Solana is testing a key support level, with liquidation data showing pressure on long positions.

Currently, Solana (SOL) is trading at $124.07, reflecting a 2.1% decline in the last 24 hours. The price has seen a bottom at $124.03 and hit its 24-hour top at $128.10, indicating some volatility within the day.

Over the past 7 days, Solana has seen a 1.1% decrease, indicating mild bearish sentiment in the short term. Over a 14-day period, the crypto has dropped by 6.6%, suggesting a broader downtrend in recent weeks.

However, the 1-year performance shows a 31.3% decline, highlighting a struggle to maintain upward momentum over the longer term. Traders will be closely watching whether Solana can regain strength or continue to face downward pressure.

Solana Price Prediction

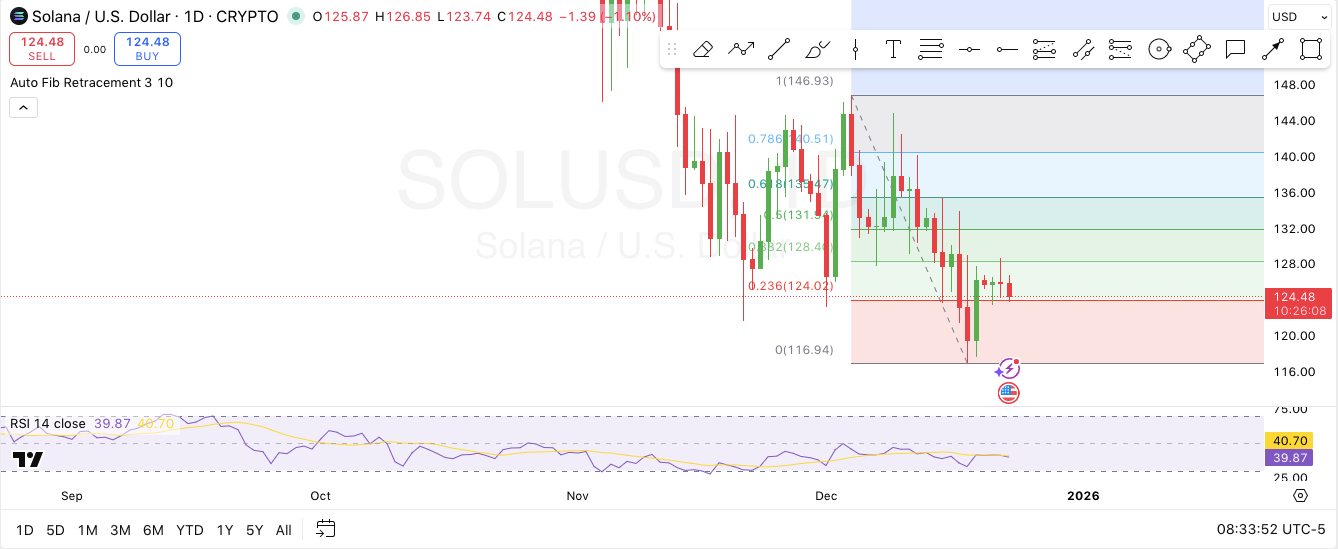

Notably, a TradingView chart shows Solana testing key levels, with Fibonacci retracement indicating critical support and resistance areas. The 0.236 Fibonacci level at $124.02 is currently being tested, with a close below it possibly launching further downside.

The next support zone appears at the 0 level at $116.94. On the upside, immediate resistance is seen at the 0.382 retracement level around $128.40, and further resistance is located at the 0.5 level near $131.94. If the price manages to break above these resistance levels, Solana could be poised for a stronger recovery toward $148.

Looking at the RSI (Relative Strength Index) at 39.87, Solana is in neutral to slightly bearish territory, indicating that there is no immediate overbought or oversold pressure. The MACD histogram shows a bearish momentum, with the MACD line below the signal line, reinforcing the possibility of further downside. For a reversal to the upside, Solana would need to close above $124.02.

Solana Liquidation Data

The liquidation data for Solana across multiple timeframes reveals significant pressure on long positions. Over the 1-hour and 4-hour periods, $3.87 million and $4.15 million in liquidations occurred, respectively, with the majority coming from long positions, indicating strong selling pressure.

Meanwhile, the 12-hour data further confirms this trend, with $13.45 million in total liquidations, and $13.27 million from long positions. This indicates that long traders are being squeezed, and the market sentiment is leaning toward the downside in the short to medium term.

In the 24-hour period, the total liquidation figure rose significantly to $17.73 million, with $16.87 million coming from long positions and $856.28K from short positions. The continued dominance of long position liquidations suggests that Solana may continue to experience downward pressure.

thecryptobasic.com

thecryptobasic.com