Crypto whales are buying again. Following a cooler US CPI print, large holders have begun adding risk rather than cutting it. Easing inflation, softer labor market data, and rising expectations for rate cuts are gradually changing how capital is allocated. These purchases are not concentrated in a single theme.

Whales are adding exposure across DeFi, political narratives, and legacy meme coins. That mix matters. It indicates this is not a single trade but rather early positioning for a broader shift in sentiment, even as prices remain largely range-bound for now.

Curve DAO Token ($CRV)

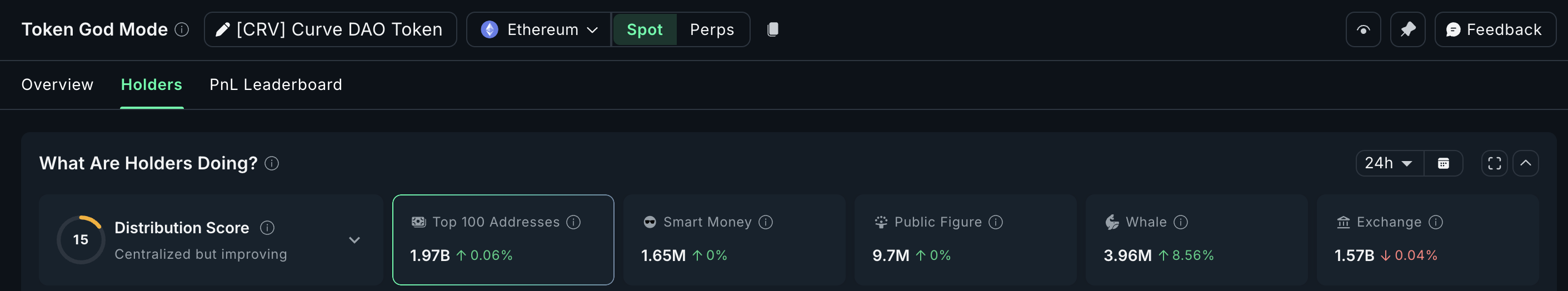

Crypto whales are buying Curve DAO token even as the broader market struggles to find direction. $CRV is still down roughly 20% over the past month, but whale behavior suggests this weakness is being treated as an opportunity, not a warning sign.

Over the past 24 hours, whales increased their $CRV holdings by 8.56%, lifting their stash to 3.96 million tokens. That equals roughly 312,000 $CRV added in a single day. The size is not massive, but the timing matters. Whales are stepping in while sentiment remains fragile, following a cooler US CPI print that improves the longer-term rate-cut outlook.

$CRV Whales:">

$CRV Whales:">

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

From a price perspective, the $CRV price still looks weak on the surface. The token has made lower lows between early November and mid-December. But momentum tells a different story. The RSI or Relative Strength Index indicator, which measures buying and selling strength, has formed a higher low during the same period. This divergence often signals that selling pressure is fading and a trend shift could follow.

For confirmation, $CRV must reclaim $0.38, with $0.41 acting as the key level that has capped rallies since early December.

$CRV Price Analysis">

$CRV Price Analysis">

A clean break there could support a reversal. If price falls below $0.33, the setup weakens, and whale conviction may stall.

Official Trump ($TRUMP)

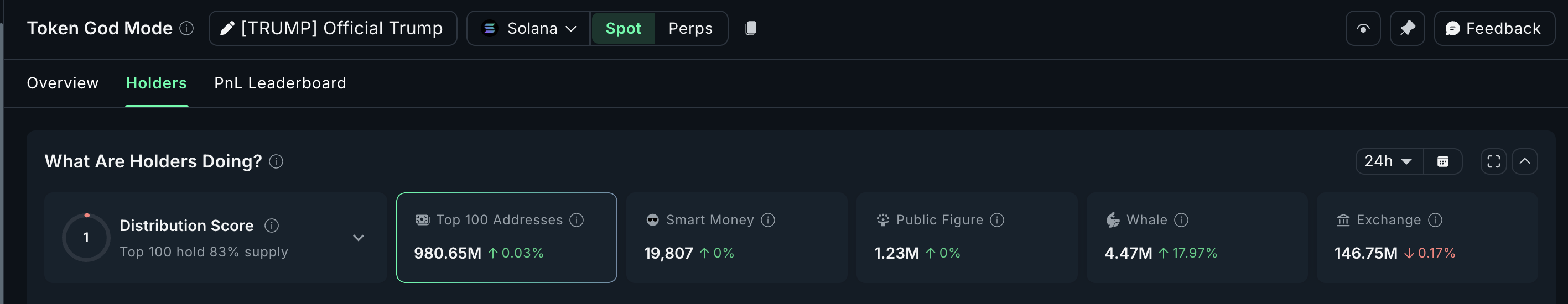

The Official Trump token is back on whale radars after the cooler US CPI print is expected to ease pressure across risk assets. $TRUMP is still down by nearly 40% over the past three months, but that weakness appears to be attracting early positioning. With inflation cooling and rate cut expectations rising again, politically sensitive tokens are seeing renewed interest.

Over the past 24 hours, crypto whales have increased their $TRUMP holdings by 17.97%, lifting their stash by over 680,000 tokens. At the current price, that addition alone is worth roughly $3.5 million. This is not aggressive chasing. It looks more like early accumulation while sentiment is still cautious.

Charts help explain the timing. The Smart Money Index, which tracks how experienced traders position, has started to curl upward after trending lower since December 9. That shift suggests informed buyers may be preparing for a rebound rather than reacting to one.

Price levels remain key. $TRUMP must hold above $4.96 to keep this recovery structure intact. If buyers manage a clean move above $6.05, a level that has capped rallies since late November, upside momentum could expand. On the downside, a daily close below $4.96 would weaken the whale thesis and reopen downside risk.

$TRUMP Price Analysis">

$TRUMP Price Analysis">

For now, crypto whales appear to be betting that easing inflation and rising political liquidity can give $TRUMP room to stabilize before the broader market reacts.

Dogecoin ($DOGE)

Dogecoin is the largest name on this list per market cap data. Over the past 24 hours, mid-sized Dogecoin whales holding between 10 million and 100 million $DOGE increased their combined balance from 17.38 billion to 17.40 billion $DOGE. That is an addition of roughly 20 million $DOGE.

At the current price, this equals about $2.6 million worth of accumulation. The number is not massive, but the timing is crucial. These wallets had been reducing exposure earlier, so this move, immediately after the US CPI print reveal, could mean something.

Whales may be reacting to early signs of a technical base. Between November 4 and December 18, the Dogecoin price made a lower low, but the RSI printed a higher low. This bullish divergence often shows that selling pressure is fading. Dogecoin is already up around 2–3% over the past 24 hours, hinting that buyers are testing the waters.

Key levels are clear. $0.13 is the first line in the sand and has capped recent rebounds. A clean daily close above $0.15 would confirm a trend recovery. That move implies roughly 19% upside from current levels and could open upside targets.

The risk remains. A break below $0.12 would invalidate the rebound idea and expose deeper downside. For now, crypto whales are buying Dogecoin carefully, betting that easing macro pressure could bring meme coin risk back into play.

The post What Crypto Whales Are Buying After a Cooler US CPI Print appeared first on BeInCrypto.

beincrypto.com

beincrypto.com