Coinbase stock price has sunk into a technical bear market in the past few months as sentiment in the crypto industry waned. It was trading at $250 on Tuesday, down sharply from the July high of $444. This article explores what to expect in the coming weeks.

Coinbase stock price faces major risks ahead

Copy link to section

The daily timeframe chart shows that the COIN stock price has crashed in the past few months, mirroring the performance of other companies in the crypto industry like Circle and Bakkt.

It has moved below the important support level at $292, its lowest level in August and September last year. Worse, it has already formed a death cross pattern as the 50-day and 200-day Exponential Moving Averages (EMA) have crossed each other.

The stock has moved below the Supertrend indicator, a sign that bears are in control for now. The last time this happened was in December 2024 and it plunged by 45% after that.

COIN stock price chart | Source: TradingView

Therefore, the most likely scenario is where the stock continues falling, potentially to the key support level at $225, its lowest level last week. A move below that level will point to more downside to the psychological level at $200.

Coinbase is facing major headwinds

Copy link to section

Coinbase stock price is facing major headwinds that may drag it lower in the near term. One of these challenges is that the company is relatively overvalued, with its forward price-to-earnings (PE) ratio being 33, much higher than the sector median of 11 and the S&P 500 Index average of 22.

The other major risk is that competition in the industry is soaring, with more companies entering the sector. For example, companies like SoFi, Charles Schwab, and Vanguard are entering the industry. These companies may push the company to cut its fees in the near term.

Meanwhile, analysts anticipate that the company’s business will remain under pressure, with the upcoming earnings expected to show that its revenue dropped by 15.5% to $1.92 billion. They also expect the revenue in the current quarter to come in at $1.96 billion, down by 4.38% from the same period last year.

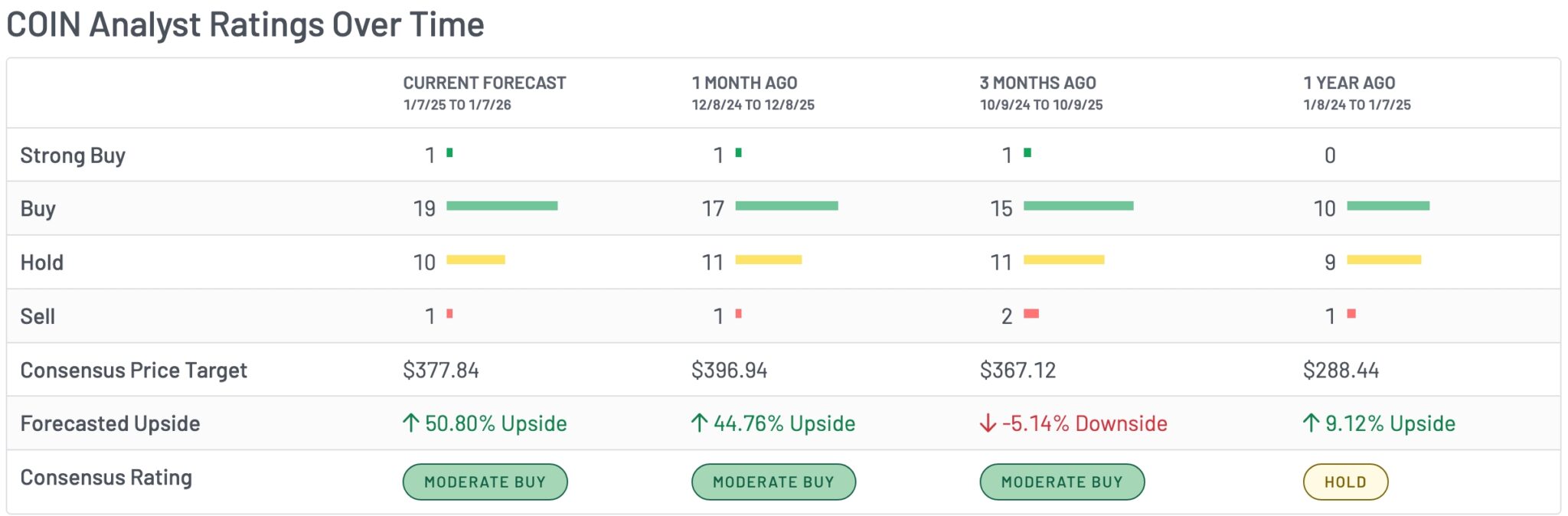

On the positive side, analysts believe that the stock will rebound over time. Data compiled by MarketBeat shows that the consensus target for the stock is $377, up by 50% from the current level.

In a recent note, Sanford analysts expect the stock to hit $440, while Goldman Sachs sees it rising to $303. Cantor Fitzgerald analysts see it rising to $320x while BTIG expects it to hit $420.

The potential catalyst for the stock is that it recently launched its predictions market through a partnership with Kalshi, the biggest company in the industry.

It is also expanding its business to the stock market by leveraging tokenization technology. This is a good move as it will help it become a trading ‘supermarket’, allowing customers to trade various assets.

The other potential catalyst that may help to offset its weakness is its growing suite of products, which includes its stablecoin, custody, staking, and subscription. Its subscription and services revenue stood at $746 million in the third quarter, a sizable amount considering that its transaction revenue rose to $1.04 billion.

READ MORE: Coinbase stock forecast as Brian Armstrong reveals 3 focus areas for 2026

invezz.com

invezz.com