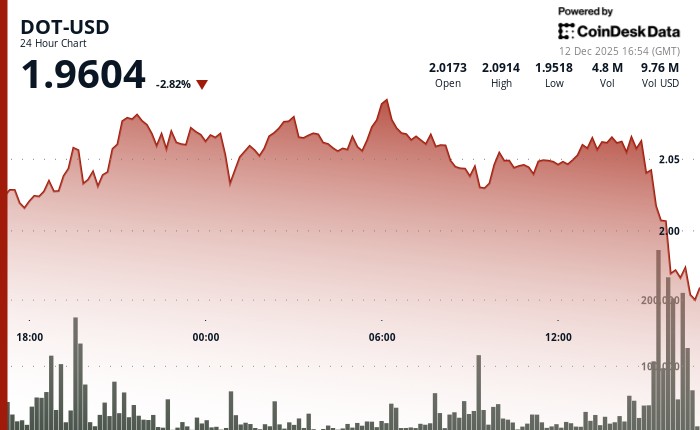

$DOT$2.0647 suffered a technical breakdown during Friday's session as the token plunged from a high of $2.09 to $1.97, erasing its previous rally momentum.

The decline occurred on heavy volume that reached 284% above normal levels, according to CoinDesk Research's technical analysis model.

The model showed that the token broke support at $2.05 as selling pressure intensified throughout the period.

The breakdown accelerated on volume of 10.3 million tokens, confirming the violation of ascending trendline support that anchored the recent bullish structure, according to the model.

Multiple tests of the $2.05 level established this zone as key resistance before the collapse undermined technical foundations.

Price action revealed a violent rejection from higher levels as $DOT forms an ascending channel from $2.01 to $2.09 before encountering massive selling, the model said.

Wider crypto markets also fell, with the CoinDesk 20 index lower by 0.6% at publication time.

Technical Analysis:

- Primary support holds $1.95 psychological level after $2.05 breakdown

- Immediate resistance forms at $1.985 following failed recovery attempts

- Critical ascending trendline support violated during breakdown

- Exceptional 10.3 million volume marks 284% surge above 24-hour average

- Peak hourly volume of 995K represents 400% above session baseline

- Elevated volume confirms technical breakdown rather than questions validity

- Ascending channel from $2.01-$2.09 completes with violent rejection

- Consolidation range of $1.95-$2.01 contains current price action

- Downside target approaches $1.90 if $1.95 support fails to hold

- Recovery requires reclaim of $2.00 resistance with volume confirmation

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

coindesk.com

coindesk.com