A long-time Bitcoin trader has argued that the evolution of XRP is deliberately structured to push retail investors out over time.

AltcoinFox, a veteran Bitcoin trader, took to X to warn that XRP’s future is not built around retail speculation. In his view, the design and direction of XRP point toward a system where everyday investors eventually lose access.

“The evolution of XRP is defined to ensure retail is priced out, AltcoinFox wrote, adding, “You will be priced out.”

His statement adds to a growing body of commentary suggesting that XRP’s endgame centers on institutional finance rather than mass retail ownership.

The XRP ‘Priced Out’ Narrative Has Been Years in the Making

AltcoinFox’s warning is not new. Similar views have surfaced repeatedly over the past two years, long before XRP climbed above the $2 level.

Back in July 2023, treasury management expert Shannon Thorp argued that XRP could not remain cheap indefinitely. She explained that retail investors make up only a tiny fraction of the XRP ecosystem and would have little influence once banks, corporations, and central institutions begin using the asset at scale.

In other words, when institutional money enters, retail becomes irrelevant.

Wallet Data Shows Retail Is Already Falling Behind

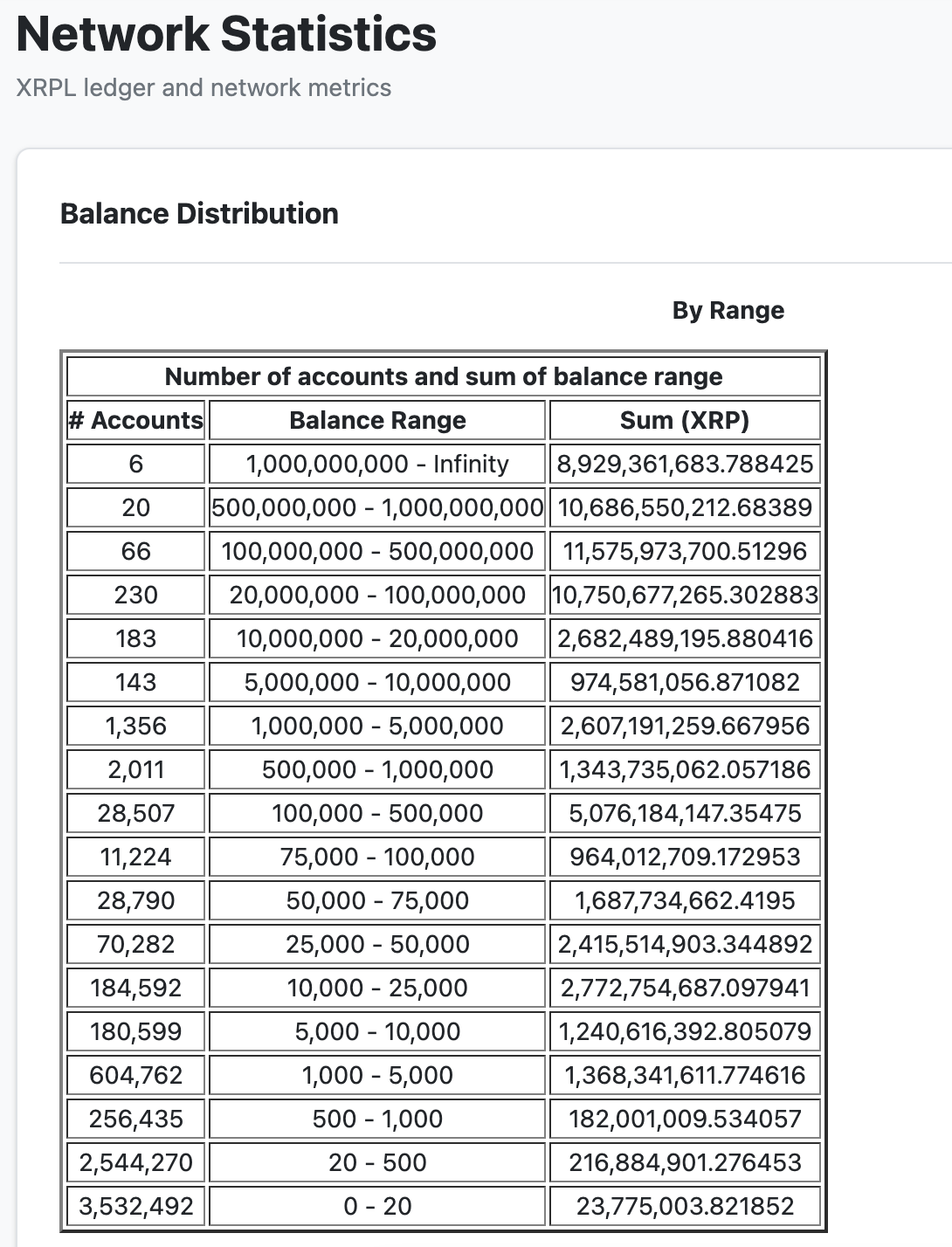

As of today, that theory is now showing up in the numbers. XRP commentators highlighted that most holders control very small balances.

Data from the XRP Rich List shows that more than 6 million XRP wallets hold 500 XRP or fewer. At the same time, acquiring 1,000 XRP is already out of reach for most participants, as it now costs about $2,000, compared to $500 just over a year ago.

Accordingly, Vandell Aljarrah, co-founder of Black Swan Capitalist, has emphasized that many people are being priced out without realizing it. With over half of Americans holding less than $5,000 in savings, even modest XRP accumulation is becoming difficult as prices rise.

He argued that by the time broader awareness arrives, meaningful exposure will already be financially impossible for most.

From Speculation to Infrastructure

Notably, supporters of the “priced out” thesis believe the shift is intentional. XRP supporters see it not as a speculative asset, but as part of financial infrastructure.

Ripple is building a large network for institutions, offering global payment systems, custody services, and XRP Ledger-based settlement tools. This suggests XRP is for big liquidity flows, not casual trading.

Analyst Pumpius even argued that XRP’s role in global settlements, tokenized real-world assets, and cross-border finance makes comparing its market cap to other coins pointless. In this view, XRP’s price depends on liquidity access, not hype.

Essentially, XRP proponents argue that rather than focusing on how high XRP’s price might go in the next bull run, the question is who will still be able to buy in once institutional demand takes over.

On the other hand, skeptics argue that these ideas are just theories, and that XRP’s price will still be driven largely by general market speculation.

Worst thing about XRP not moving is y'all speaking on it, y'all jinxing the sgit

— GeraldEls (@GeraldEltz) December 27, 2025

thecryptobasic.com

thecryptobasic.com