The price movements from last Friday repeated, with bitcoin tumbling several grand in just minutes, dropping below $90,000.

Most altcoins followed suit, and it’s no surprise that the total value of liquidated positions has rocketed past $400 million.

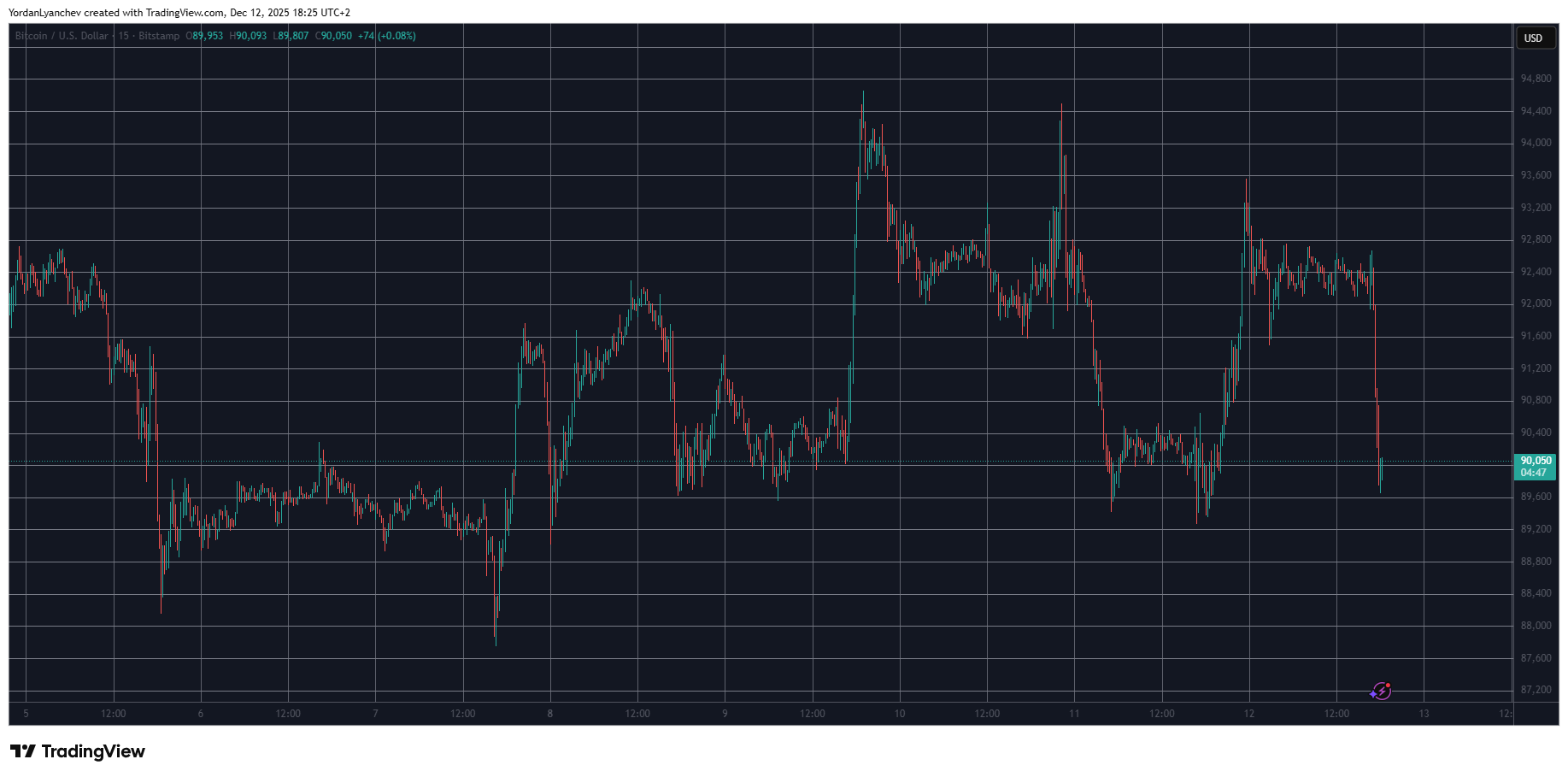

CryptoPotato reported just over an hour ago that BTC’s price had stabilized above $92,000 after the highly volatile week it had. Recall that the asset skyrocketed from under $90,000 to over $94,000 before and after the US Federal Reserve reduced the interest rates mid-week.

However, it slipped beneath $89,500 yesterday before the bulls initiated an impressive leg up to $93,600. Bitcoin was stopped there but maintained a healthy price tag of around $92,300 until an hour ago, when it suddenly dropped to $89,600.

It has managed to recover some ground and is now testing the $90,000 mark. Most altcoins have followed suit with even more painful declines within the same timeframe.

Ethereum is among the poorest performers, having lost 4.5% of value and now sitting just inches above $3,000. Just a few days ago, ETH flew past $3,400 but met a violent rejection at that point.

ARB, UNI, ENA, and AAVE have dumped by up to 5.5% in the past hour. As such, the total value of wrecked positions has jumped to $415 million on a daily scale, with $163 million coming in the past hour alone.

You may also like:

- XRP Stands Alone as the Only Truly Undervalued Top-10 Crypto, per Santiment

- Ethereum Sentiment Crashes After FOMC Rate Cut

- Bitcoin (BTC) Taps $92K, Zcash (ZEC) Soars by 17% Daily: Market Watch

More than 120,000 traders have been wiped out daily, while the single-largest liquidated position (worth $5.7 million) took place on Hyperliquid.

cryptopotato.com

cryptopotato.com