XRP trades near $1.86, down about 2% in the past 24 hours and almost 15% in a month. The XRP price is still trapped inside a bearish channel that carries a 41% breakdown risk if key levels fail.

What makes this setup unusual is that multiple buyer groups are finally stepping in. Long-term holders are buying again, short-term holders are adding, yet one group isn’t convinced. That clash explains why the chart still leans bearish.

Long-Term Holders Return While the Bearish Channel Remains

The XRP price has been trading inside a descending channel since early October. Every bounce has failed near the upper trendline. The pattern projects a potential 41% drop from the breakdown point. And while XRP now trades closer to the upper trendline, some on-chain support seems to be showing up.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

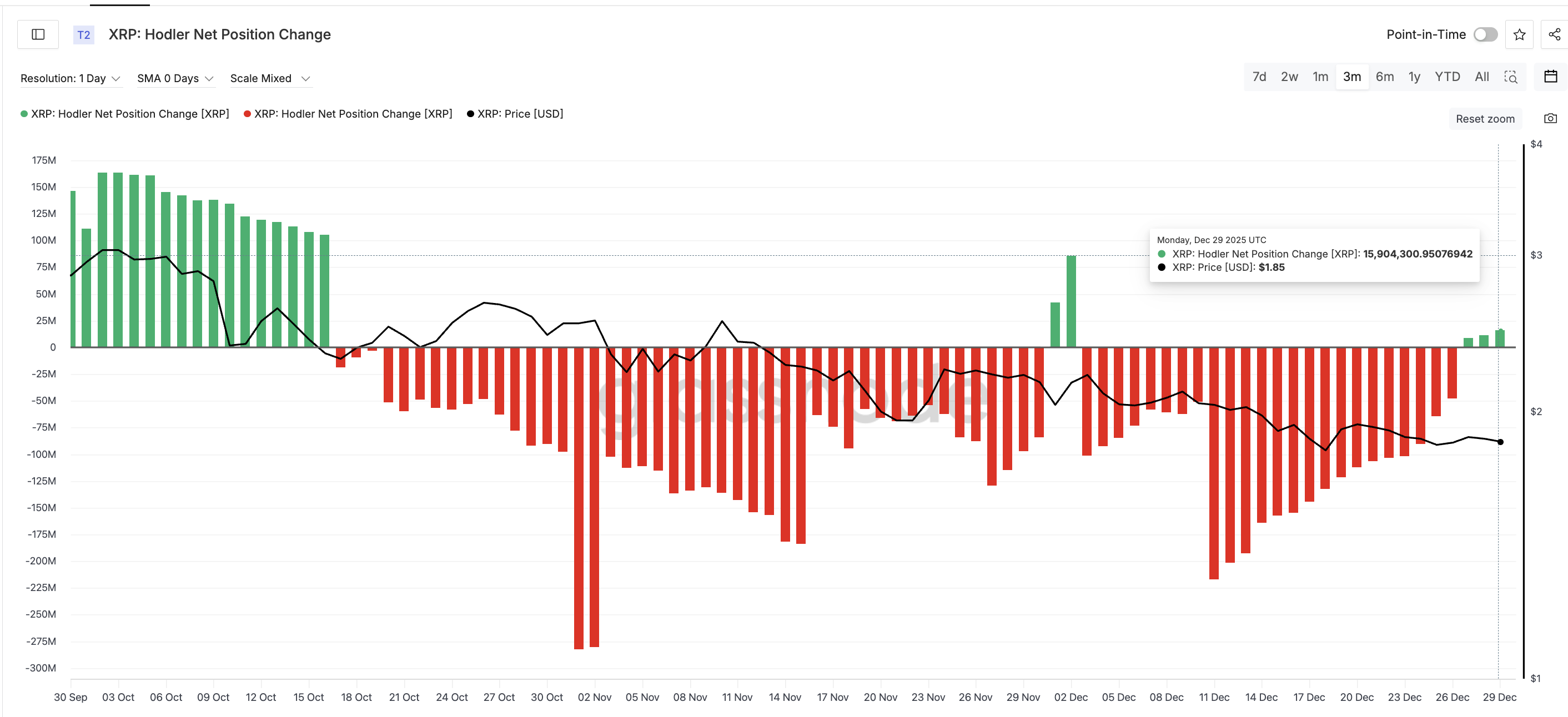

Long-term holders have finally changed their behavior, as seen via the Hodler net position change metric.

After almost three straight weeks of net selling, December flipped the trend. Between December 3 and December 26, the XRP hodler metric saw a negative net position change every single day. That shifted on December 27, when long-term holders added 9.03 million XRP. The next jump came on December 29, when acquisitions reached 15.90 million XRP. Buying has surged almost 76% in 48 hours.

That level of buying has helped XRP remain near the upper trendline of the falling channel, but it has not broken the channel to the upside.

Short-Term Buyers Join In — But Whales Start Selling Again

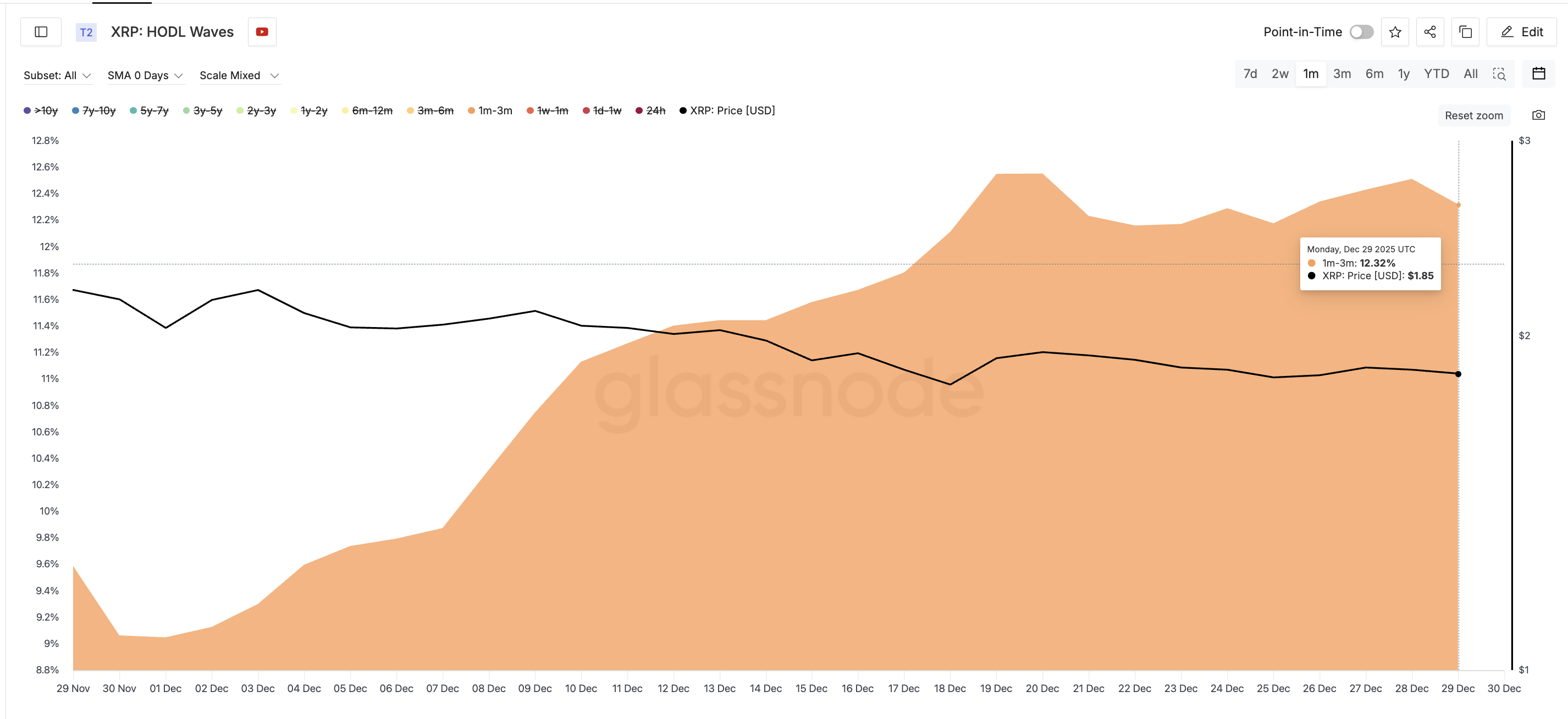

Short-term holders (1–3 months) have expanded from 9.58% of supply on November 29 to 12.32% on December 29, as seen via the HODL Waves metric. HODL Waves metric typically segregates cohorts by age.

This group typically drives rapid upside moves, but it is also the first to exit amid volatility. Their buying is a double-edged sword: it helps limit breakdowns, but it also creates exit pressure if rallies stay weak.

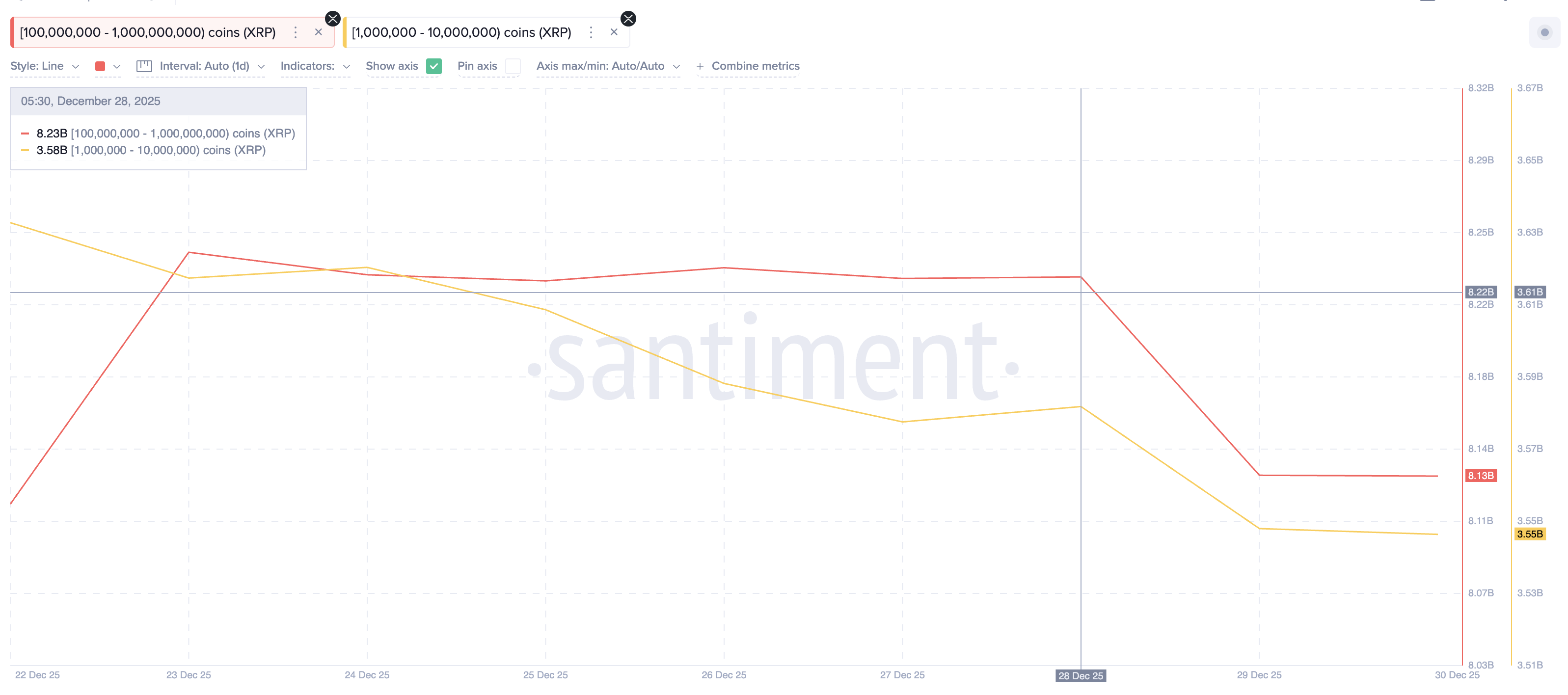

Whales are moving the other way, probably after seeing a sizable pickup by the short-term holders amid a weakening price pattern.

The 100 million –1 billion XRP cohort dropped holdings from 8.23 billion to 8.13 billion on December 28, a reduction of 100 million XRP, almost $186 million sold.

The 1million –10 million XRP cohort fell from 3.58 billion to 3.55 billion, a reduction of 30 million XRP, equivalent to approximately $55 million in sell-side pressure.

XRP">

XRP">

Whale exits against two layers of holder inflows create friction. It blocks every attempt at a clean breakout and explains why the price keeps returning to the mid-range instead of challenging resistance. If short-term holders sell into any bounce, whales trimming positions can accelerate the downside.

XRP Price Levels That Decide The Next Leg

The market sits at a crossroads. The XRP price remains within the channel. It needs to hold above $1.79 to avoid an early breakdown. Sustaining above that level while long-term holders continue to buy could send the price toward $1.98. A daily close above $1.98 would neutralize the bearish structure and open a path back to $2.28, where bullish momentum returns.

But the danger is clear.

XRP Price Analysis">

XRP Price Analysis">

If $1.79 fails, the next XRP price supports are $1.64 and $1.48. Losing $1.48 breaks the channel and exposes the 41% risk toward $1.27 and even lower.

Right now, broad holder buying has not flipped the structure. It has only slowed the breakdown. For the narrative to change, whales need to return. Until then, every bounce inside the channel carries exit pressure.

The post Why XRP Price Faces a 41% Crash Risk Despite Broad Holder Buying? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com