2.225, SMA 100 at $2.264, EMA 200 at $2.345 and SMA 200 at $2.569 remain overhead, forming a layered ceiling that XRP has yet to decisively overcome. In short, the market is trending, but it still has homework to finish.

XRP Derivatives Action

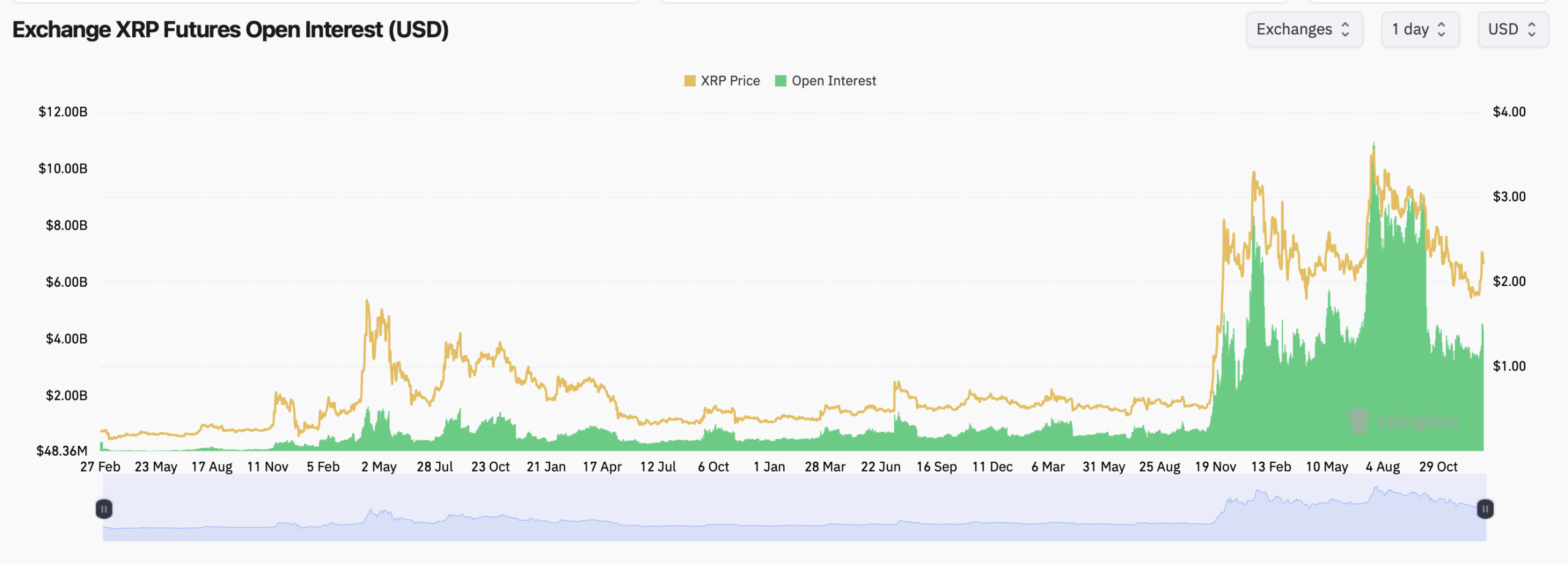

Futures positioning adds another layer of context, and it is quietly revealing where conviction is thinning. Aggregate XRP futures open interest stands at roughly $4.30 billion, representing about 1.95 billion XRP outstanding, but the short-term trend shows contraction rather than expansion.

Open interest is up a modest 0.36% over the past hour, yet down 2.78% over four hours and off 4.57% over the past 24 hours, signaling de-risking rather than aggressive new positioning. CME leads with $964.14 million in open interest, followed by Binance at $704.76 million and Bybit at $450.42 million. The decline across most major venues suggests leverage is being trimmed as price consolidates, a classic “hands off the keyboard” moment rather than a rush for directional exposure.

Options activity, meanwhile, carries a slightly different tone and a bit more attitude. Call contracts dominate both open interest and volume, with calls accounting for roughly 65.60% of open interest versus 34.40% for puts, and an even more lopsided 71.63% share of 24-hour volume. On Binance, notional call open interest sits near 712,986 USDT compared with about 373,826 USDT on the put side, while volume shows a similar skew.

The most active strikes cluster around the $2.20 to $2.50 range, suggesting traders are positioning around nearby price action rather than swinging for the fences. In short, options participants are leaning optimistic, but not reckless — confident enough to favor upside structures, cautious enough to keep them close to the money.

Bull Verdict:

The technical backdrop still leans constructive despite the recent cooldown. XRP is holding above a dense cluster of short- and medium-term moving averages, daily structure remains intact above key support near $1.95, and the moving average convergence divergence ( MACD) continues to reflect positive underlying trend bias. Futures data shows leverage being reduced rather than aggressively flipped, while options markets skew decisively toward call exposure, signaling expectations for higher prices once consolidation runs its course. In short, the trend has paused, not broken, and the market still respects the broader upside framework.

Bear Verdict:

The caution flags are equally visible for anyone willing to look past the headline trend. Momentum oscillators such as the stochastic oscillator and commodity channel index (CCI) are stretched, the one-hour chart shows weak recovery attempts with declining volume, and long-term moving averages remain stacked overhead like an uncooperative ceiling. Futures open interest has been contracting across most major venues, reflecting reduced risk appetite, while price continues to struggle reclaiming levels above $2.26 to $2.30. If support weakens, this consolidation risks morphing into a deeper reset rather than a simple breather.

FAQ ⚙️

- What is XRP’s price today? XRP is trading near $2.19 to $2.21, consolidating after a recent rally and holding within a tight intraday range.

- Why is XRP consolidating right now? XRP is pausing after a strong upside move as momentum cools and traders reduce leverage while watching key support levels.

- What do XRP futures data show? XRP futures open interest is declining across major exchanges, signaling de-risking rather than aggressive new positioning.

- What do XRP options markets indicate? XRP options activity is skewed toward call contracts, suggesting traders are positioning for potential upside once consolidation resolves.

news.bitcoin.com

news.bitcoin.com