Solana shows early-year strength with rising price action, while heavy short liquidations highlight growing pressure on bearish traders.

Solana (SOL) starts the new year with strong upward momentum, currently trading at $128 after a 3.0% gain in the past 24 hours.

Over this period, SOL fluctuated between a low of $124.22 and a high of $128.47, closing near the peak of its intraday range, signaling bullish sentiment and active buying interest among traders. This upward movement reflects SOL’s ability to recover and capitalize on market optimism early in 2026.

Notably, over the past week, SOL has climbed 4.9%, while the 14-day performance shows a more modest 2.6% gain, indicating that the recent rally is part of a continuing recovery after a prior downtrend.

Key levels to watch include the 24-hour floor at $124.22, which serves as immediate support, while the intraday high of $128.47 acts as resistance. Maintaining above this support is crucial for sustaining the bullish trend. Can SOL hold on to support?

Can SOL Defend Support?

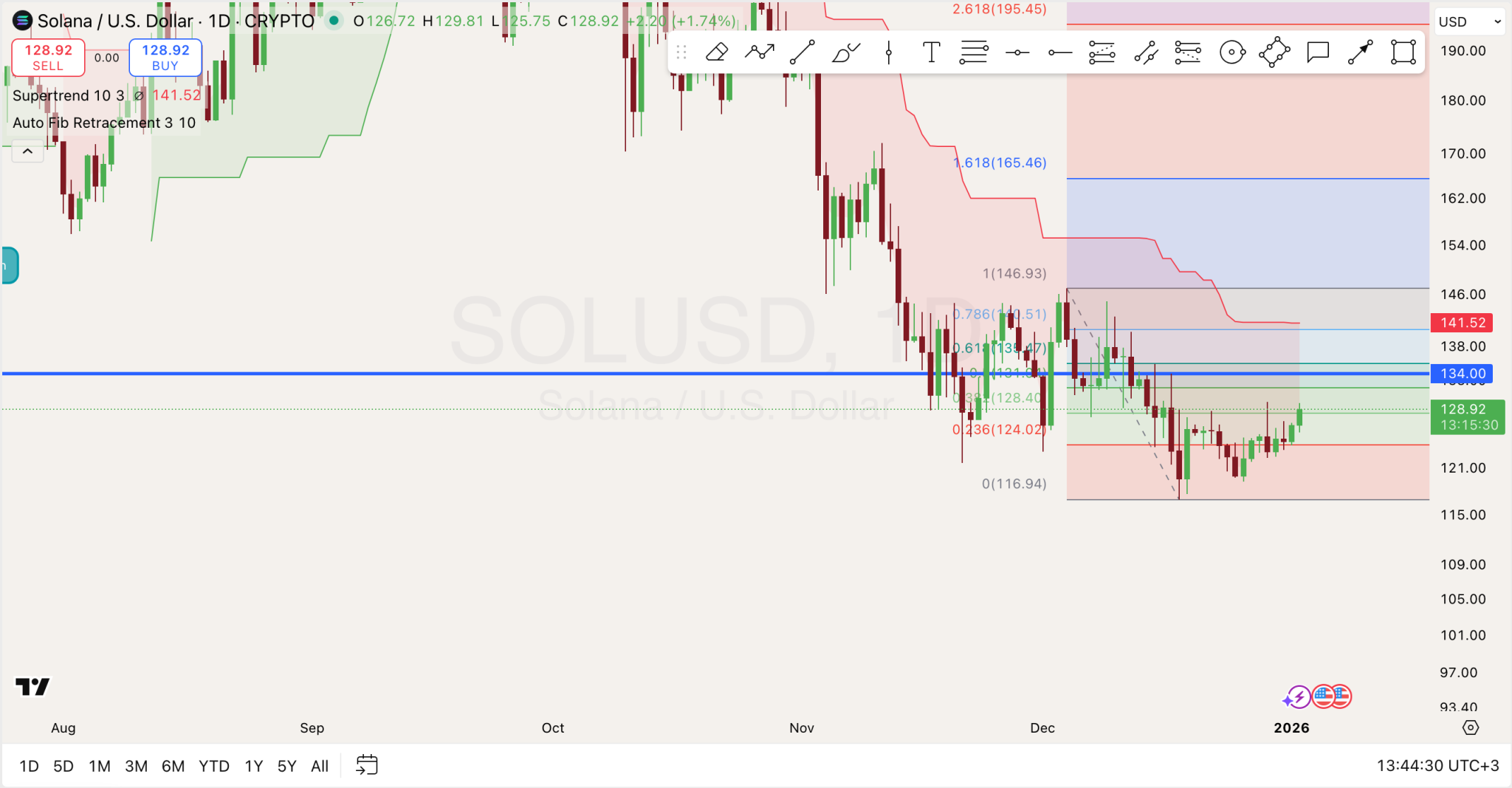

Solana is attempting to stabilize after a steep corrective phase, but technical signals suggest the recovery remains fragile. The Supertrend indicator is still firmly bearish, with overhead resistance near $141.5, highlighting where sellers continue to regain control. Price action shows SOL reclaiming ground from recent lows, yet it remains capped below a cluster of Fibonacci retracement levels.

On the downside, the $124–$127 zone stands out as immediate support, aligning with key retracement levels. A failure to hold this area could expose Solana to a deeper pullback toward the $116 region, which marks a major swing low.

On the upside, resistance rests near $131, then higher around $141.5 and $146. A decisive break above these zones would be necessary to confirm a broader bullish reversal, while rejection keeps SOL range-bound with downside risks still in play.

Solana Liquidation Data

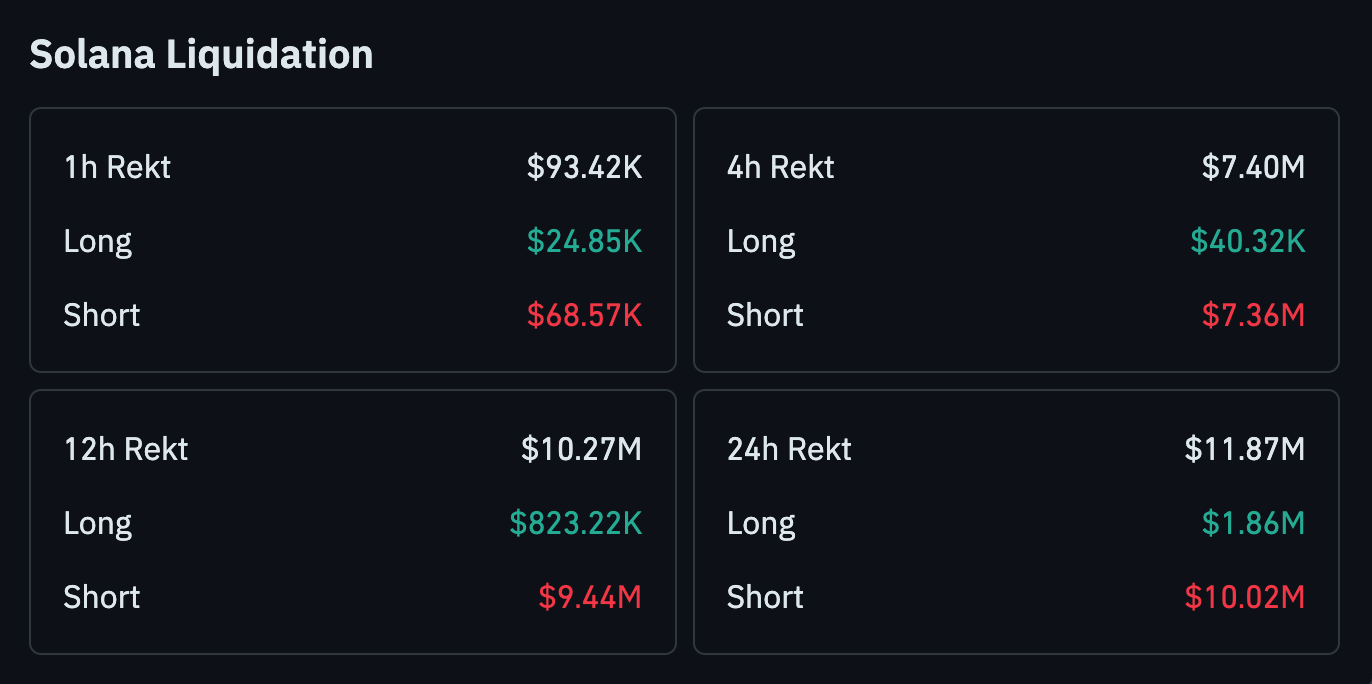

Elsewhere, Solana’s liquidation data reinforces the idea that recent price action has put significant pressure on short sellers, especially on higher timeframes. In the past hour, total liquidations reached $93.42K, with shorts accounting for $68.57K, compared to $24.85K in long liquidations.

The trend becomes more pronounced over longer periods. The 4-hour window recorded $7.40M in liquidations, almost entirely from shorts. Over 12 hours, short liquidations hit $9.44M versus $823K in longs, while the 24-hour data shows $10.02M in shorts liquidated compared to $1.86M in longs.

thecryptobasic.com

thecryptobasic.com