Most token launches in 2025 failed to reward early buyers, with projects that debuted at lower fully diluted valuations (FDV) greatly outperforming their bigger, more hyped rivals, data from Memento Research shows.

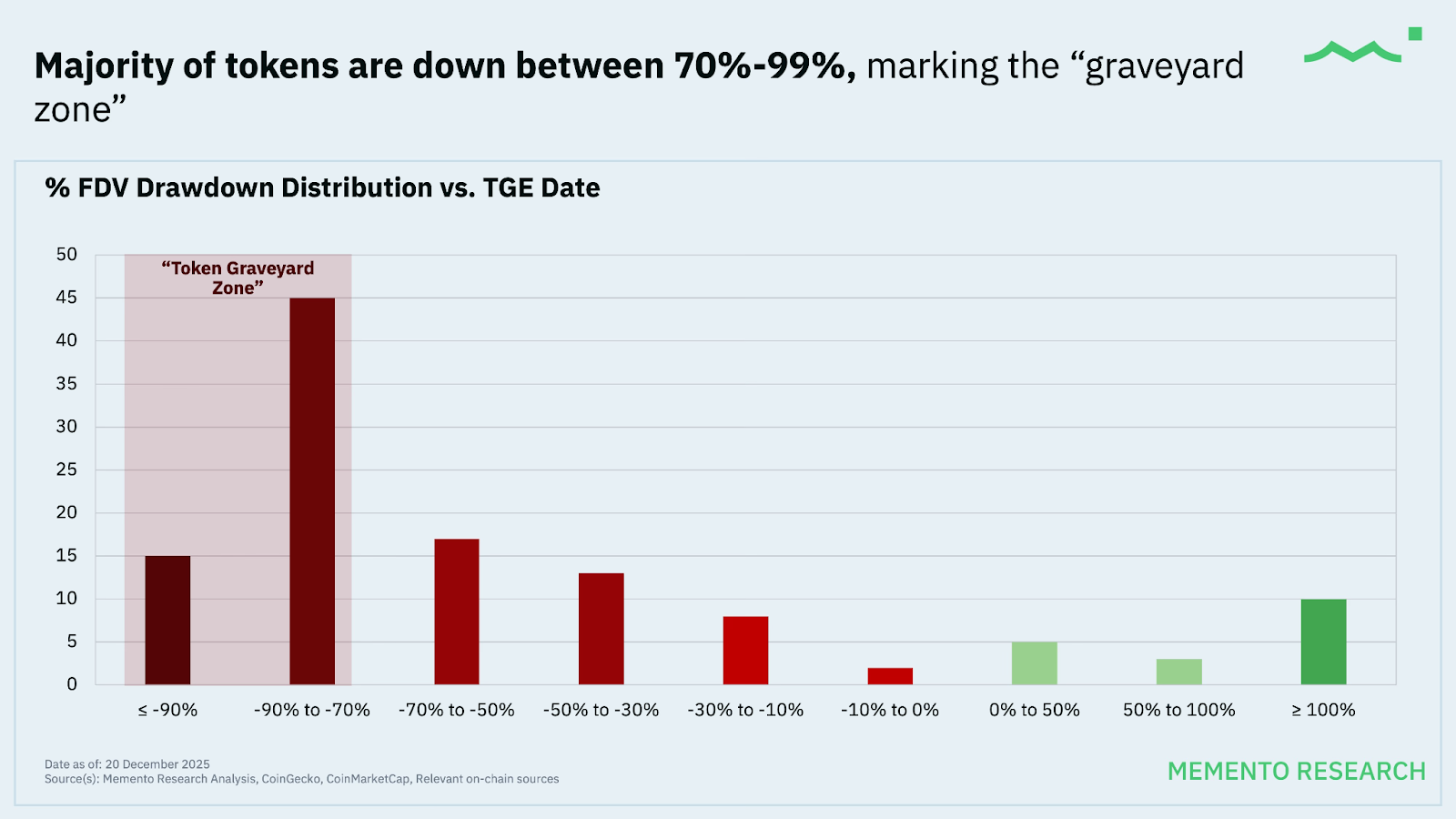

The firm tracked 118 token launches in 2025 and found that more than 84% are now trading below their token generation event (TGE) valuations, with a median loss of more than 70%. Only 18 tokens are still in the green, while the rest have suffered substantial losses since launch.

“Big, hyped launches did worse,” the report notes, pointing out that an equal-weighted basket of tokens is down about 33%. But when weighted by FDV, the drop widens to more than 61%, implying that bigger launches performed much worse.

For context, stablecoin-focused Layer 1 blockchain Plasma’s FDV jumped to about $17 billion shortly after its TGE, before falling sharply. As of press time, its FDV stands at around $1.2 billion, according to CoinGecko data.

“Opening valuations are set way too high and above their fair value, resulting in worse long-term performance with larger % drawdowns,” the report notes.

The clearest signal comes from starting valuations. Tokens that launched with FDVs between $25 million and $200 million had the best results, with 40% still in the green.

Once FDVs get larger, results degrade quickly. Among 28 launches with starting FDVs above $1 billion, “0% of them are green today, and the median is roughly -81%,” the report points out.

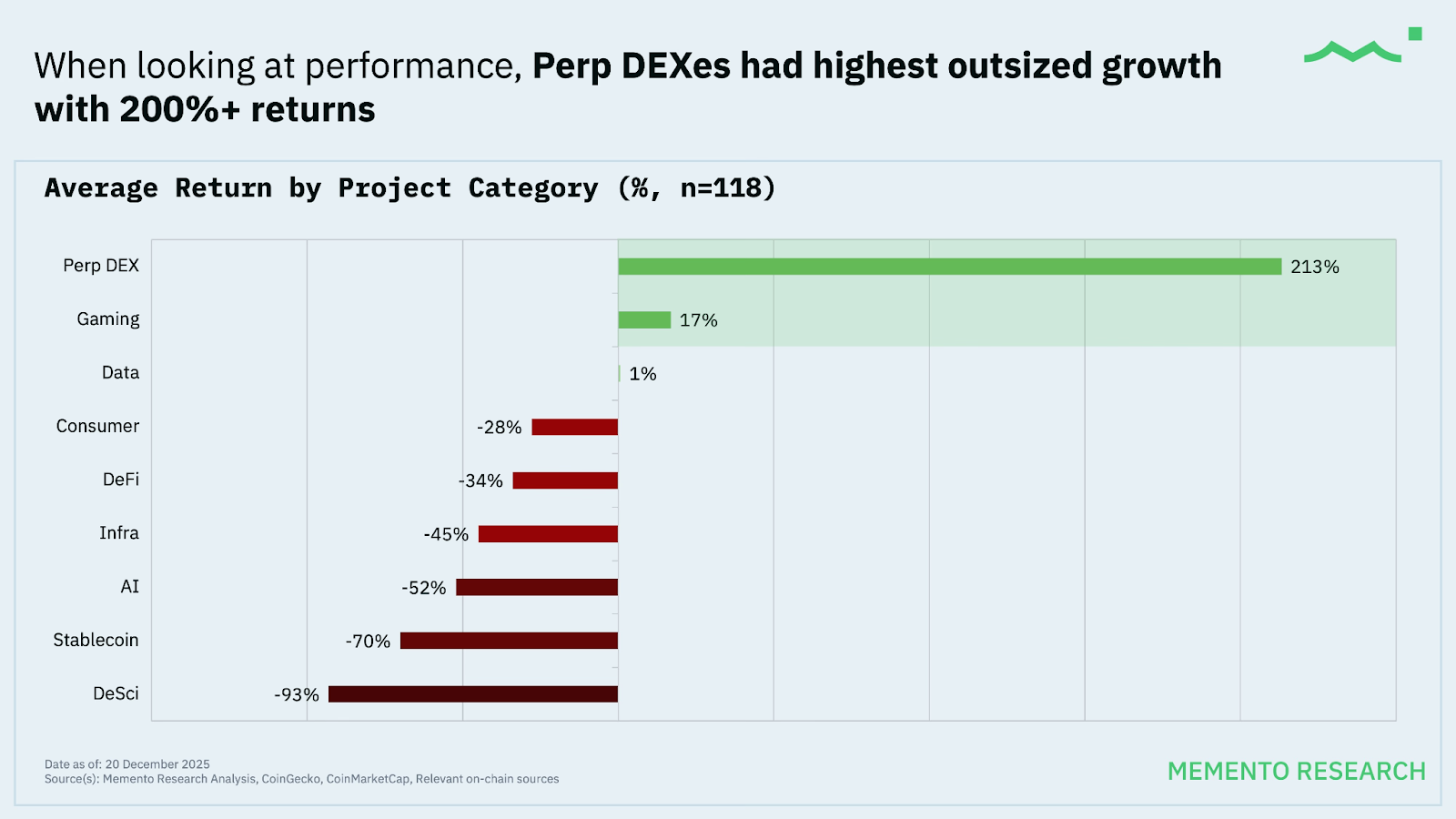

Hyperliquid Drives Perp DEX Outperformance

By categories, perpetual decentralized exchanges stood out, with average gains above 200%, though the report admits the result was mainly “led by Hyperliquid and during Q4 when Aster launched as well.”

Surprisingly, gaming and data tokens also showed positive averages of 17% and about 1%, though the report doesn’t name the projects driving those gains. At the other end, decentralized science (DeSci) and stablecoin projects were among the worst performers, with average losses of 93% and 70%, respectively.

“So if there’s one lesson from this dataset, it’s that TGE in 2025 was a valuation reset period: most tokens bled, a tiny number of outliers did all the upside, and the ‘bigger’ the FDV debut, the worse the drawdown,” the firm concluded.