Key takeaways

- Stacks’ $STX is up nearly 7% in the last 24 hours and is trading at $0.378.

- The coin could retrace towards $0.35 thanks to the $0.39 resistance level.

$STX hits $0.39 amid growing TVL

$STX, the native coin of Stacks, a layer-2 protocol built on Bitcoin, is trading at $0.37 after adding 7% to its value in the last 24 hours.

The rally comes as Stacks is experiencing a growing Total Value Locked (TVL). Data obtained from DeFiLlama shows that Bitcoin’s TVL is at $7.176 billion, up from $6.728 billion last week.

There is a renewed interest in Bitcoin’s DeFi utility, with Stacks one of the leading DeFi platforms on the Bitcoin blockchain.

Furthermore, DeFiLlama data shows that Stacks TVL is at $129.73 million, up from $116.62 million last week.

Retail traders are also renewing interest in the network. Stacks futures Open Interest (OI) currently stands at $27.79 million, up from the $16 million recorded a week ago. This suggests a capital inflow driven by renewed risk-on sentiment among traders.

$STX could retrace below $0.35 if the $0.39 resistance holds

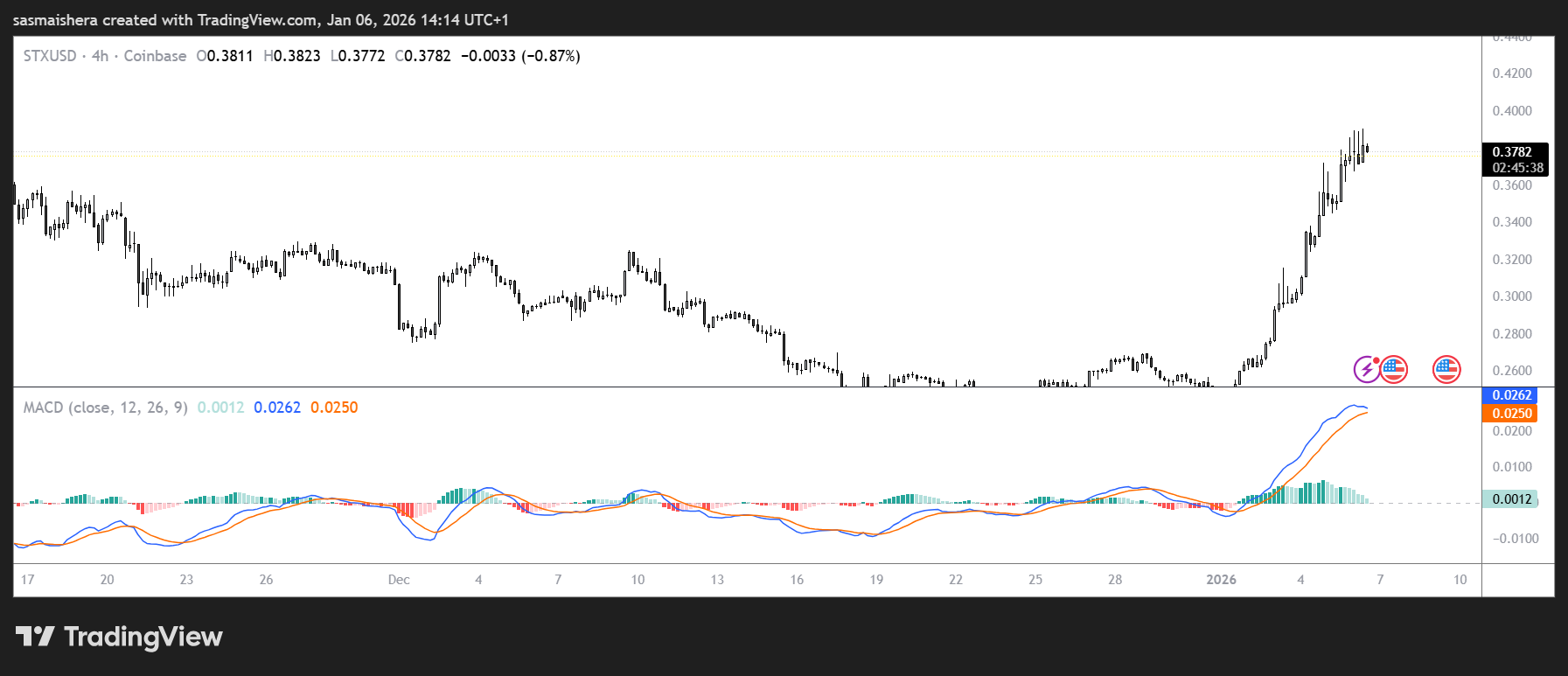

The $STX/USD 4-hour chart is bullish and efficient after $STX added 17% to its value since hitting the $0.3060 50-day EMA level on Sunday. At press time, $STX is trading at $0.3781 and could rally higher in the near term.

$STX/USD 4H Chart">

$STX/USD 4H Chart">

If it extends its gains, $STX could surge towards the $0.413 resistance level for the first time since November 13. An extended bullish run would allow $STX to hit $0.50 for the first time since the October 10 deleveraging event.

The Relative Strength Index (RSI) on the 4-hour chart is at 83, suggesting heightened buying pressure. However, with the RSI in the overbought region, $STX could undergo a slight correction in the near term.

If that happens, $STX could retest the $0.3500 resistance-turned-support level, with the 50-day EMA at $0.3060 expected to be a strong support zone.