- Polkadot price risks falling to $1.70 or lower amid bearish pressure.

- Broader market weakness gives bears the advantage.

- Technical indicators are also largely bearish.

Polkadot is among the altcoins to trade in the red on Monday as current market weakness continues to hinder bulls.

$DOT, the blockchain interoperability protocol’s native token, was at $1.83 and down 2% in the past 24 hours.

With the broader market experiencing volatility amid macroeconomic pressures, $DOT’s performance has been underwhelming.

Market weakness hinders $DOT near 1.90

Polkadot’s recent attempts to break above $1.90 have been thwarted by pervasive market weakness.

The token has suffered downward action amid a bearish undercurrent across the crypto space.

After briefly peaking near this level, $DOT encountered stiff resistance. Price dropped to $1.83.

Bulls risk giving up further ground as uncertainty brings low trading volumes and waning buyer interest.

While price is 1.5% up this past week, it’s down 18% in 30 days and 74% down in the past year.

Short-term negatives like the disruption seen on Sunday are worth watching too.

Staking rewards on Polkadot follow a ~24-hour cycle called an "Era," usually split between ~22K nominators.

Yesterday, in Era #2035, an issue with an off-chain election tool limited the nominator set to just 3K, leading to higher individual payouts for those included. The issue…

— Polkadot (@Polkadot) December 29, 2025

Polkadot price forecast

Currently trading at $1.85, the token has struggled to regain momentum from its earlier highs.

$DOT’s muted price action reflects overall investor caution in the market.

Bitcoin and Ethereum face key resistance levels near $90,000 and $3,000 respectively. Meanwhile, XRP, Solana, and BNB have also pared gains as profit taking and end of year reset takes shape.

Technical indicators, network developments, and market sentiment will all offer tailwinds or be potential headwinds in coming the months.

As such, $DOT could see modest gains in the short term, potentially reaching $2.00 and $2.25.

More optimistic forecasts suggest a rebound to above $4.00. However, this might be a bit ambitious for bulls in the short term given, the token’s recent downtrend.

Polkadot price fell from highs above $10 in January this year.

Year-to-date, bulls have failed to hold onto gains above $6.00 and above $4.50. The dip to below $2.00 has only added to the bearish strength currently dominating the altcoin.

A further decline is a possibility if bearish trends persist.

The technical outlook

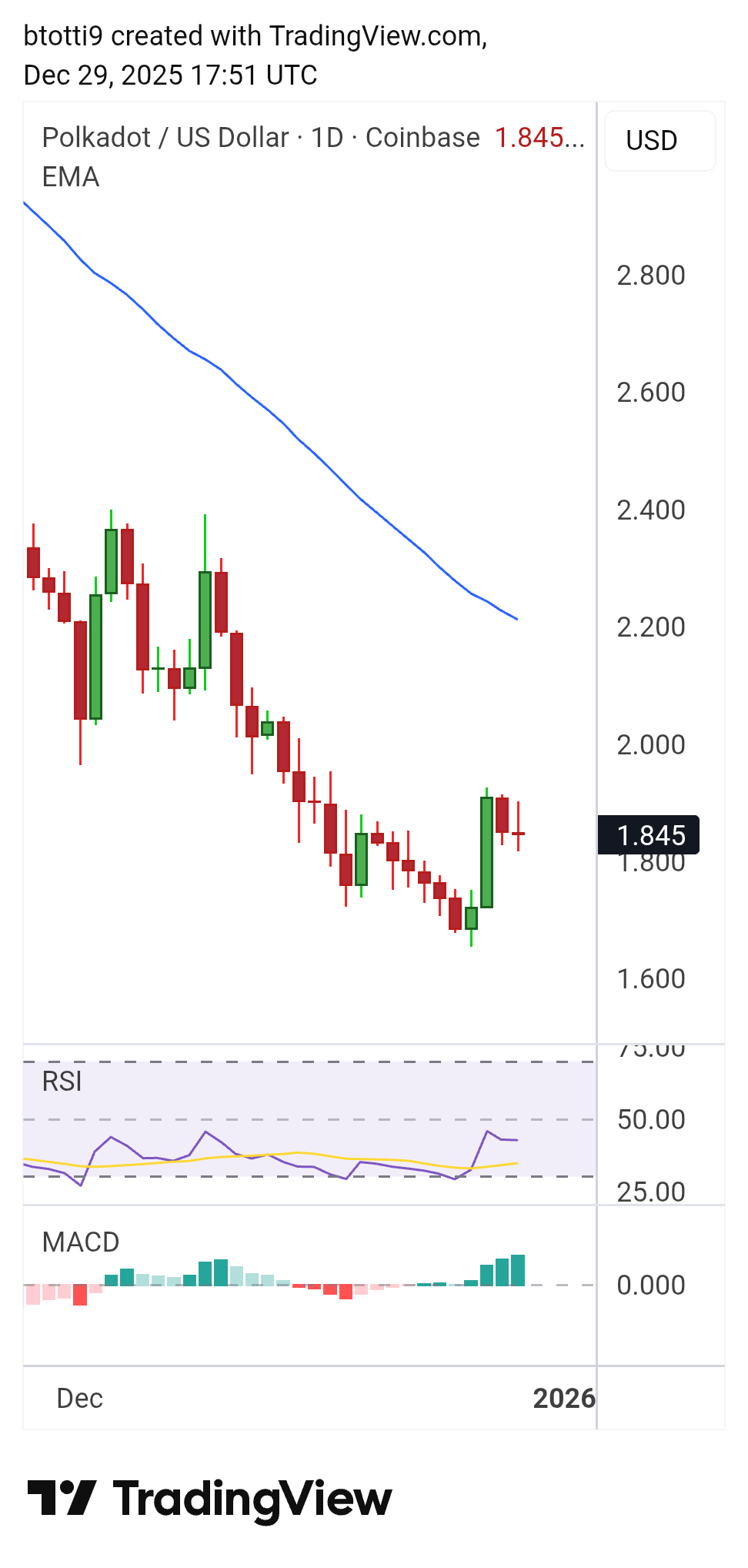

The 50-day exponential moving average is declining, signaling short-term weakness.

Meanwhile, the Relative Strength Index (RSI) hovers below 50. This hints at potential downside continuation. Exhaustion if the metric hits oversold territory will signal reversal.

The moving average convergence divergence indicator, however, hints at bullish resilience.

Short-term, sideways trading below $1.80 is likely.

But any fresh bleeding will not only limit a potential breakout, but also allow sellers to target $1.70 or lower.

Key factors likely to influence these forecasts include Polkadot’s parachain auctions, governance improvements, and macroeconomic conditions.