Venture capital is the lifeblood of the startup world in Web3 and crypto. Entrepreneurs need to raise money for projects in order to hire talented people, pay operating costs, and perform marketing for scaling a business.

VCs, of course, are more than happy to do this, as they get a chunk of the long-term payoff – if there ever is one, of course. Most startups fail, and the business is highly predicated on unicorns to drive venture funds.

The crypto market is unique, to be sure, with cryptocurrencies also playing a role as many startups launch tokens. However, the digital asset market hasn’t been performing as well.

Since October, when the price per 1 BTC hit an eye-watering $126,000 record level, the orange asset is in the red by 25%.

Crypto prices impact the VC market, and dynamics have certainly changed for startups to raise money. What’s the outlook looking like overall right now?

“Market cycles may influence investment sentiment and can slow or accelerate the pace of closing deals,” noted Stefan Deiss, CEO of Hashgraph Group, focused on VC in the Hedera ecosystem.

Lowered Expectations From Venture Capital

One of the first things that happens when crypto trends to a downward cycle is that startup valuations go lower.

It may not seem directly related, but the concept of the “hot rounds” for fashionable startups cool off, and VCs don’t really go for sky-high valuations so much, noted Artem Gordadze, an angel investor in NEAR Foundation and advisor at startup accelerator Techstars.

“When Bitcoin is trading at high levels, like the perceived $100k level, startup valuations are commensurately high,” Gordadze said. “This creates a challenging dynamic: VCs must justify the entry valuation based on a potential future price that must materialize within the investment horizon to generate acceptable returns.”

It seems the theory that Bitcoin always goes up is not one venture capitalists are attuned to. Because of long time horizons for VC investments, they have seen many cycles, especially with Bitcoin.

In addition, many VCs often call November and December “write-off” months. This means they don’t expect to do too much work during the fourth quarter and the holiday season, preferring to start investing anew after the calendar turns to another year.

The Pragmatic View

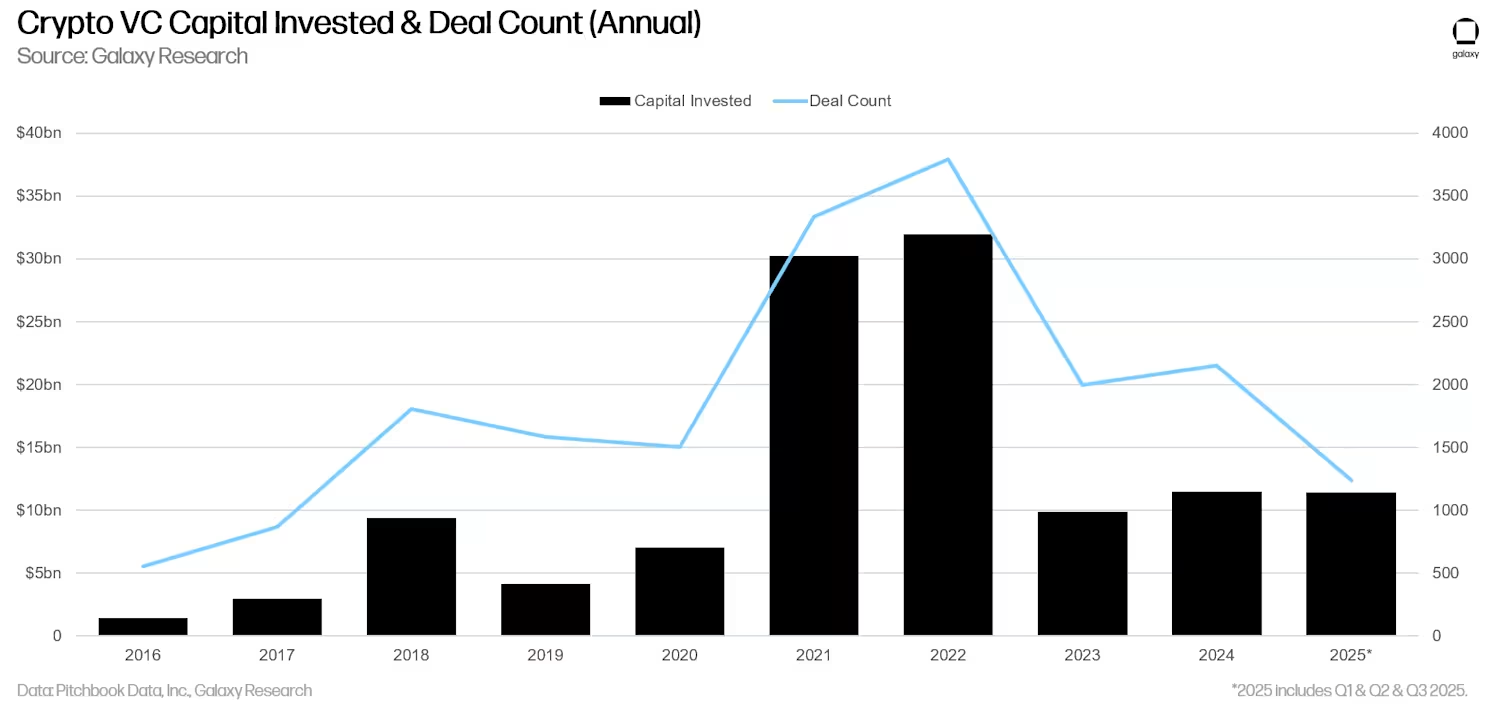

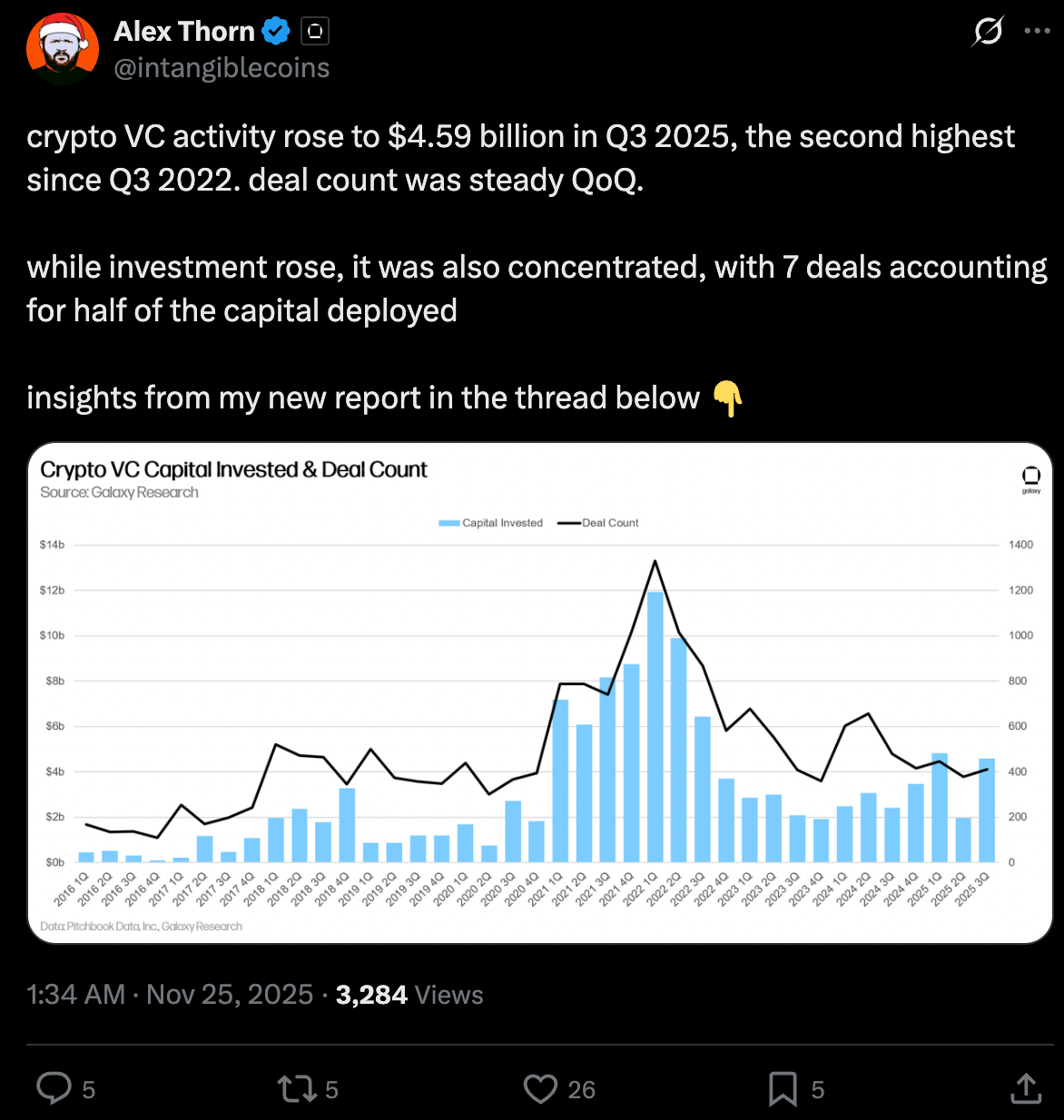

The view of venture from 10,000 feet up, as it pertains to the crypto sector specifically, is one of spending, but less volume.

Case in point: Prediction market Polymarket closed $1 billion, while Kraken took in $800m in funding this quarter.

In the third quarter, the total amount of funding was $4.59 billion, but half of that was concentrated on just seven deals, according to Alex Thorne, head of research for Galaxy.

“Market downturns sharpen the focus because you stop seeing price action as a signal but rather resilience in execution and product as the main indicators that count,” said Hashgraph Group’s Deiss. “Downturns push investors to focus more on fundamentals rather than short-term momentum.”

That short-term momentum may often be more hype than anything else. And many big venture-backed projects doing a TGE have not performed very well this year. This includes PUMP (down over 50% in 2025) and Berachain (a 91% drop since its February launch).

“High volatility and uncertain early-stage valuations are driving a significant shift in capital deployment, favoring strategies with shorter liquidity cycles and better pricing control,” added Gordadze.

The Lock-Up and the Liquidity

One of the most distinctive aspects of the cryptocurrency industry is the token generation event, or TGE.

The successor to ICOs of days past, Coinbase is now facilitating TGEs after its $375 million purchase of investor platform Echo.

Monad was the first project to launch there, raising $296m, and there’s surely more to come.

However, once a token launches, there are a few metrics that are unique to crypto that venture investors must closely monitor.

One is the lock-up, whereby, at TGE, not all tokens are circulating in the market yet; there is a period of holding these assets back. This is designed to better incentivize a network’s participants, from team members to community airdrops and foundation efforts.

Then there’s fully diluted value, or FDV – this is the total number of tokens times the price – basically a market cap for all tokens, even if they haven’t been unlocked yet.

And when markets gyrate, it’s really hard to forecast any potential exits of tokens for VCs, which can be a conundrum.

Recently, Arthur Hayes of Maelstrom Capital went on a rant about lock-ups, specifically related to Monad. As a trader, Hayes clearly doesn’t like the illiquidity of these types of tokens.

“Given the average token or equity vesting/lock-up period of 12 to 48 months, VCs must model the market’s likely condition when these lock-ups end,” said Gordadze, the Techstars mentor. “The entry price must be strategically set to ensure a profitable exit, making long-term market forecasts crucial for deal finalization.

The Future of Crypto VC Investment in 2026 and Beyond

On the subject of market forecasts, VCs surely love to talk about the future. And for crypto, it seems, given favorable US regulatory actions in 2025, that next year could be much better. Is that just investor hopium?

Maybe. But rose colored (or green) glasses are always the default mode for VCs. Optimism, of course, always wins.

“2026 is shaping up as a year defined by real utility – DeFi will make a strong comeback with enhanced momentum and maturity and the stablecoin moment becomes background,” noted Deiss. Stablecoins certainly had a moment this year, although they are the boring infrastructure that’s going to power, say, the next Polymarket, which uses USDC on Polygon as its main coin and chain.

“Now that stablecoins are finally going mainstream and banks are rushing to get in, the next level will be services for users that are powered by these assets behind the scenes,” noted Gordadze.

The most significant growth areas will likely reside in the intersection of AI/Blockchain and RWA/Blockchain, as these represent the greatest opportunities for real-world impact and institutional revenue generation.”

The post How is Crypto VC Investment Trending in a Bearish Market? appeared first on BeInCrypto.

beincrypto.com

beincrypto.com