Standard Chartered has released one of the most bullish XRP forecasts from a major global bank.

The firm is projecting a dramatic price surge for XRP, supported by regulatory clarity and the rise of spot XRP ETFs. According to the bank, XRP could be heading for a multi-year rally as legal uncertainty fades and institutional exposure expands.

Standard Chartered Sees 332% Upside for XRP

In particular, Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, has outlined a price target of $8 for XRP by 2026. At XRP’s current price of around $1.85, this forecast implies a potential upside of 332%.

A key driver behind the bullish outlook is the conclusion of the long-running legal battle between Ripple and the U.S. SEC.

The case, which began in December 2020, centered on whether XRP should be classified as a security. Ripple maintained that XRP functions as a digital currency for fast, low-cost cross-border payments.

Why the Ripple–SEC Case Was a Turning Point

In July 2023, a U.S. court ruled that XRP’s programmatic sales on exchanges did not qualify as securities transactions. Meanwhile, sales to institutional investors were found to violate securities laws. The court ordered Ripple to pay a fine of $125 million in August 2024, delivering the final judgment in the case.

However, the SEC and Ripple later entered into appeal and cross-appeal proceedings. Fast forward to August 2025, the legal saga officially came to an end following a change of government in the U.S. and the appointment of a new SEC chair.

As a result, the SEC and Ripple dropped their appeals, removing a major overhang that had weighed on XRP for years. While XRP’s price has not surged dramatically since then, many believe a major rally is coming, particularly after the Clarity Act passes next year.

Spot XRP ETFs Gain Rapid Traction

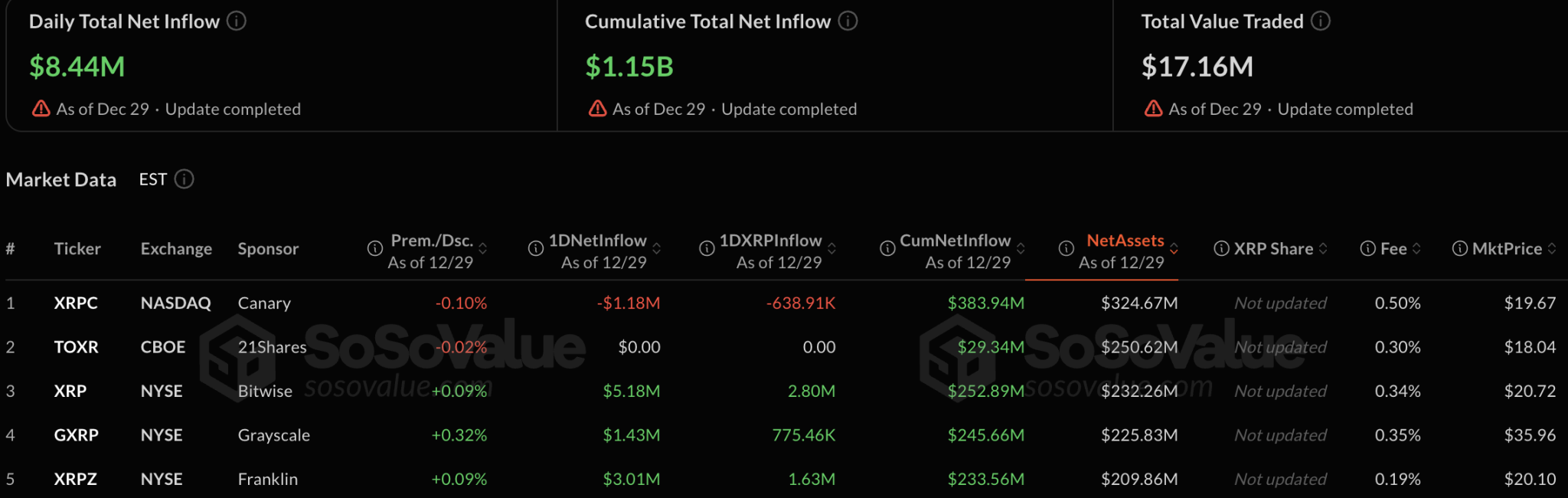

Meanwhile, after the legal dispute ended, spot XRP ETFs quickly entered the U.S. market. Asset managers such as Canary, Franklin Templeton, 21Shares, Grayscale, and Bitwise launched XRP products, giving institutional investors regulated exposure to the token.

Data from on-chain analytics platform SoSoValue shows that spot XRP ETFs have recorded $1.15 billion in net inflows as of December 29. In the latest market activity, these ETFs recorded $8.44 million in new investment.

Meanwhile, total assets under management for XRP ETFs have reached $1.24 billion, which some industry leaders believe is just the beginning, saying momentum in 2026 could be far more explosive.

XRP Price Outlook Heading Into 2026

Standard Chartered believes regulatory clarity and growing ETF adoption have fundamentally improved XRP’s long-term outlook.

With XRP increasingly viewed as a financial asset rather than a legal risk, the bank expects institutional participation to support higher valuations over time.

If Kendrick’s forecast plays out, XRP’s move toward $8 by 2026 would give the asset a valuation of nearly half a trillion dollars.

This outlook would put XRP on a path toward breaking into double-digit price levels. In particular, the bank believes XRP could reach $10.5 by 2027. Looking further ahead, it suggests XRP could climb to $12.5 by 2028.

thecryptobasic.com

thecryptobasic.com