Despite fresh institutional adoption, newly launched $XRP exchange traded funds (ETFs), and growing cross chain experimentation, $XRP has quietly lost momentum, sliding more than 17% over the past month and struggling to reclaim key technical levels.

With the token trading just above $2, investors are increasingly asking a difficult question. Is $XRP setting up for a recovery by the end of 2025, or are recent catalysts already priced in?

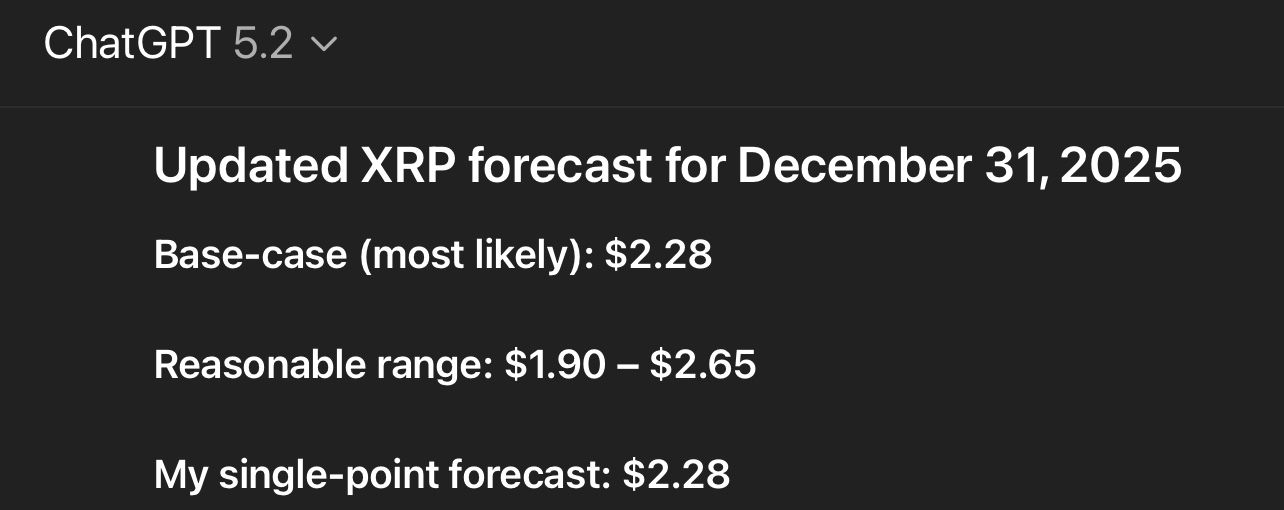

To gauge $XRP’s realistic price trajectory, Finbold prompted ChatGPT 5.2, OpenAI’s most advanced large language model, to assess where $XRP could stand by December 31, 2025, factoring in current price action, ETF inflows, institutional adoption via Ripple Payments, and mounting technical headwinds such as declining volume and whale driven selling pressure.

$XRP price reflects fading momentum despite positive headlines

At the time of analysis, $XRP is trading at $2.04, up 1.8% over the past 24 hours but still down just over 1% on the week. On a broader timeframe, the token has underperformed sharply, falling more than 16% over the past month even as attention around $XRP ETFs has intensified.

$XRP’s market capitalization currently stands at approximately $123.3 billion, reflecting a modest daily increase of 1.75%. However, the more telling signal comes from trading activity. The token’s 24 hour volume has dropped to $2.82 billion, marking a decline of nearly 28% in a single day.

This contraction in volume suggests waning short term conviction, particularly notable given that the broader cryptocurrency market has gained roughly 2.21% over the same period.

$XRP technical outlook shows resistance at key levels

From a technical standpoint, $XRP remains under pressure. The token continues to trade below its 50 day exponential moving average, currently located near $2.16, a level that has repeatedly acted as resistance during recent attempts higher.

Price action remains confined within a descending channel, indicating that lower highs continue to define the prevailing trend. While brief rebounds have occurred, they have lacked follow through, largely due to weak volume and consistent selling into strength.

Unless $XRP can reclaim and hold above the 50 day EMA with increasing participation, upside moves are likely to remain limited, reinforcing a cautious outlook into the end of the year.

Ripple Payments adoption supports long term utility narrative

On the fundamental side, $XRP continues to benefit from incremental progress in institutional adoption.

On December 12, MINA Bank became the first European bank to adopt Ripple Payments, enabling faster cross border transactions for its clients. The development represents another step in Ripple’s broader effort to position its payment infrastructure within regulated financial institutions.

As a result, adoption continues to support $XRP’s long term valuation case, but not at a pace that typically translates into rapid price appreciation.

This projection assumes continued gradual growth in RippleNet usage, steady but limited expansion of On Demand Liquidity, and no major deterioration in broader cryptocurrency market conditions. It also factors in the likelihood that selling pressure from large holders persists, preventing aggressive upside moves.

Under these assumptions, $XRP appears more likely to grind modestly higher rather than stage a breakout to new all time highs within the current cycle.

finbold.com

finbold.com