XRP price continues to trade under pressure, hovering near 1.82 USD after another rejection from the 2.00 mark. Despite the broader crypto market showing signs of stabilization, XRP has remained in a prolonged downtrend. The macro backdrop, however, could soon shift the momentum. Cooling U.S. inflation has reignited expectations of Federal Reserve rate cuts, potentially reshaping liquidity conditions across global markets. For XRP price, that could mean a turning point — but the charts suggest it’s not there yet.

XRP Price Prediction: Inflation Eases, Rate Cut Hopes Rise

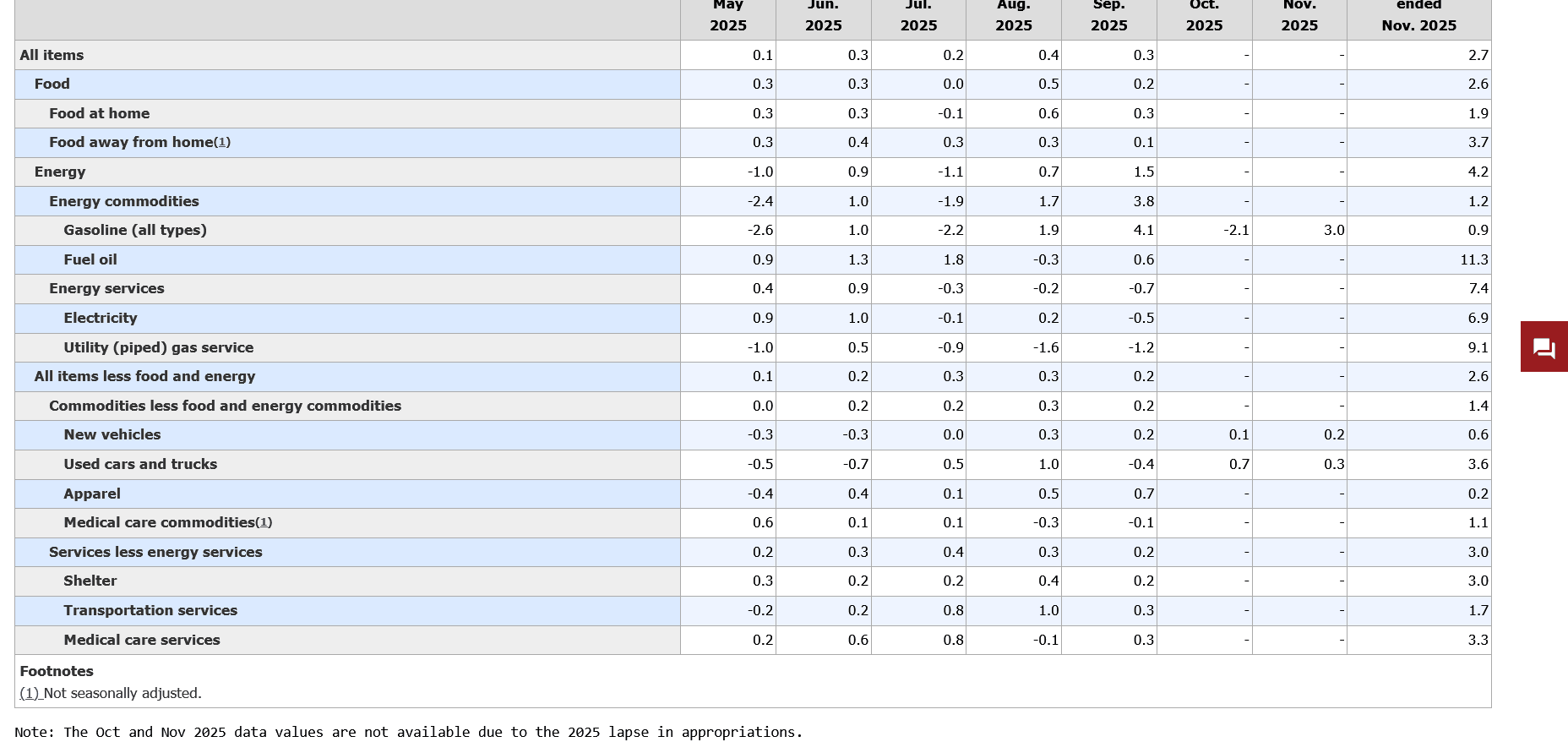

The latest U.S. CPI data showed core inflation falling to a four-year low in November. Historically, falling inflation opens the door for the Fed to reduce borrowing costs, a move that tends to boost risk assets like cryptocurrencies. If the Fed proceeds with further rate cuts in early 2026, capital could flow back into speculative markets as investors seek higher returns.

Still, the narrative isn’t straightforward. The government shutdown in October and November distorted the economic data, leaving Fed officials cautious. For now, futures markets are pricing only about a one-in-four chance of a rate cut in January, but dovish expectations are building for the first quarter of 2026. That macro optimism might be the spark XRP price needs — but timing remains key.

XRP Price Prediction: XRP Under Pressure

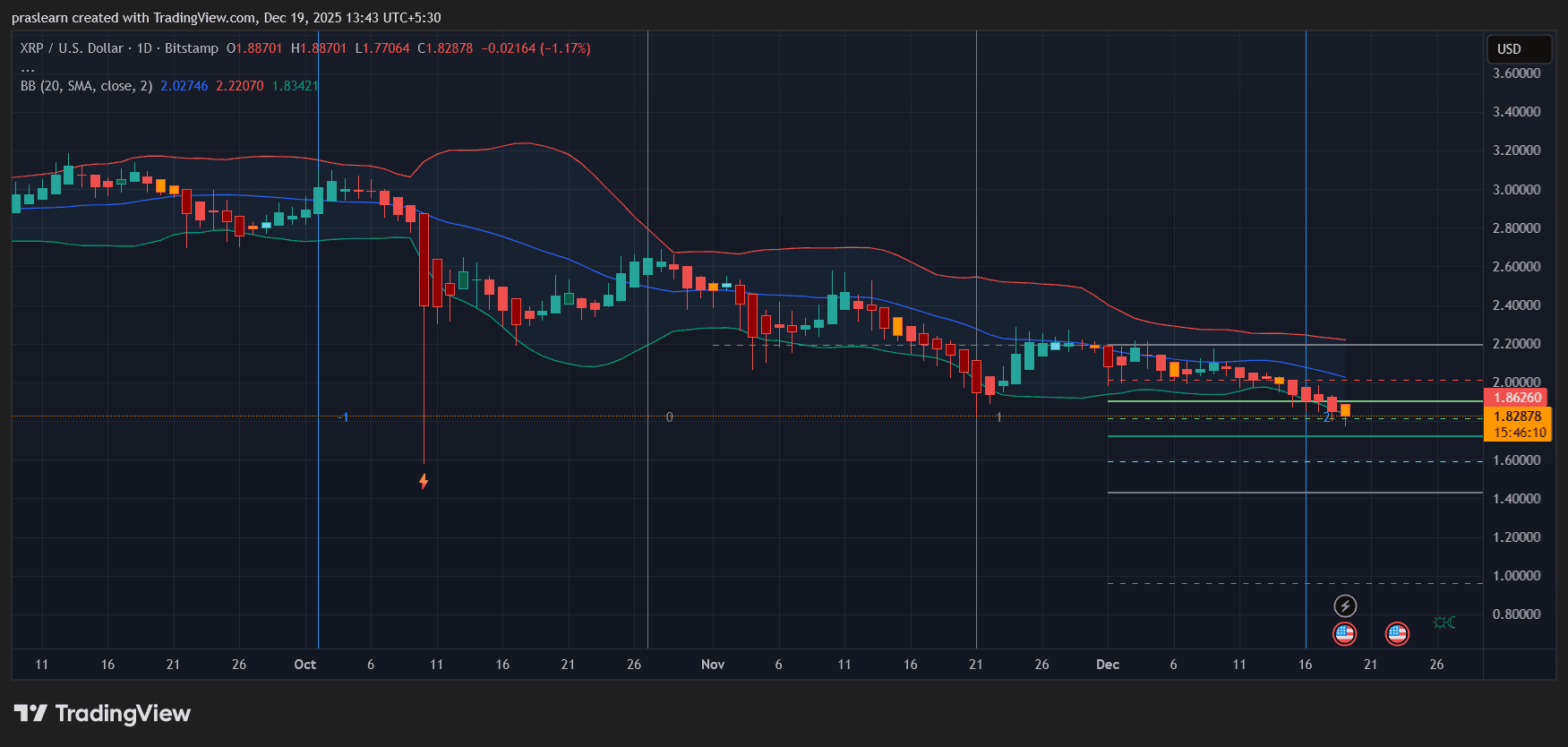

On the daily chart, XRP price remains below the 20-day moving average and continues to slide within a descending channel. The Bollinger Bands show widening volatility, with price hugging the lower band near 1.82 USD — a zone often associated with oversold conditions. This level coincides with a support cluster between 1.78 and 1.70 USD, which has held since early December.

If XRP price manages to reclaim the 2.00 resistance level, a short-term recovery toward 2.22 USD (upper Bollinger band) becomes likely. However, repeated failures near that zone indicate that sellers still dominate. A daily close below 1.75 USD would open the door to deeper losses toward 1.50 USD, a level not seen since mid-2023. The overall structure remains bearish until a decisive close above the 20-day SMA confirms momentum reversal.

Liquidity Flows and Market Psychology

Crypto sentiment often shifts before policy does. Traders tend to position ahead of official rate cuts, especially when inflation data signals relief. If the Fed follows through with another quarter-point reduction in early 2026, it could revive risk appetite across digital assets. Liquidity injections would lower yields and push investors toward higher-beta assets like XRP, particularly if broader altcoin indices begin to recover.

However, XRP price history shows a lagging response to macro shifts compared with Bitcoin and Ethereum. That means XRP could underperform early in a recovery cycle, then play catch-up once investor confidence spreads beyond the major caps.

Short-Term Outlook: Consolidation Before Direction

The coming days could see XRP price oscillate between 1.75 and 1.95 USD as traders await clearer signals from the Fed. The next inflation report and FOMC commentary will likely define the next breakout direction. A confirmed rate cut would weaken the dollar and strengthen crypto’s macro outlook — but for XRP, bulls must first defend current support to avoid another slide.

In short, XRP’s immediate fate sits at the intersection of policy and psychology. A dovish Fed could be the catalyst, but the charts demand caution: unless 2.00 USD is reclaimed with volume, the trend remains tilted downward.

XRP Price Prediction: Recovery Possible, But Confirmation Needed

If the Fed’s tone continues to soften and rate cuts materialize in Q1 2026, XRP price could rebound toward 2.20–2.40 USD by February. Sustained bullish volume above 2.00 would validate that breakout. Conversely, if macro uncertainty persists or Bitcoin weakens, XRP could revisit the 1.50–1.60 range before any recovery.

What this really means is that $XRP is sitting at a macro-technical crossroads. The inflation cooldown provides a lifeline, but until traders see confirmation both from the Fed and the chart, the path of least resistance remains sideways to slightly down.

cryptoticker.io

cryptoticker.io