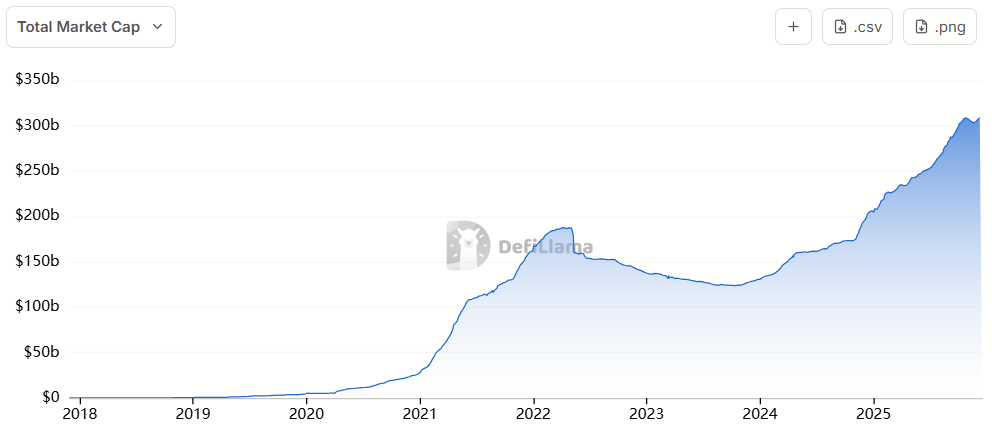

Stablecoins finished 2025 far bigger and louder than most expected. On-chain data from DefiLlama shows that the total stablecoin supply is near $310 billion as of mid-December, up more than 50% from the roughly $205 billion at the start of the year.

The growth accelerated with optimism from crypto investors and builders in late 2024, when venture firms began framing stablecoins as one of the sector’s most underappreciated trends heading into 2025.

In its “Big Ideas” outlook for 2025, VC giant a16z hinted that stablecoins were one of the few things in crypto really worth watching closely as Sam Broner, an investing partner on the firm’s crypto team, anticipated a “bigger experimentation wave in 2025” centered on stablecoins.

“We should also expect larger enterprises to adopt stablecoins as well. If stablecoins indeed speedrun banking history, then enterprises will attempt to disintermediate payment providers — adding 2% directly to their bottom line,” Broner wrote.

Gainers and Losers

And Broner wasn’t wrong. This year, stablecoins indeed grew large enough that even fintech giants and payments networks couldn’t ignore them. But growth didn’t happen the same way for every stablecoin.

While Ethena’s USDtb, backed by BlackRock's BUIDL tokenized Treasury fund, saw the most significant percentage gain in supply, soaring more than 850% this year, Ethena’s other stablecoin, USDe, saw its earlier gains almost wiped out after a sharp market correction following the Oct. 10 liquidation event.

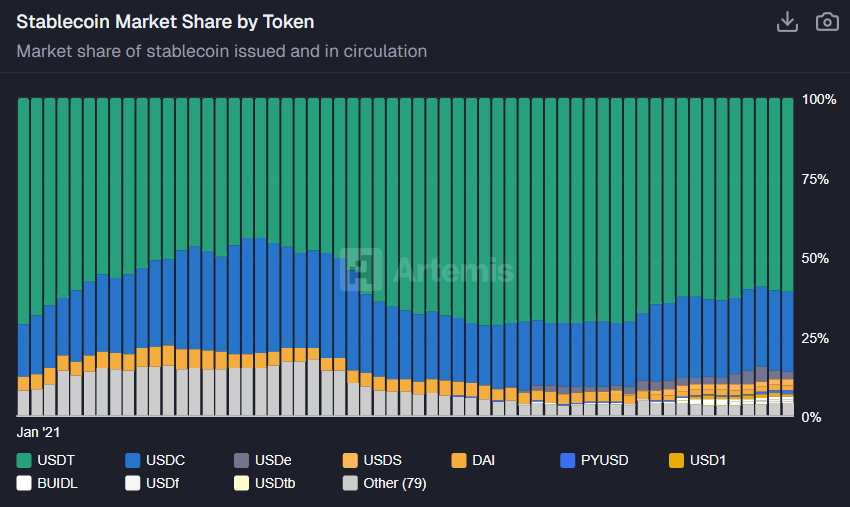

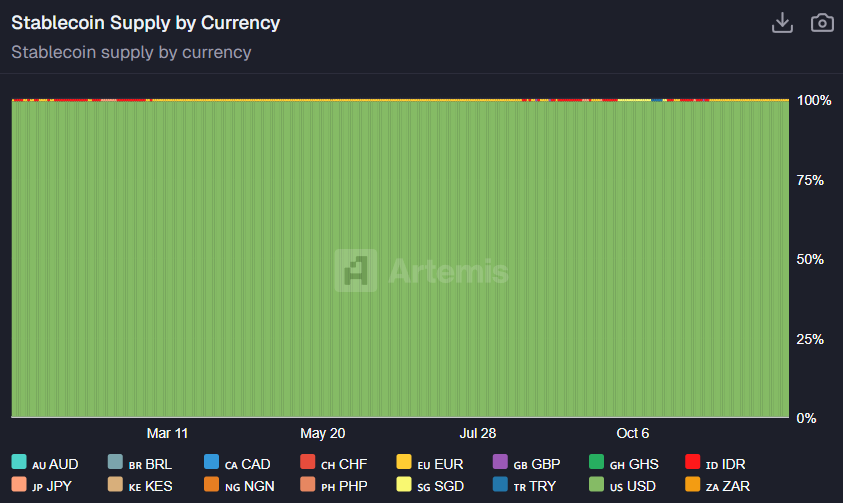

By supply, Tether’s USDT remains the dominant force, controlling over 60% of the market. In late January, Circle’s USDC briefly neared 37% market share but later declined, staying below 26% for the remainder of the year.

Andrew Van Aken, data science analyst at Artemis, noted in commentary for The Defiant that stablecoins had an impressive year, with supply growth becoming uncoupled from the broader crypto market, rising 50% while the crypto market fell 10%.

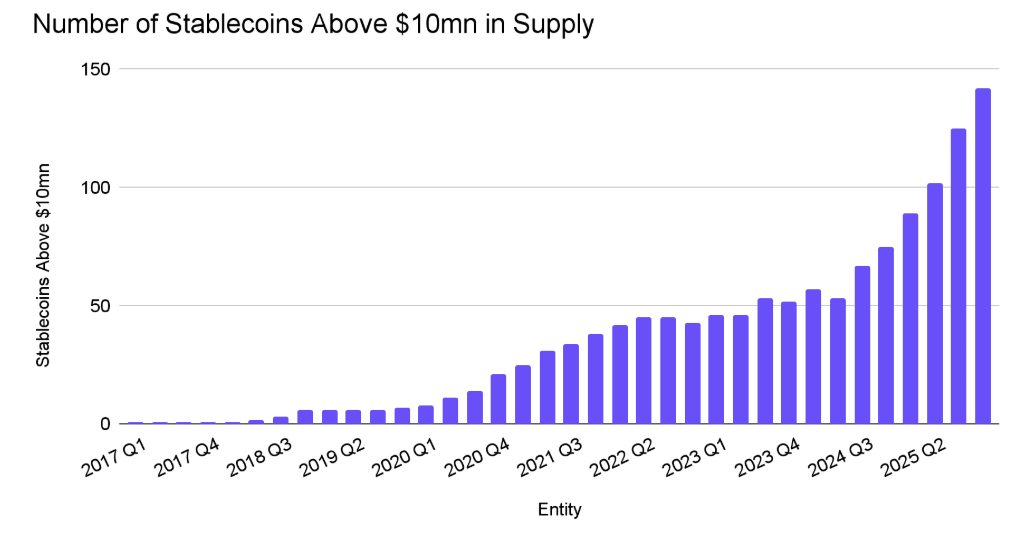

Van Aken added that July to August saw the fastest percentage change, a 7% increase in stablecoin supply, following the passage of the GENIUS Act.

“The theme of this year was absolutely new entrants launching stablecoins as we saw the number of stablecoins above $10mn in supply increase from 75 to 142,” Van Aken said.

Stablecoins Everywhere

Stablecoin adoption wasn’t just about supply. Issuers rushed to launch new pilots and experiment with new infrastructure to gain market share amid heated competition.

For example, Circle unveiled Arc, a Layer-1 blockchain built for USDC-focused activity, while Stripe teamed up with crypto VC giant Paradigm to launch Tempo, another stablecoin-focused chain.

Tether, meanwhile, went a slightly different route, backing new stablecoin networks like the USDT-powered Stable Chain and supporting omnichain liquidity projects like USDT0.

Even crypto wallets like Phantom and MetaMask jumped on the stablecoin bandwagon, launching CASH and mUSD through partnerships with M^0 and Bridge, stablecoin infrastructure providers.

Natalia Karayaneva, CEO and co-founder of real-estate tokenization startup Propy, noted in commentary to The Defiant that the stablecoin growth this year “wasn’t speculative” as stablecoins became the fastest way to move value globally at scale.

She added that enterprise adoption was key as stablecoins “stopped being ‘crypto products’ and started acting like infrastructure.”

“By 2026, stablecoins will be the default settlement layer for cross-border transactions in multiple industries. We’re already seeing that in real estate, where buyers are choosing USDC or USDT not because it’s novel, but because it closes deals faster, reduces risk, and unlocks global liquidity,” Karayaneva added.

Kanny Lee, CEO and co-founder of SecondSwap, a marketplace for trading locked tokens, told The Defiant that stablecoins have hit a “sweet spot in the adoption curve where everything just starts to feel right.” Lee explained:

“You’re no longer whispering ‘do you accept stables’ — they’ve become the easy button for

cross-border payments and on-chain settlement. What’s driving this surge is real demand.”

On-Chain Mechanics

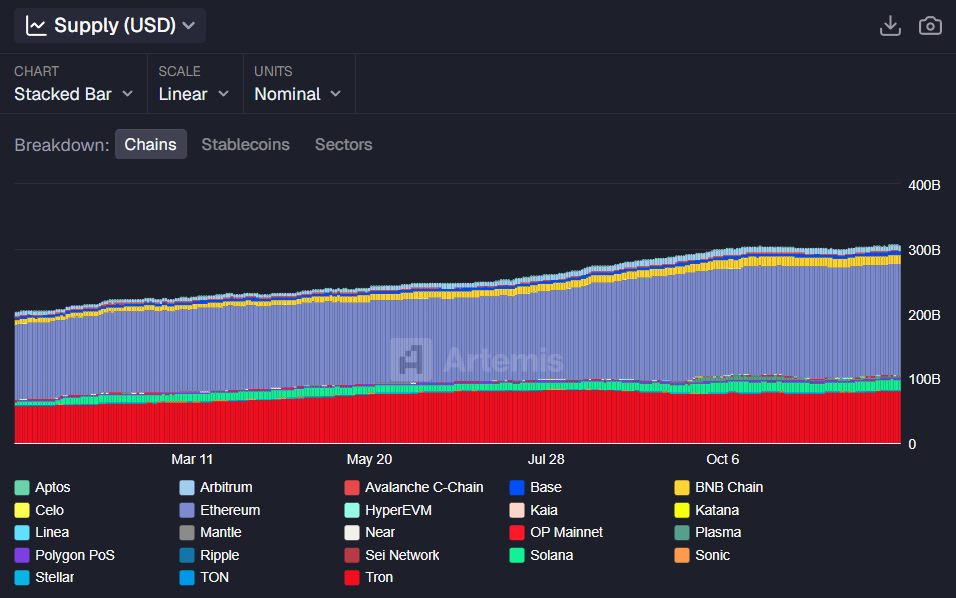

From an on-chain perspective, Ethereum still holds the largest share of circulating supply at over $170 billion, followed by TRON with $81 billion, and Solana with $16.3 billion, according to data from Artemis.

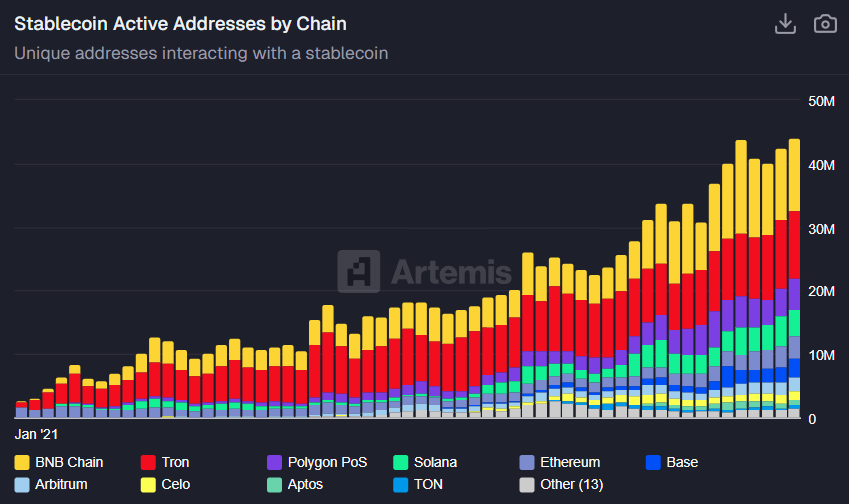

But when measured by network usage, the picture changes significantly. BNB Chain leads with more than 11 million unique addresses interacting with stablecoins as of November, followed by TRON and Polygon, with 10.6 million and 4.8 million, respectively.

Traditional payment giants and fintechs are now in the mix, too. PayPal’s PYUSD has grown to over $3.8 billion across multiple chains, while platforms like Shopify and Klarna have either rolled out stablecoin rails for their customers or signaled they’ll do so soon.

Visa and Mastercard are also publicly enabling stablecoin settlement pilots and integrations. As The Defiant reported, Visa has started letting U.S. banks settle transactions using USDC, while Mastercard expands its stablecoin-focused partnerships.

But there are still issues to be solved. Maksym Sakharov, co-founder and CEO of decentralized banking platform WeFi, told The Defiant that the biggest hurdle for broader stablecoin adoption is still building trust at scale.

He pointed out that stablecoins continue to struggle with consistent KYC/AML coverage across wallets and exchanges, which is essential for merchants and remittances.

“That ‘who is on the other side of this transfer?’ problem is actually table stakes for merchants, payroll, and remittances. Add the macro angle (currency substitution and volatile capital flows), and you get a policy reason for governments to move cautiously, even when the tech is ready,” Sakharov said.

Sakharov added that regulation remains “the bottleneck that determines whether stablecoins can graduate from crypto-native rails into mainstream payment flows,” adding that moving value across different networks still hurts.

“It’s no surprise that the winners will abstract the chains away and ship a single, compliant experience users don’t have to think about,” Sakharov concluded.

The Policy Shift

Regulation also played a significant role. In the U.S., the GENIUS Act was signed into law in July, creating the first federal regulatory framework for stablecoins. However, the law hasn’t taken effect yet and could kick in as early as late March 2026 if regulators move quickly, though it won’t legally take effect any later than early 2027.

Yet, as The Defiant reported earlier, some issuers couldn’t wait and already started putting “GENIUS-compliant” labels on their products.

John Paller, the founder and chief steward of crypto hackathon ETHDenver, told The Defiant that the passage of the GENIUS Act “was a historic milestone” as it established audit standards and consumer protections “that transformed stablecoins from a grey-area experiment into regulated financial infrastructure.”

According to Paller, the industry can expect “similar momentum” when the CLARITY Act — a proposed U.S. market structure bill that aims to clearly define regulatory responsibilities among U.S. agencies — is passed.

In Europe, MiCA’s stablecoin rules have been in force since mid-2024, but their impact was most visible in 2025. Tether, once dominant in the region, retraced after its CEO Paolo Ardoino criticized MiCA’s requirement that issuers hold reserves in European banks, noting in an X post that “uninsured cash deposits are not a good idea.”

As a result, euro-pegged stablecoins remain a niche. Artemis data shows their supply barely changed over the year, holding at roughly 0.18% of the total market, with dollar-pegged stablecoins dominating the lion’s share.

Chris Aruliah, chief commercial officer at UK-based stablecoin infrastructure company Agant, suggested in commentary for The Defiant that in 2026, non-USD stablecoins will “proliferate as more and more companies see the potential of stablecoins radically improving cross-border and FX payments and settlement.”

According to Aruliah, stablecoins will become the go-to way to move value in and out of on-chain assets, letting companies and consumers stick to their local currencies instead of dealing with the U.S. dollar.