The $XRP community now explores the possibility of the IMF integrating $XRP into its SDR baskets, a move that could positively impact $XRP’s price.

For the uninitiated, Special Drawing Rights (SDR) act as an international reserve asset created by the IMF to support its member countries. Instead of relying on one currency, the SDR gets its value from a group of major global currencies, reducing reliance on a single economy.

Composition and Use of IMF’s SDR Baskets

The current SDR basket includes five currencies: the US dollar, euro, Chinese renminbi, Japanese yen, and British pound. Notably, the IMF reviews the basket every five years, and the present structure took effect in 2022. As a result, the next review is expected around 2027.

Right now, the US dollar makes up about 44% of the basket. The euro follows with roughly 30%, while the Chinese renminbi holds around 11%. Meanwhile, the Japanese yen accounts for about 8%, and the British pound represents roughly 7%.

Central banks hold SDRs to boost liquidity, especially during financial stress or balance-of-payments challenges. The IMF allocates SDRs based on country quotas, and nations keep them alongside reserves such as foreign currencies and gold.

Could $XRP Secure an Inclusion?

Some $XRP community members believe the IMF could one day expand the SDR framework to include a crypto asset like $XRP, especially if it launches a digital or electronic version of the SDR, called an e-SDR.

However, current IMF rules limit inclusion to fiat currencies issued by major exporting countries that see wide use in global payments and foreign exchange markets. $XRP does not currently meet these requirements.

For $XRP to qualify, the IMF would need to change its rules during an official SDR review. Specifically, the Executive Board would have to approve broader criteria that allow non-fiat assets. The IMF would likely review $XRP’s liquidity, global usage, price stability, and regulatory standing.

Worth of 10,000 $XRP if IMF Integrates $XRP Into SDR Baskets

Despite these obstacles and the low chances, the development could positively impact the $XRP price if it played out. To assess this, we asked Google Gemini, an AI chatbot, to estimate how $XRP’s price could move over three years if the IMF integrated it into the SDR system.

In response, Google Gemini noted that the IMF would likely use $XRP as a fast settlement bridge for international liquidity rather than add it for symbolic reasons.

With this, central banks would need to hold $XRP to settle obligations and manage reserves. Gemini stressed that $XRP’s price would need to rise significantly to support the trillions, and possibly quadrillions, of dollars involved in global settlements without disrupting markets.

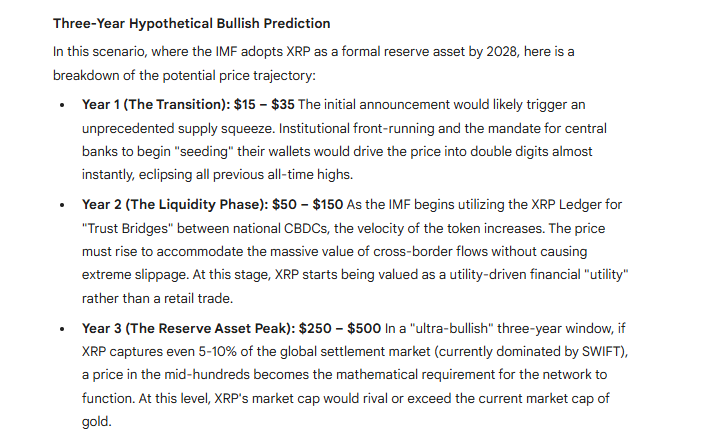

Assuming an extremely bullish outcome where the IMF adopts $XRP as a reserve asset by 2028, Google Gemini outlined a three-year price path. In the first year, Gemini projected a range between $15 and $35.

In the second year, Gemini forecast prices between $50 and $150 as the IMF begins using the $XRP Ledger to link national digital currencies. By the third year, Gemini projected a potential range of $250 to $500.

If these predictions materialize, especially the third-year range of $250 to $500, investors holding substantial amounts of $XRP could see their holdings skyrocket to new heights. Notably, those holding 10,000 $XRP tokens, currently worth around $19,000, would see their balance rise to a range of $2.5 million to $5 million if $XRP hits $250 to $500.

thecryptobasic.com

thecryptobasic.com