XRP has erased a significant portion of its market value in December, as a sharp technical breakdown and worsening risk sentiment pushed the token well below key support levels.

XRP’s price has fallen from around $2.20 at the start of the month to $1.88, marking a notable pullback.

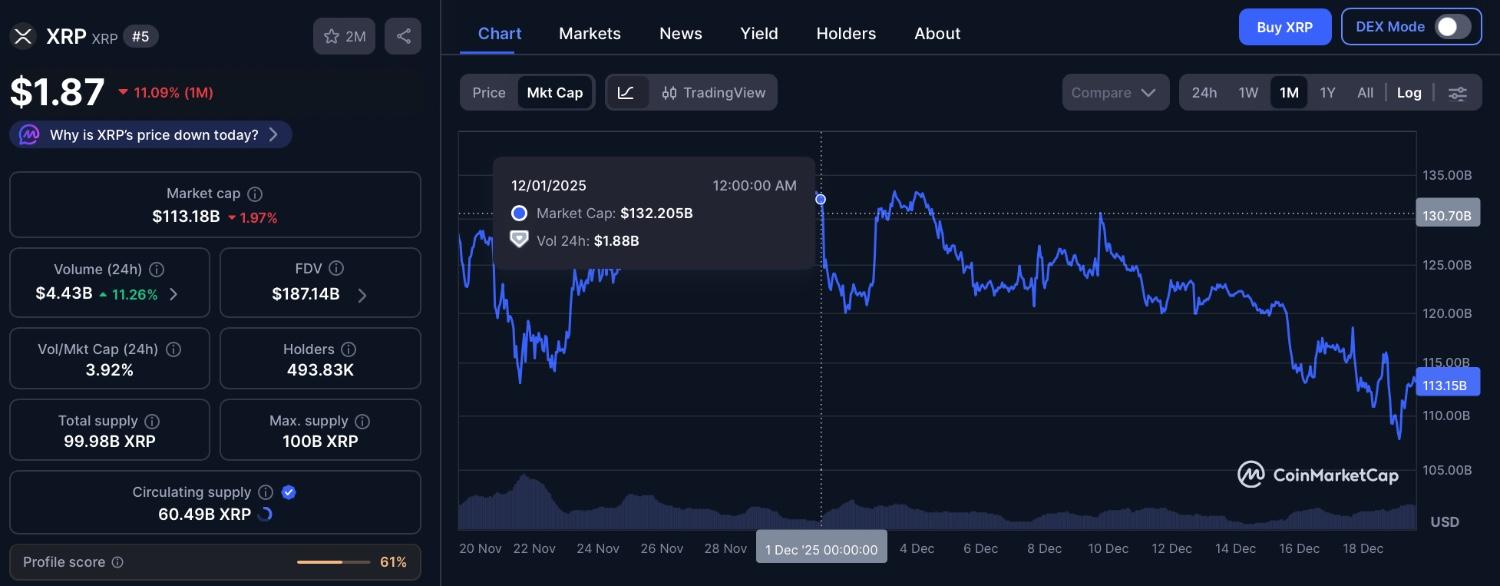

According to data retrieved by Finbold from CoinMarketCap on December 19, over the same period, XRP’s market capitalization declined from approximately $132.2 billion to $113.2 billion, wiping out roughly $19 billion in value in less than three weeks.

On a shorter time frame, XRP slipped 1.19% over the past 24 hours, underperforming the broader cryptocurrency market, which fell by around 0.8%. The move comes as Bitcoin dominance climbed to 59.2%, reinforcing a risk-off rotation away from altcoins.

XRP technical analysis

From a technical perspective, XRP’s decline intensified after the token lost its $1.95 support level, a zone that had held for more than a year. The breakdown triggered automated sell orders and pushed prices toward key Fibonacci levels.

XRP is now testing the 78.6% Fibonacci retracement near $1.91, with the relative strength index (RSI) at 31.64, indicating oversold conditions but not yet signaling extreme capitulation. Analysts warn that a sustained close below $1.85 could open the door to a deeper move toward the $1.70–$1.75 range.

XRP sentiment turns defensive despite institutional headlines

The technical weakness has been compounded by a broader shift in market sentiment. The crypto fear and greed index has dropped to 21 out of 100, reflecting elevated fear across digital assets as investors reduce exposure amid macro uncertainty.

Meanwhile, recent institutional developments, including Ripple’s partnership initiatives, have so far failed to offset near-term market anxiety. Traders appear focused on broken chart structures rather than long-term fundamentals, particularly as liquidity thins and volatility increases.

Key XRP levels to watch

XRP’s recent decline highlights how technical triggers can be amplified during periods of sector-wide deleveraging. While Ripple’s institutional progress continues to provide longer-term tailwinds, near-term price action remains vulnerable.

The critical zone to watch is $1.85–$1.88 into the weekly close. Holding this range could stabilize price action, while a decisive breakdown may validate bearish targets below $1.70.

finbold.com

finbold.com