XRP price has remained under pressure over the past several weeks, with multiple recovery attempts failing to gain traction. As 2025 comes to an end, the altcoin continues to succumb to bearish momentum after recording a mildly negative year overall.

Weak spot demand and cautious retail participation have weighed on price action. However, institutional interest has emerged as XRP’s primary stabilizing force, preventing deeper drawdowns despite persistent selling.

XRP Is Institutions’ Favorite

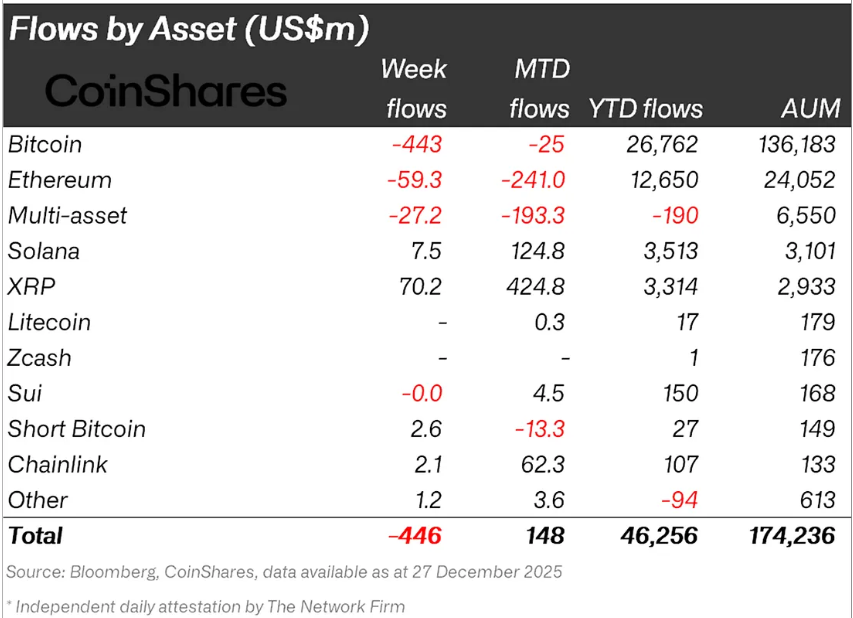

Institutional investors have been XRP’s most consistent supporters throughout 2025. According to CoinShares data, XRP recorded $70 million in inflows during the week ending December 27. This pushed month-to-date inflows to $424 million, highlighting steady capital allocation even during periods of declining prices.

Notably, XRP outperformed larger digital assets during the same period. Bitcoin recorded $25 million in outflows, while Ethereum saw significantly higher outflows totaling $241 million.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Institutional Holding. ">

XRP Institutional Holding. ">

On a yearly basis, XRP attracted $3.3 billion in inflows, highlighting sustained institutional confidence despite ongoing volatility and legal uncertainties surrounding the broader crypto market.

XRP ETFs Show Strength

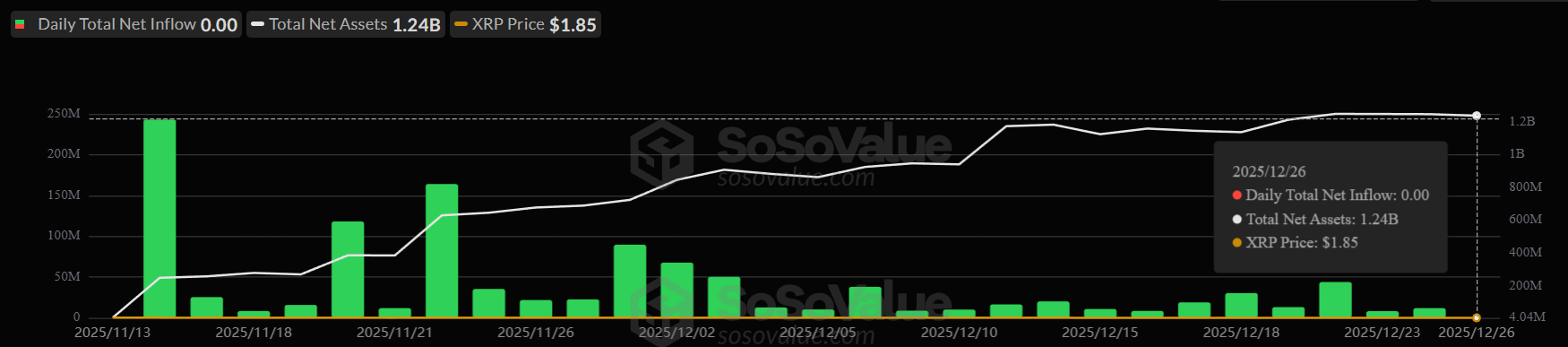

Institutional support has extended beyond traditional exchange-traded products following the launch of XRP ETFs earlier this year. Since their debut, XRP ETFs have not recorded a single day of net outflows. Only one trading session closed flat, without inflows, reflecting unusually strong consistency in demand.

XRP ETF Inflow">

XRP ETF Inflow">

Speaking exclusively to BeInCrypto, Ray Youssef, CEO of crypto app NoOnes, emphasized that institutional investors are executing structured, long-term strategies.

“XRP’s early December accumulation was a strategic positioning by market participants to catch the ETF momentum upside. As with early Bitcoin and Ethereum ETF launch cycles, institutional investors often accumulate assets before their prices begin to reflect these developments,” Youssef noted.

He further stated that XRP is now observed as a high beta asset with a strong value proposition.

“[This] is thanks to the increased participation of institutional players in the asset’s trading, which is further mainstreaming the asset. Despite the prevailing price weakness, traders still consider the current price points as suitable entry opportunities to capture growth potential once XRP’s performance finally reflects the ETF’s momentum,” stated Youssef.

The XRP Holders Who Refuse To Hold

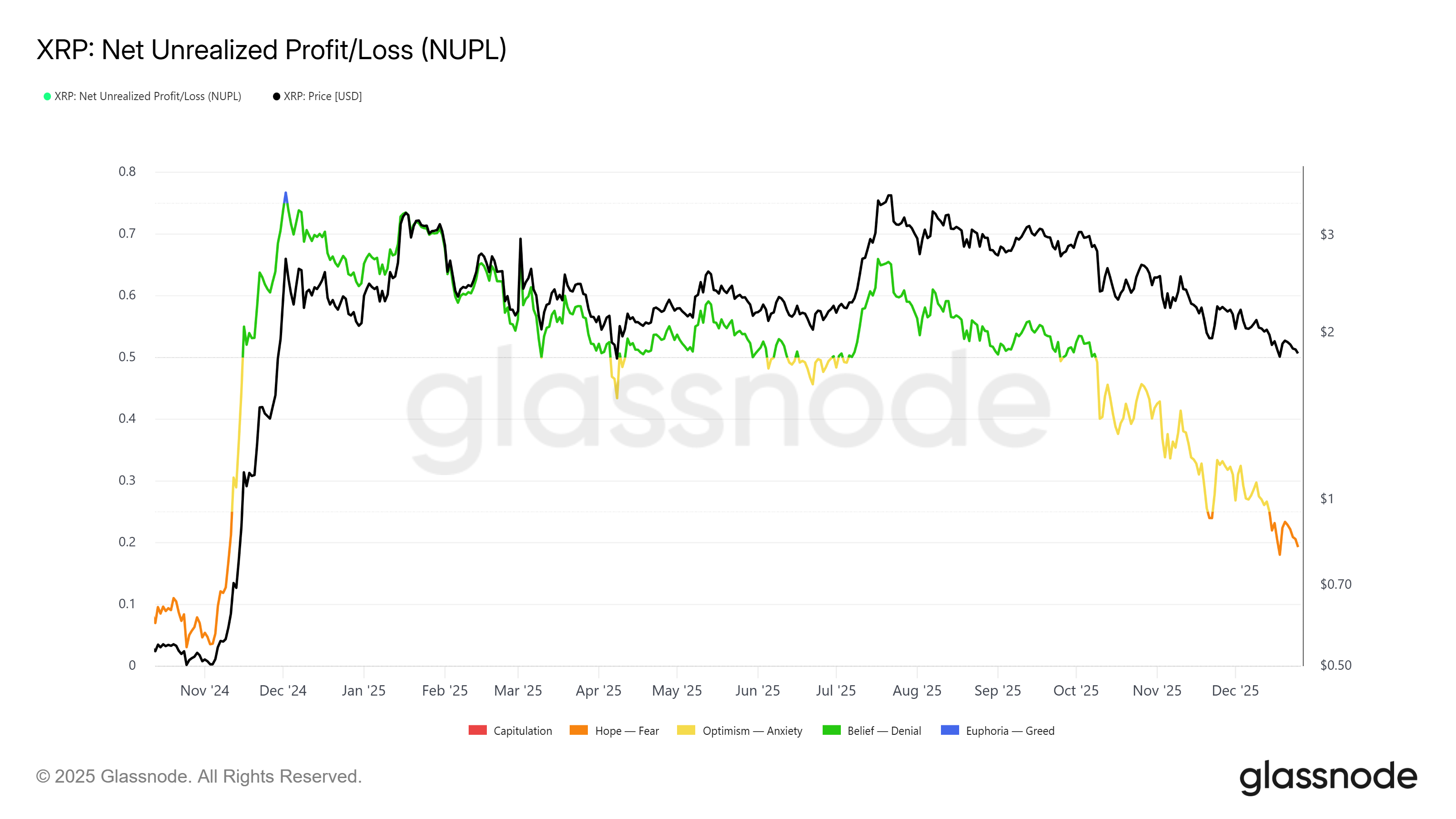

Long-term holders remain a critical cohort heading into 2026. Historically, this group has played a stabilizing role during market downturns. Over the past year, long-term holders alternated between accumulation and distribution, reflecting uncertainty around XRP’s medium-term prospects.

XRP NUPL">

XRP NUPL">

By Q4 2025, selling activity dominated long-term holder behavior. This shift suggests declining confidence among investors who typically hold through volatility. If this lack of conviction persists into 2026, XRP could face heightened downside risk. Sustained distribution from long-term holders often precedes extended consolidation or deeper corrections.

XRP Price May See a Mild Start To 2026

XRP price traded near $1.87 at the time of writing after suffering a 38% decline during Q4 2025. Year-to-date performance shows the altcoin down 9.7% from its opening price. December failed to generate positive momentum, reinforcing bearish sentiment as the year closed.

Despite this, 2026 may chart an independent course. Ray Youssef noted that January, and potentially the entire first quarter, could remain largely stagnant for XRP.

“XRP will likely continue to consolidate and trade between $2 and $2.50 in January and Q1 2026, unless a decisive macro catalyst emerges. The market has yet to recover from persistent volatility and geopolitical disruptions caused by the strained trade relations. The numerous deleveraging and risk-off episodes have made traders hesitant to increase directional exposure until the market headwinds have entirely dissipated,” Youssef highlighted.

The broader objective remains recovery of recent losses. A sustained move above $3.00 would be required to reestablish bullish structure and open a path toward the $3.66 all-time high.

Downside scenarios remain relevant if selling pressure intensifies. Continued consolidation combined with reduced demand could push XRP lower. A decisive break below the $1.79 support level would likely expose the $1.50 zone. Such a move would invalidate the bullish-neutral thesis and reinforce bearish dominance.

ETH Price Analysis. ">

ETH Price Analysis. ">

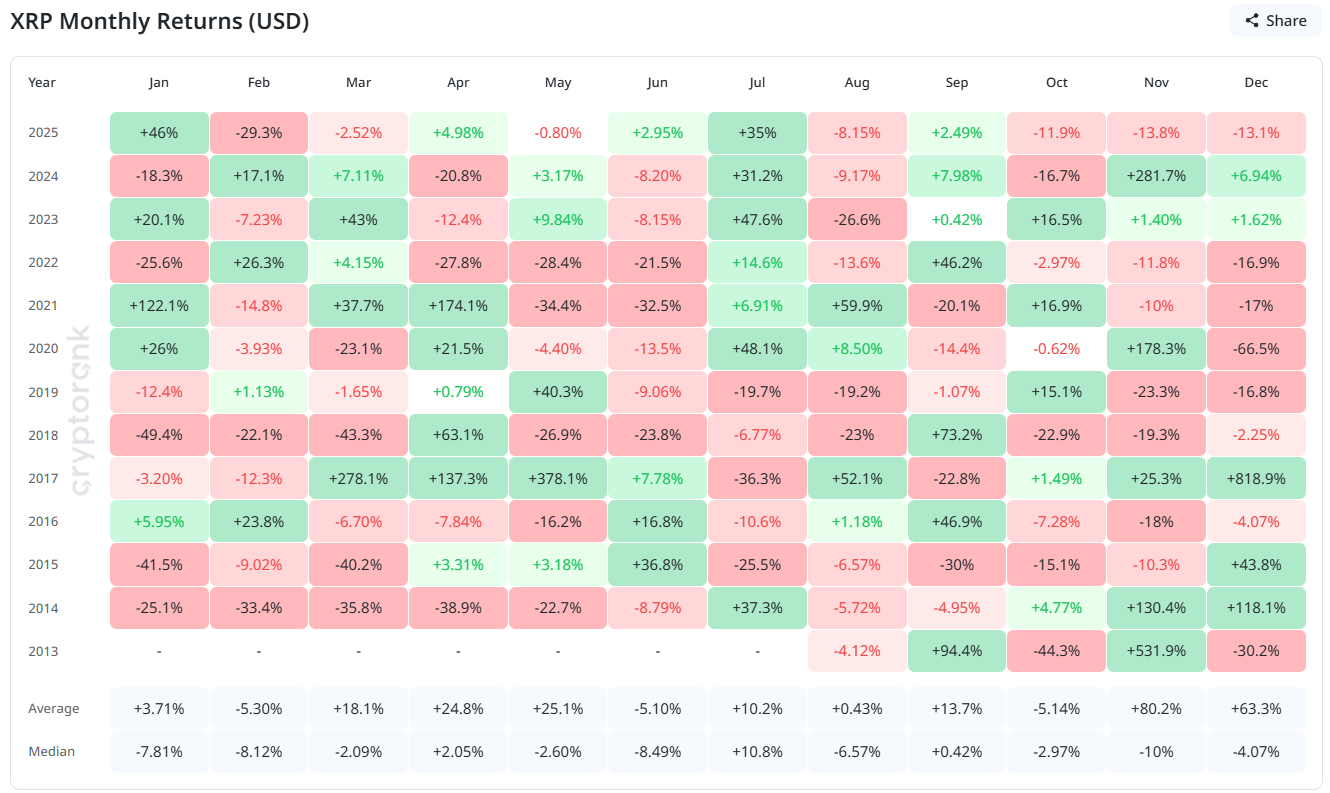

Seasonality adds another layer of caution.

“XRP underperformed in December due to the broader market’s structural weakness. Liquidity contraction, weak risk appetite, and the AI bubble scare sell-off, which spilled into high-risk assets and the entire digital asset market, curtailed the effects of the expected seasonal tailwinds. The crypto market saw one of its worst Q4 performances in almost 7 years,” Youssef further noted.

Historical XRP performance over the past 12 years shows that January delivers an average gain of 3%. However, the median return reflects a 7.8% decline, indicating frequent underperformance.

XRP Monthly Returns. ">

XRP Monthly Returns. ">

Thus, unless market sentiment and investor behavior shift significantly, XRP price prediction suggests that the price may struggle during the early months of 2026 before clearer directional trends emerge.

beincrypto.com

beincrypto.com