In 2025, real-world assets (RWAs) tokenized on a blockchain moved from being a mere concept to something institutions and corporations actively adopted, anticipating the next big thing to emerge in the space.

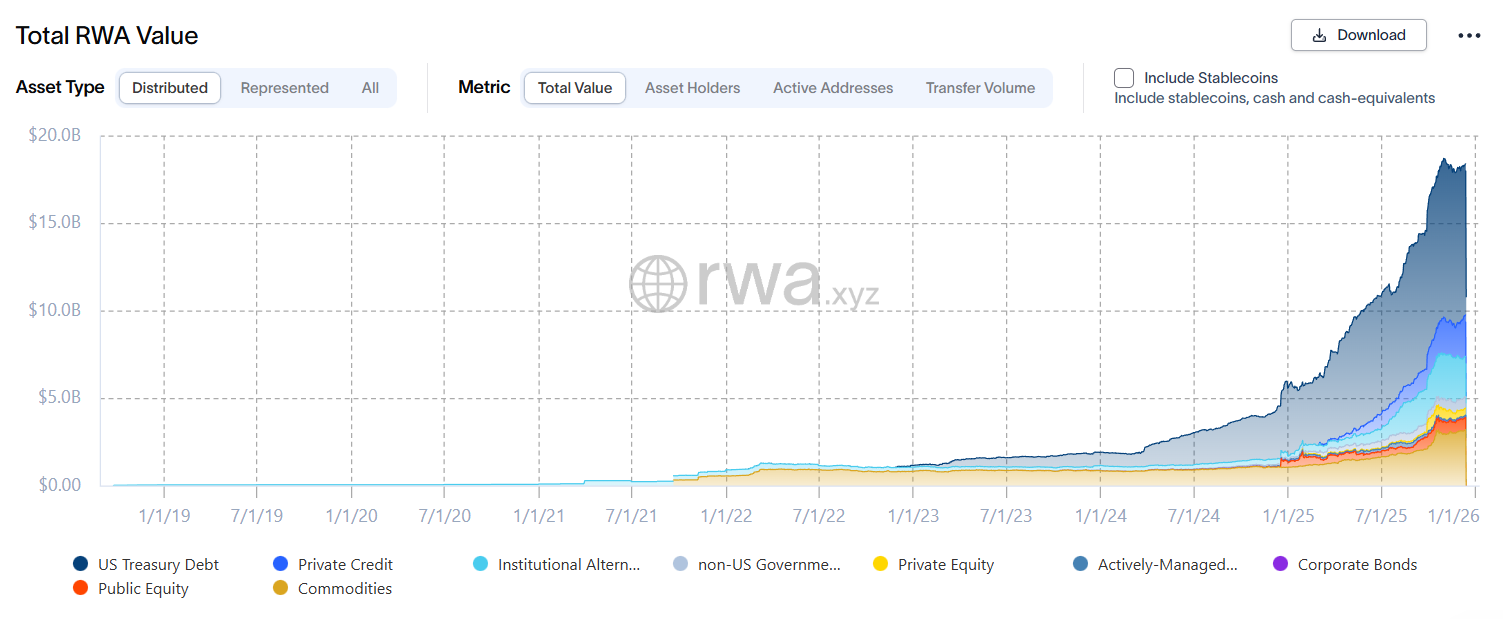

In early 2025, on-chain tokenized RWAs totaled around $5.5 billion, but quickly tripled to roughly $18.6 billion over the course of the year, according to RWA.xyz data. Analysts now project the market could reach about $2 trillion by 2030.

“In a bullish scenario, this value could double to around $4 trillion, but we are less optimistic than previously published estimates as we approach the middle of the decade,” McKinsey analysts wrote in June 2024.

A real-world asset (RWA) is a tangible asset from outside the blockchain ecosystem — like real estate, bonds, invoices or art — that’s been tokenized so it can be bought, sold or used on-chain.

Tokenizing RWAs brings fractional ownership and faster settlement than traditional markets, but still relies on legal contracts and trusted off-chain data to prove the token represents the real asset.

Before diving into the topic, it’s worth noting that RWA.xyz, whose data we’ll use in the article, changed its methodology in 2025. As of press time, assets that can be transferred between user wallets are counted as “distributed,” while platform-locked tokens are classified as “represented.”

This affects comparisons of market size with earlier data. For this article, we track statistics only related to distributed assets because these actually circulate on blockchains, unlike platform-locked tokens, which remain isolated in private systems.

Where It All Began

TZERO and a few others pioneered tokenization when the space was still in its infancy, experimenting with blockchain-based securities.

Later on, in 2021, Franklin Templeton debuted its money-market fund BENJI on the Stellar network and amassed hundreds of millions in tokens, having allocated around $800 million as of press time.

But the sector really took off after BlackRock launched its BUIDL fund through Securitize on Ethereum in March 2024, growing from $40 million at launch to over $1.8 billion on-chain by late 2025.

That product helped establish the tokenized U.S. Treasury category and gave larger asset managers confidence to deploy similar offerings. Later on, BUIDL’s offerings were expanded to include other networks too, like BNB Chain, Aptos and many others. Other firms like WisdomTree, Ondo and Centrifuge also joined the fray.

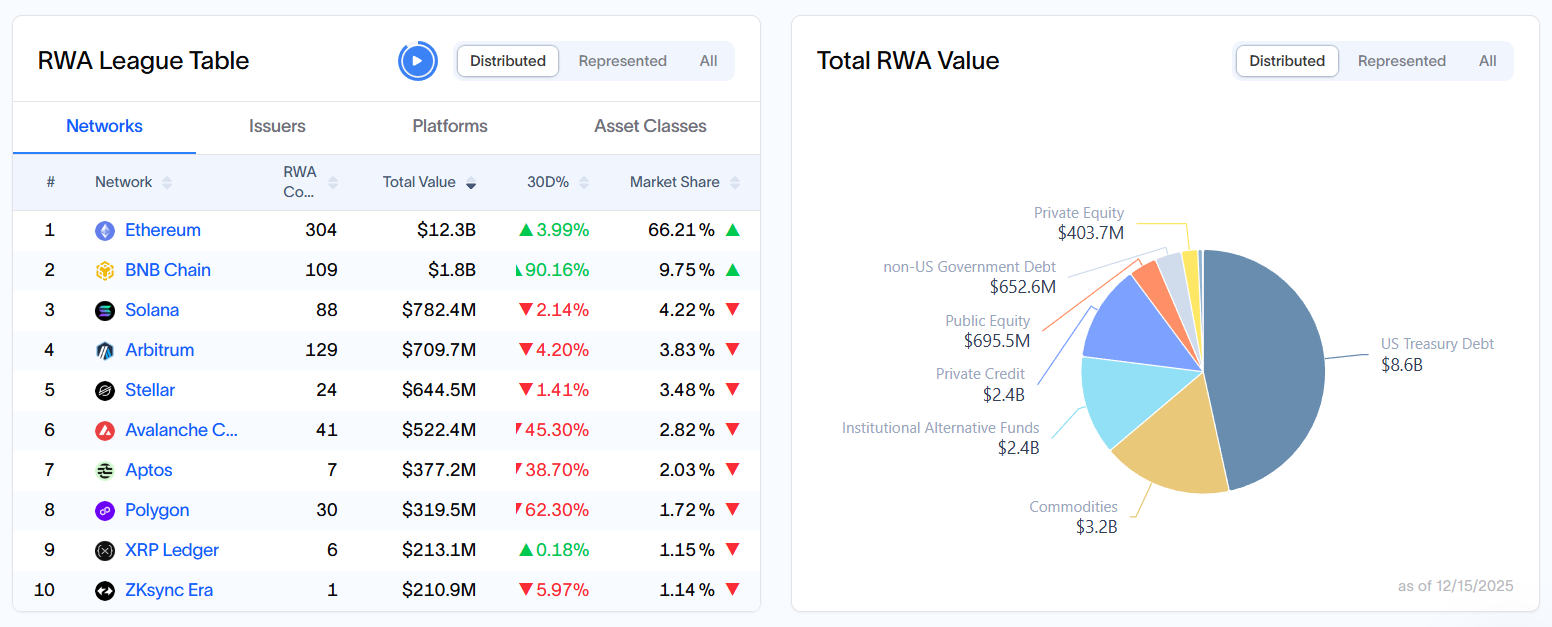

U.S. Treasury debt remained the largest segment for much of the year. Data from RWA.xyz shows that private credit accounted for around $8.6 billion of the on-chain RWA total as of December, followed by commodities, institutional alternative funds, and private credit.

Wall Street firms are increasingly piloting in this space, too. As The Defiant reported earlier, J.P. Morgan Asset Management revealed on Monday, Dec. 15, that it had launched its first tokenized money market fund on Ethereum, marking another step toward moving traditional financial products onto public blockchains.

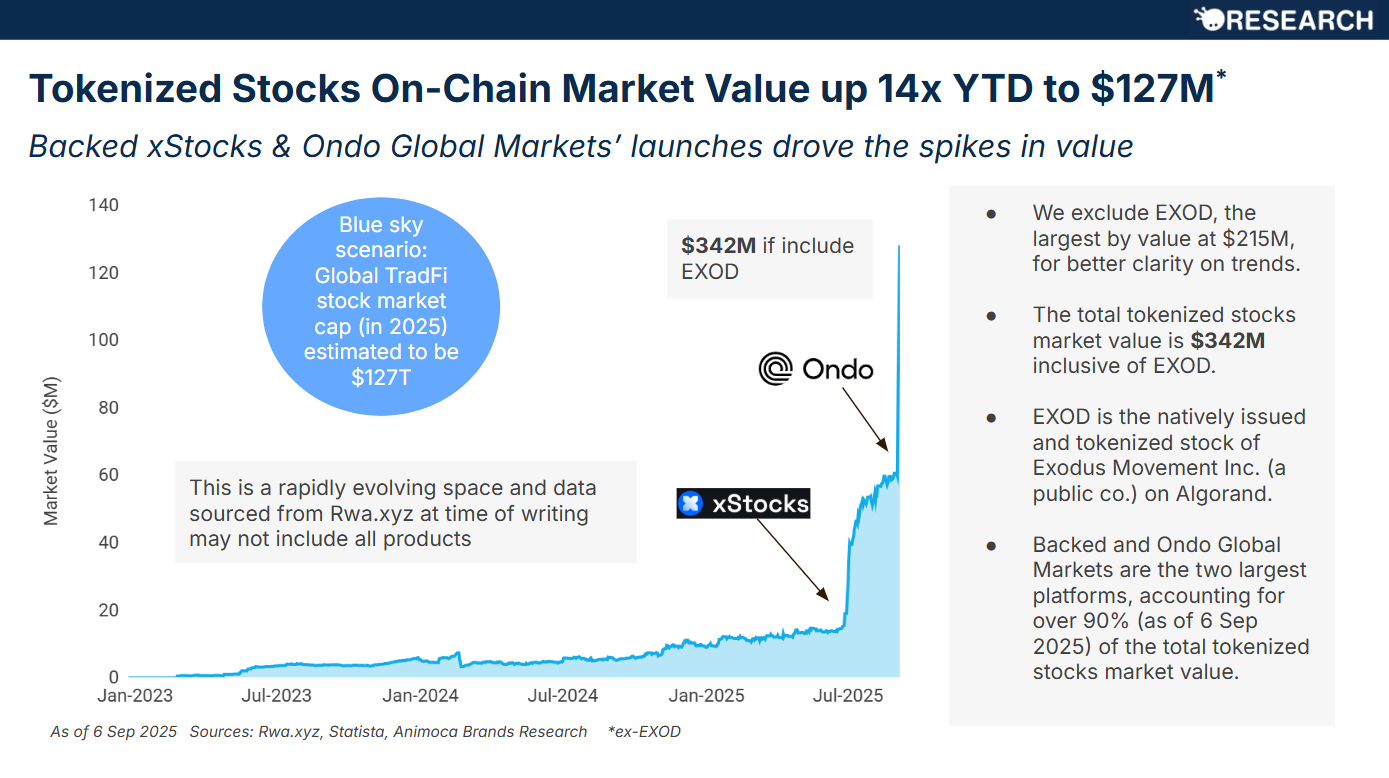

But the key turning point was the summer of 2025, when Robinhood announced tokenized versions of U.S. stocks and ETFs on Arbitrum for European users. Those tokenized stocks were among the most talked-about launches of the year simply because they brought RWA concepts to a retail audience in a way that earlier tokenized Treasuries and credit had not.

Speaking with The Defiant, Markus Levin, co-founder of XYO, one of the first to tokenize and publicly list its shares as $XYLB on the tZERO ATS, suggested that one of the main reasons RWA tokenization accelerated in 2025 is that “several long-standing constraints began to ease at the same time.”

“Regulatory expectations became clearer. Large asset managers moved beyond pilots and began deploying tokenization selectively. Scaling infrastructure improved to the point where costs and settlement times were no longer prohibitive,” Levin added.

As of December, tokenized RWAs — excluding stablecoins — are valued at around $18.6 billion. By comparison, the broader crypto market sits near $3 trillion, putting RWAs at about 0.7% of total crypto value. In the context of a $147 trillion equities market, the RWA segment is miniscule, at just ~0.01-0.02 % of market cap.

Most tokenized RWAs today live in walled gardens rather than open DeFi, which means they’re issued and traded inside closed or permissioned platforms. According to RWA.xyz, this sector of RWAs has over $402.5 billion in locked liquidity, which is more than 20 times larger than the $18.6 billion actually tokenized on‑chain.

On-Chain Tokenization Map

Despite the hype, most tokenized assets are synthetic, meaning they don’t grant shareholders rights such as voting or dividends. Instead, they function as price-linked digital contracts rather than true stock ownership, a move that has already sparked some drama.

As Animoca Brands noted in its “State of Tokenized Stocks” report from September, only two firms, Backed Finance and Ondo Finance, account for 95% of the tokenized stock market, mostly through Ethereum-based synthetic products tied to major U.S. tech shares and ETFs.

But at the on-chain level, Ethereum remains the dominant blockchain for RWAs, hosting around $12.3 billion in distributed tokenized assets, per RWA.xyz. It’s followed by BNB Chain and Solana, with $1.8 billion and $782.4 million, respectively.

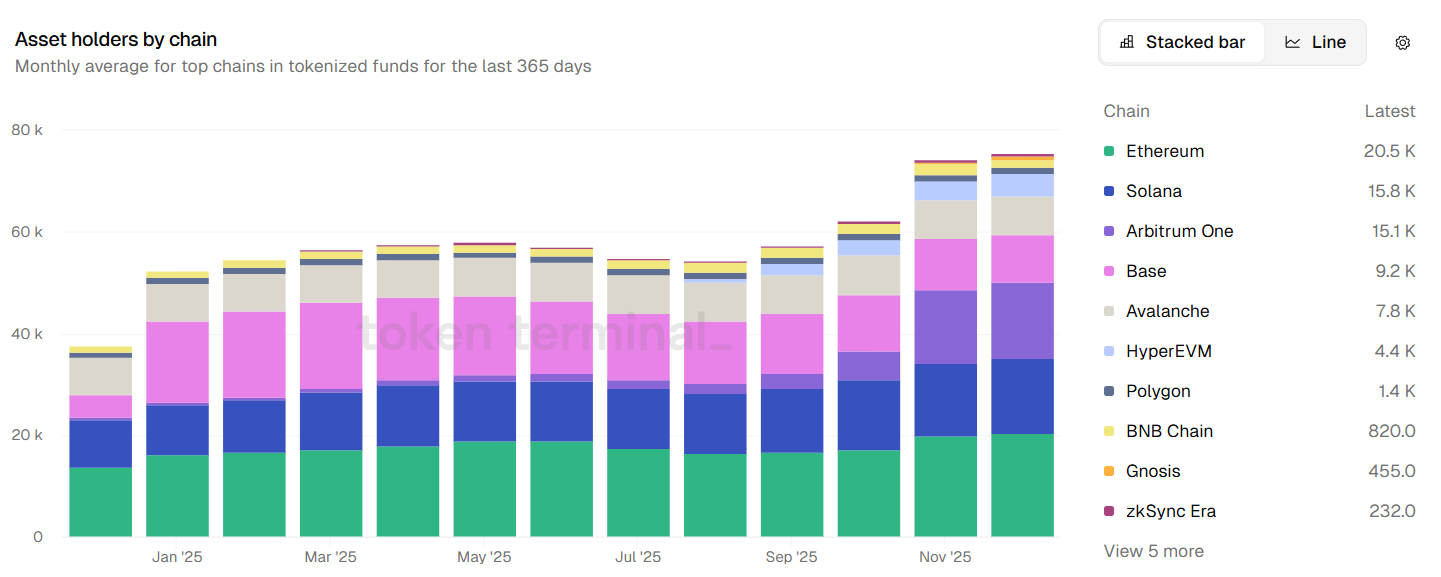

Data from Token Terminal also shows that Ethereum leads in unique addresses holding a non-zero balance in tokenized fund assets, with over 20,000 addresses, followed by Solana at 15,800 and Arbitrum One at 15,100.

Among tokenized fund issuers, Securitize leads with $2.2 billion in liquidity, followed by Ondo Finance at $1.6 billion and Circle at $1.4 billion, according to Token Terminal.

How Big RWAs Can Become

It’s hard to predict exactly how far tokenization will go, and experts disagree on how quickly it will benefit the blockchain industry.

Mike Novogratz’s crypto firm Galaxy Digital, whose shares were also tokenized on Solana in a collaboration with Superstate, projects that tokenized assets could reach a $1.9 trillion market capitalization by 2030 under its base scenario, and as much as $3.8 trillion if adoption accelerates.

Bitcoin-focused fintech firm NYDIG sees it differently. In a Dec. 12 research note, NYDIG’s global head of research, Greg Ciporalo, said that tokenizing stocks won’t provide immediate huge benefits to the crypto market, though the impact could grow if these assets become better integrated on blockchains.

“The benefits to networks these assets reside on, such as Ethereum, are light at first, but increase as their access and interoperability and composability increase,” Cipolaro said.

By contrast, Citadel Securities, the U.S. market-making powerhouse, has a completely different take. In a letter to the U.S. Securities and Exchange Commission, the firm demanded that tokenized stocks be regulated just like traditional exchanges and brokers, sparking a firestorm of debate in the industry.

XYO Network’s Levin believes that RWA tokenization is likely to move “beyond simply wrapping existing assets and start reshaping how those assets are originated and managed.”

“As stablecoins continue to mature as a settlement layer, tokenized assets will start to function more like internet-native infrastructure than standalone financial products. The long-term winners are unlikely to be defined by headline launches, but by who builds trust, verification, and data integrity deeply enough for institutions and applications to rely on these assets at scale,” he concluded.