With the DTCC breaking into the tokenization market and X Money looking to launch publicly, $XRP has an integration opportunity in both areas.

Notably, $XRP has stayed under strong selling pressure amid a broader market downturn. Over the past three months, the price has dropped about 35%, falling to $1.86. With this decline, $XRP is now on track to post its third straight monthly loss for the first time since late 2022.

$XRP Price Down Despite Bullish Developments

Meanwhile, this weak price action comes despite multiple bullish developments within the $XRP ecosystem. For instance, $XRP ETFs have launched and gained momentum, recently surpassing $1 billion in total inflows. In addition, Ripple secured conditional approval to operate under a banking license.

Several market commentators believe this disparity between price action and ecosystem developments may not last. They suggested that the developments could be setting up the foundation for an $XRP price explosion soon.

One of the individuals who holds this optimism is Digital Asset Investor or $DAI, an $XRP community figure. $DAI recently called attention to two areas where he believes $XRP has a real opportunity to gain traction and possibly influence its long-term price action.

In a recent video, $DAI called attention to reports of the Depository Trust & Clearing Corporation (DTCC) entering the tokenization space. He also highlighted the attention around X, as the platform prepares to roll out its X Money product to the public.

DTCC Entering the Tokenization Market

During his commentary, $DAI shared a CNBC Crypto World interview featuring DTCC Chief Executive Officer Frank La Salla. During the interview, CNBC host Jordan Smith asked La Salla to explain DTCC’s tokenization pilot, the users expected to adopt it, and the timing behind the launch.

Responding, Frank La Salla explained that the securities industry has steadily moved toward tokenization for several years. He said clearer regulatory guidance from Washington has helped push progress, allowing firms to tokenize real-world assets with greater confidence.

La Salla called digital assets software and said blockchain now acts as the next-generation system capable of carrying both financial and physical assets, including securities, artwork, vehicles, and more.

He also noted that DTCC holds an important position in the financial system, pointing out that the organization oversees roughly $100 trillion in assets. La Salla said many DTCC members want to tokenize different asset classes, such as ETFs and market indexes.

To prevent fragmented liquidity across disconnected platforms, DTCC decided to approach tokenization at a foundational level. He explained that DTCC plans to methodically tokenize real-world assets and allow them to operate across multiple blockchain networks, including Layer 1 and Layer 2 systems, while acting as the industry’s facilitator.

Possible X Money Integration

Moving on from the CNBC interview, $DAI then called attention to a post from Tesla, in which the electric vehicle simply said: “Slowly, them all at once.”

Speaking on this, $DAI stressed that it is now public knowledge that Elon Musk is looking to take SpaceX public next year. According to him, X Money could also emerge, possibly getting tied into the entire push. $DAI believes there could be a convergence of AI and crypto.

He then speculated that crypto could power the backend of X Money, suggesting that Stellar’s XLM, $XRP, or both could have a role in this system.

$XRP Price if It Leverages These Opportunities

If $XRP succeeds in capturing a meaningful share of the growing tokenization market and secures integration within X Money, its price outlook could improve massively. To explore how these could impact $XRP price, we asked Google Gemini to provide an assessment.

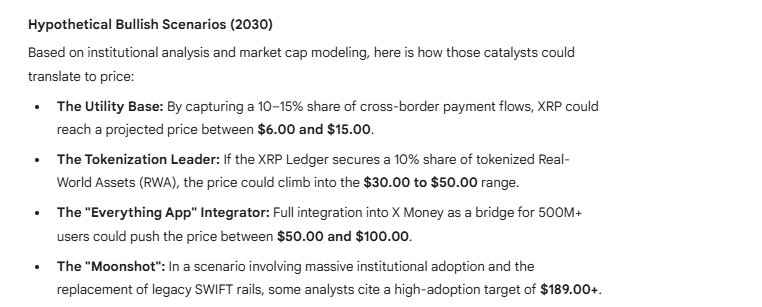

In response, Google Gemini presented a possible $XRP price outlook for the next five years. Under its utility-based scenario, the AI suggested that $XRP could reach between $6 and $15 if it captures roughly 10% to 15% of global cross-border payment flows.

In a more bullish environment where the XRPL secures about 10% of the tokenization market, Gemini projects prices ranging from $30 to $50. The chatbot then added that full integration with X Money, potentially serving more than 500 million users, could push $XRP into a $50 to $100 price range.

Meanwhile, in a high-adoption “moonshot” environment involving institutional use and the replacement of legacy systems such as SWIFT, Gemini noted that some analysts place $XRP’s long-term price above $189.

thecryptobasic.com

thecryptobasic.com